Profiting from Rental Properties isn’t just about collecting rent, it’s about being strategic enough to maximize your income while keeping costs under control. Whether you’re a first-time landlord or looking to scale your investment portfolio in Saudi Arabia, this guide offers smart, actionable strategies to help you generate more income from your rental assets.

Strategies for Earning from Rental Properties

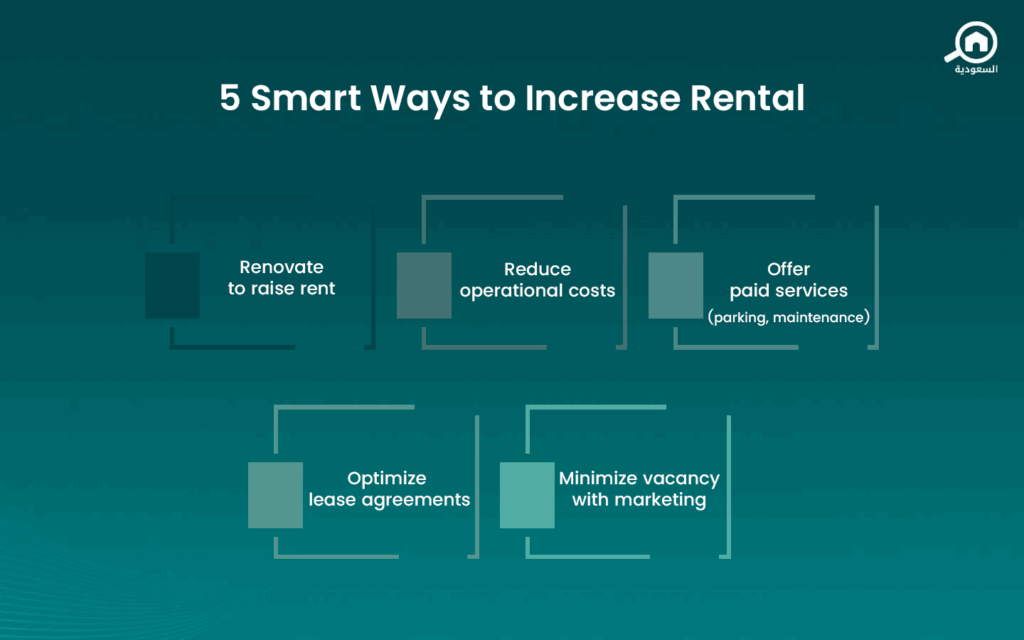

One of the most effective ways to boost your monthly cash flow is by improving the property itself. Simple upgrades can go a long way, and will justify higher rental rates and attract more reliable tenants. Consider the following:

- Renovating interiors with modern finishes

- Improving lighting and ventilation

- Converting unused space into rentable areas, such as storage or home offices

In Saudi Arabia’s competitive rental market, visual appeal plays a huge role in tenant retention and income growth. Even small adjustments, like adding energy-efficient appliances, can make a big impact.

Investing in Leased Real Estate – How to Cut Costs Without Sacrificing Quality

When you’re trying to start Profiting from Rental Properties, reducing your operational costs is just as important when profiting from rental properties. Some of the smartest landlords in Saudi Arabia reduce costs through:

- Preventative maintenance instead of reactive repairs

- Switching to solar power or energy-efficient systems

- Negotiating long-term service contracts at better rates

These efforts not only reduce monthly expenses but also extend the life of the property, which helps lead to a more sustainable long-term investment.

What Are the Best Ways to Generate Profit from Rental Properties?

Beyond upgrades and cost control, consider new revenue streams by offering value-added services to your tenants. These could include:

- Dedicated parking spaces

- Monthly maintenance plans

- High-speed internet or smart home features

These amenities can really enhance the tenant experience and justify premium pricing, making your property stand out. Also, review lease terms regularly to ensure your rental rate matches market trends…. and renegotiate when needed to reduce vacancy periods.

You may also be interested in our article on 9 Smart Ways to Make Money from Real Estate in Saudi Arabia

Internal Tips and Local Considerations

Keep in mind that rental income in Saudi Arabia is currently not subject to income tax, which is a major advantage compared to many global markets. This exemption itself is a unique profit-enhancing factor for local investors.

For more on this, see our article on What Are the Real Estate Taxes in Saudi Arabia ? You can also refer to foundational concepts like the Four Pillars of Real Estate, which include cash flow, appreciation, loan paydown, and tax benefits.

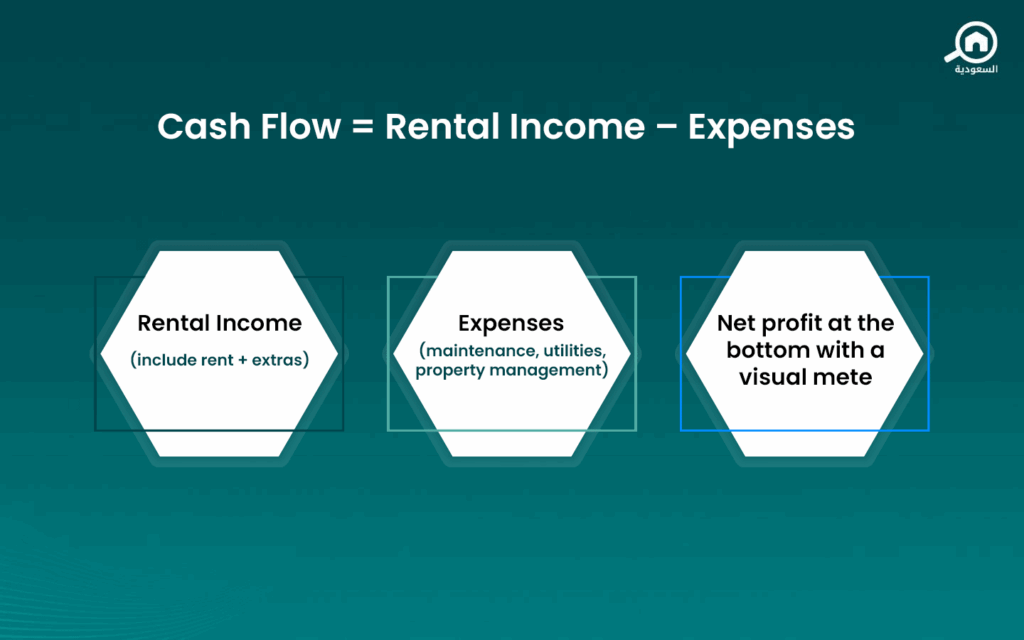

If you’re unsure how to measure your financial performance, start with our guide on How to Use Cash Flow Calculation before Investing in a Property.

Start Profiting from Rental Properties Today

Ultimately, profiting from rental properties in Saudi Arabia requires a mix of practical upgrades, strategic cost management, and creative monetization. By applying the right strategies, you can unlock the full earning potential of your property.

Whether you’re managing a single unit or an entire portfolio, the goal remains the same: to build long-term wealth through smart, sustainable rental income.

You can also keep exploring and learning about real estate, market trends, and more by following along our blog My Bayut.