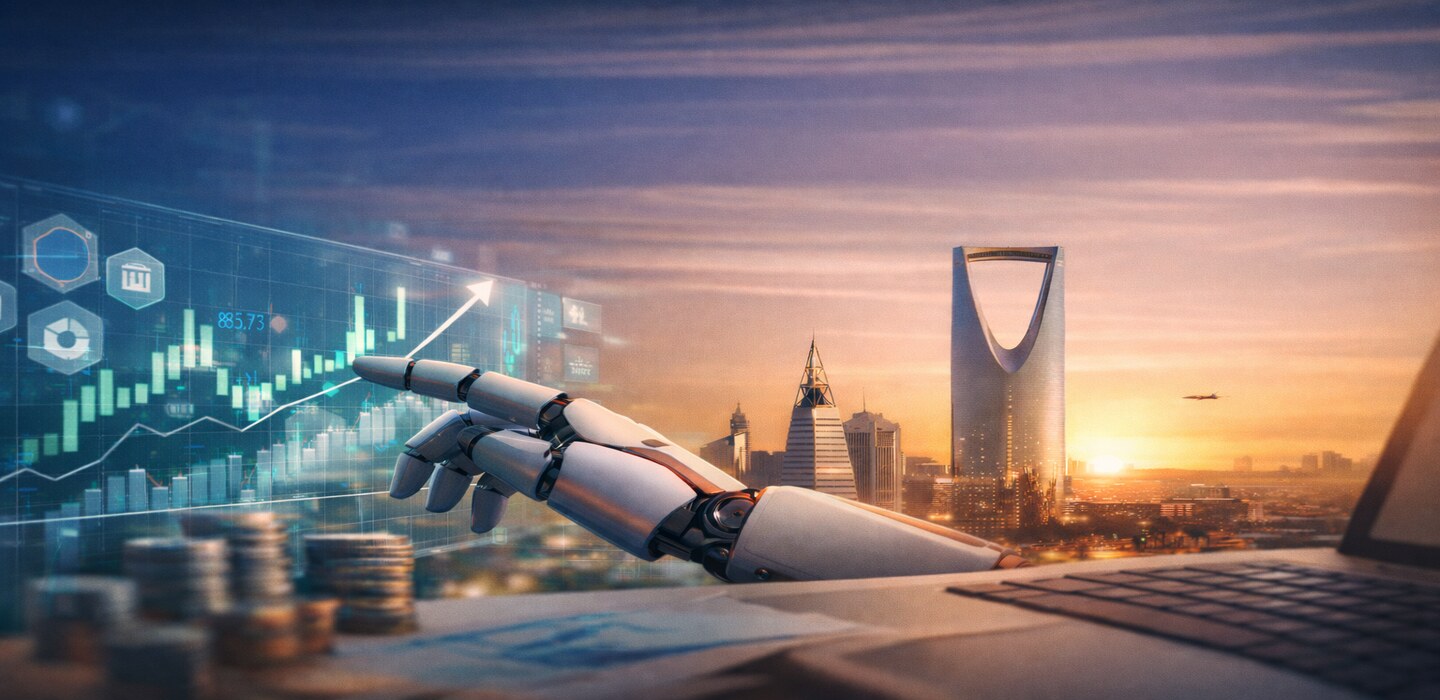

You set aside your savings and promise yourself you will invest “soon.” Weeks pass by, markets fluctuate, news headlines feel overwhelming, and you can not invest anymore. You hesitate, not because you do not wish to invest, but because you do not know where and how to start without making mistakes. This situation is increasingly common in Saudi Arabia, especially among busy professionals and first-time investors. As a result, many in Saudi Arabia are turning to automated investing.

What is Automated Investing?

Automated investing, also known as robo-advisory investing, is a digital investment approach where software manages portfolios based on predefined rules rather than day-to-day human decisions.

Once an investor sets preferences such as risk tolerance, time horizon, and contribution size, the system handles:

- Asset allocation

- Portfolio diversification

- Scheduled investing

- Automatic rebalancing

The objective is consistency, not speculation. This type of investing focuses on long-term growth rather than short-term market timing.

Process of Automated Investing

This investing technique follows a structured and predictable process designed to reduce emotional decision-making.

The process:

- Investor profiling: Risk tolerance and goals are assessed

- Portfolio construction: Assets are selected and diversified

- Automatic contributions: Investments are made on a set schedule

- Rebalancing: Portfolios adjust as markets move

- Ongoing monitoring: Performance is tracked through dashboards

For most users, the appeal lies in staying invested without needing constant attention.

Is It Regulated in Saudi Arabia?

Automated investing is regulated in Saudi Arabia and is no longer experimental.

Key points to know:

- Platforms operate under the supervision of the Capital Market Authority (CMA)

- Robo-advisory and automated portfolio services are formally licensed

- Many platforms offer Shariah-compliant portfolios, meeting local investor requirements

In February 2026, the Capital Market Authority (CMA) fully opened Saudi Arabia’s main capital market to all foreign investors. The move removed the Qualified Foreign Investor (QFI) requirement and aimed to boost liquidity, attract global capital, and support Vision 2030 goals.

What the Data Shows

Automated investing in Saudi Arabia is backed by measurable growth and regulatory progress, not just marketing claims.

Key figures shaping the market (2024–2026):

- SAR 5.44 billion in assets under management through licensed robo-advisory platforms by Q3 2025

- 500,000+ investment portfolios managed digitally across Saudi platforms

- Nearly 79% year-on-year growth in robo-advisory assets

- 99% of robo-advisory users are retail investors, not institutions

These figures highlight rising trust among everyday investors.

