Real Estate Insurance in Saudi Arabia is an important and yet often overlooked component of property ownership. Whether you’re a homeowner, landlord, or real estate investor, protecting your property from fire, theft, natural disasters, and liability ensures financial security and peace of mind.

In this article, we’ll explore everything from types of coverage to costs and choosing the best provider in the Kingdom.

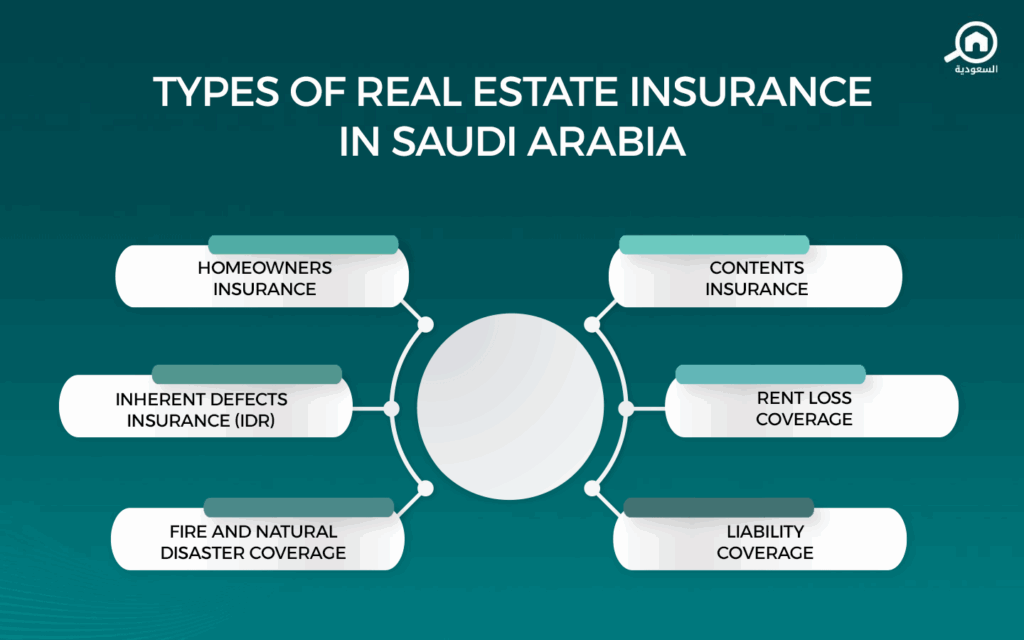

Types of Real Estate Insurance in Saudi Arabia

Several categories of Real Estate Insurance in Saudi Arabia are available:

- Homeowners insurance provides building and contents coverage, fire, theft, storms, and liability protection.

- All-risk property insurance (Property All Risk) covers a wide range of perils unless explicitly excluded.

- Fire‑only policies provide specialized coverage with higher limits for fire-related losses.

- Flood or earthquake policies are available as add-ons in high-risk areas.

These options allow you to tailor coverage to your property’s location, construction type, and personal risk tolerance.

You may also be interested in our article 9 Smart Ways to Make Money from Real Estate in Saudi Arabia

Importance of Real Estate Insurance in Saudi Arabia

As Saudi Arabia continues its rapid real estate and infrastructure expansion under Vision 2030, the value of protected property is slowly increasing. According to market data, property insurance premiums in the Kingdom are projected to reach $1.87 billion in 2025.

Real Estate Insurance in Saudi Arabia safeguards owners from financial losses due to unforeseen events like fire, theft, or flooding while providing liability coverage and assistance with temporary relocation if the home becomes uninhabitable.