Also read about logisitcs zone in Dammam as an area of massive investment potential with Bayut.sa.

Regulatory momentum

In 2025, the Capital Market Authority (CMA) launched a public consultation on formal robo-advisory regulations. These draft rules focus on:

- Algorithm transparency

- Risk controls and testing

- Investor protection standards

This signals that automated investing is moving toward long-term regulatory integration.

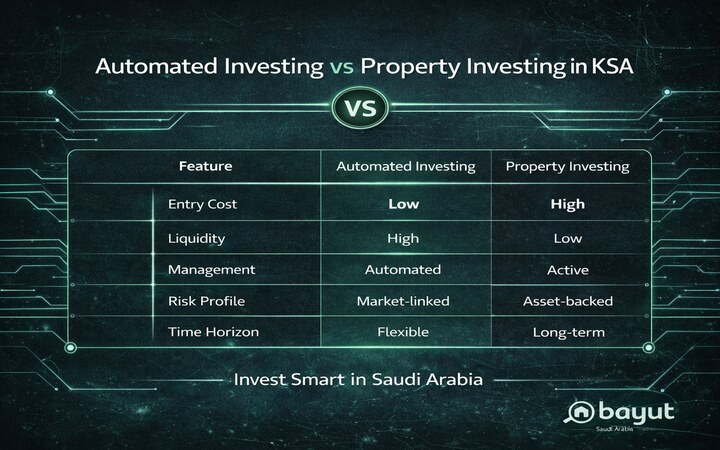

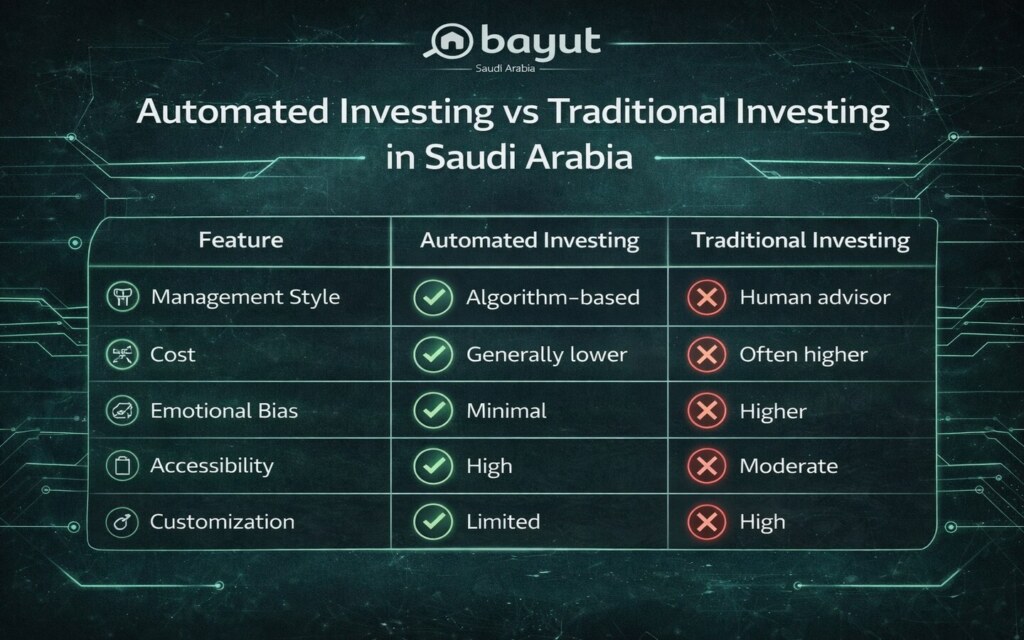

Pros and Cons of Automated Investing

Automated investing offers convenience and discipline, but it also has limitations. Understanding both sides helps investors make informed decisions.

Key advantages:

- Reduces emotional investing decisions

- Encourages consistent investing habits

- Lower fees than traditional advisory services

- Easy entry for beginners

- Built-in diversification

Potential drawbacks:

- Limited customization for complex financial needs

- Less flexibility during extreme market volatility

- Dependence on algorithms rather than human judgment

- Platform fees still impact long-term returns

Automated investing works best as a long-term strategy, not a short-term trading tool.

How Can You Start Automated Investing in KSA?

Getting started is relatively simple, but choosing the right setup matters.

Practical steps to follow:

- Select a CMA-licensed platform

- Decide if you need Shariah-compliant investing options

- Set clear goals (retirement, savings, diversification)

- Choose a realistic contribution schedule

- Review performance periodically, not daily

Who Should Consider Automated Investing?

Automated investing is not for everyone, but it suits many profiles.

It is particularly suitable for:

- First-time investors

- Busy professionals

- Long-term savers

- Investors who prefer hands-off portfolio management

Those seeking active trading strategies or highly customized portfolios may prefer hybrid or traditional advisory models.

Both models can coexist. Many investors combine automation with property or other asset classes.

Impact on Real Estate Decisions

For many buyers in Saudi Arabia, property is no longer the first financial step; it is the planned one. Instead of rushing into ownership, investors are taking time to build capital and confidence through other tools before committing to real estate.

Automated investing is shaping this shift by:

- Helping first-time buyers build savings before purchasing property

- Encouraging more deliberate, long-term entry into the real estate market

- Complementing property ownership with liquidity and flexibility

- Reducing rushed or speculative buying decisions

Together, automated investing and real estate are supporting more informed and disciplined property choices.

Bayut KSA: Invest Smart

Major financial trends often shape lifestyle and property decisions long before they appear in listings. Bayut-KSA helps connect investment trends, infrastructure developments, and wealth planning insights, giving users the context they need to make confident, future-focused decisions.