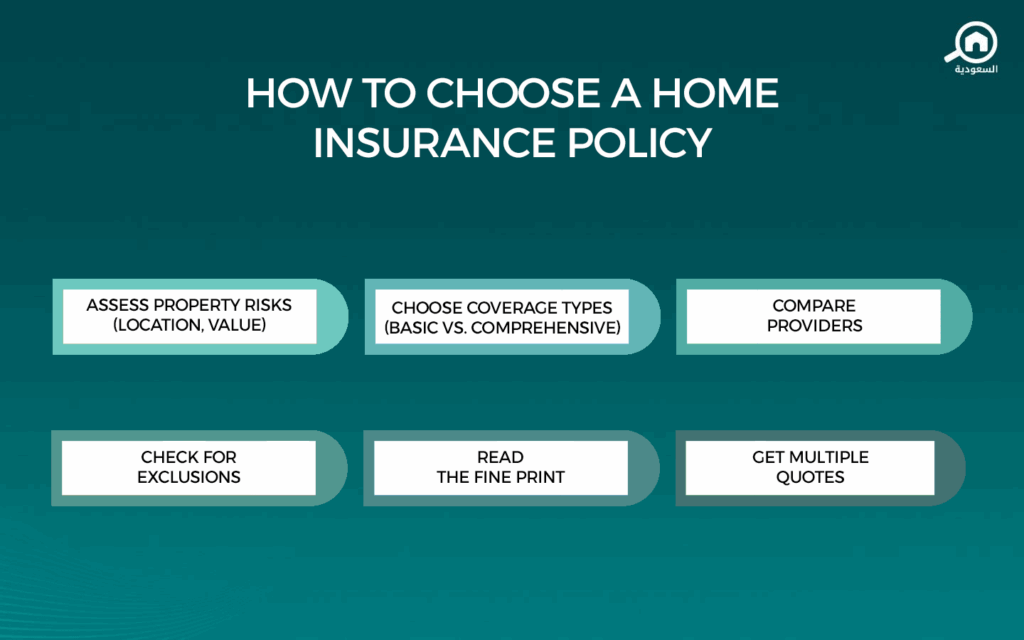

How to Choose a Home Insurance Policy

Choosing the right Real Estate Insurance in Saudi Arabia policy requires careful consideration:

- Compare coverage types: Basic named-peril vs. all-risk policies

- Review policy limits and exclusions

- Confirm liability and contents coverage, as well as temporary accommodation (ALE)

- Assess premiums vs. protection levels

Platforms like Giraffy offer transparent comparison tools for leading Saudi insurance providers and product types.

What Are the Home Insurance Prices in Saudi Arabia?

Premiums vary widely depending on property value, location, and coverage level. Premiums in high-risk flood or coastal areas may be higher due to regional risk profiles.

- Average annual premium: Approximately SAR 5,000 per house, reported following Jeddah flooding incidents.

- Urban vs high-risk zones: Insurance providers adjust premiums upward in flood-prone or coastal regions due to increased claims activity.

- Inherent defects insurance (for new residential buildings up to 3 stories): Estimated at 1–1.5% of total construction cost for a 10-year policy, with minimum annual premium around SAR 7,000.

- Per‑capita insurance spend (all property insurance lines): Estimated at $49 (≈ SAR 185) in 2025, highlighting modest retreat coverage but growing interest.

What Are the Most Well-Known Insurance Companies in Saudi Arabia?

Major insurers specializing in Real Estate Insurance in Saudi Arabia include:

- Tawuniya Cooperative Insurance

- Salama Cooperative Insurance

- GIG (Gulf Insurance Group)

- Liva Insurance

- Arabian Shield Cooperative Insurance

- SAICO (Saudi Arabian Cooperative Insurance Company)

These firms offer comprehensive Real Estate Insurance in Saudi Arabia: both home and property insurance options, with several offering takaful (Shariah-compliant) policies.

Does Third‑Party Insurance Cover Fire?

When choosing Real Estate Insurance in Saudi Arabia, you should keep in mind that standard third-party liability insurance does not cover fire damage. Fire-related claims must be filed under your own home insurance policy. It is always advisable to notify your insurer promptly after damage and let them handle third-party subrogation if applicable.

Real Estate Insurance in Saudi Arabia : What Services Are Included in Home Insurance?

Most Real Estate Insurance in Saudi Arabia policies cover:

- Building repair or replacement

- Contents protection for household items

- Liability coverage for injuries or property damage

- Additional Living Expenses (ALE) if the home is uninhabitable after a covered event

Some policies offer optional add-ons such as business use, high-value items endorsements, or flood/earthquake coverage.

Read also: Common Problems of Real Estate Investment in Saudi Arabia.

Nothing is More Expensive Than Your Peace of Mind – Get Real Estate Insurance in Saudi Arabia Now

Understanding real estate insurance in Saudi Arabia helps property owners mitigate risk and safeguard their investments. From choosing the right policy to knowing what’s covered, well-chosen insurance can protect against fire, theft, natural disasters, liability, and more.

With the Saudi property market poised for further growth, securing comprehensive coverage from trusted providers is a strategic step toward long-term financial security.

Be sure to follow My Bayut to stay updated with Saudi Arabia’s real estate market, trends, and more.