Understanding occupancy rates in Saudi real estate is essential for investors, property managers, and developers. This metric shows how much of a property is currently rented or utilized and directly impacts rental income, market valuation, and investment decisions. Whether you’re evaluating commercial spaces, residential units, hospitality, or industrial properties, occupancy rates provide a clear picture of performance.

In this article, we’ll explain what are the occupancy rates in Saudi real estate, highlight the types of real estate used in occupancy rate calculations, and provide formulas and practical examples to help analyze property yield effectively.

Types of Real Estate in Occupancy Rates in Saudi Arabia

Occupancy rates are calculated differently depending on the type of property. Here’s a breakdown:

Commercial Properties

Includes:

- Offices

- Showrooms

- Shopping malls

- Clinics and medical centers

Why it matters: Occupancy in commercial properties is closely tied to steady monthly income. High occupancy rates indicate strong demand and profitability.

Residential Rental Properties

Includes:

- Apartment buildings

- Investment apartments

- Rental villas

Example: A building with 10 units, of which 8 are rented → Occupancy Rate = 80%.

Hospitality Properties

Includes:

- Hotels

- Serviced apartments

- Short-term rentals (e.g., Airbnb units)

Occupancy here is typically measured daily or monthly rather than annually. It serves as a key indicator of operational performance.

Industrial Properties

Includes:

- Warehouses

- Factories

- Workshops

Higher occupancy in industrial assets increases market value and return on investment.

Read also: Real Estate Contribution Platform in Saudi Arabia.

Properties Not Directly Calculated for Occupancy

Some properties are excluded from occupancy calculations:

- Undeveloped land (white land)

- Properties not yet leased

- Owner-occupied residential properties

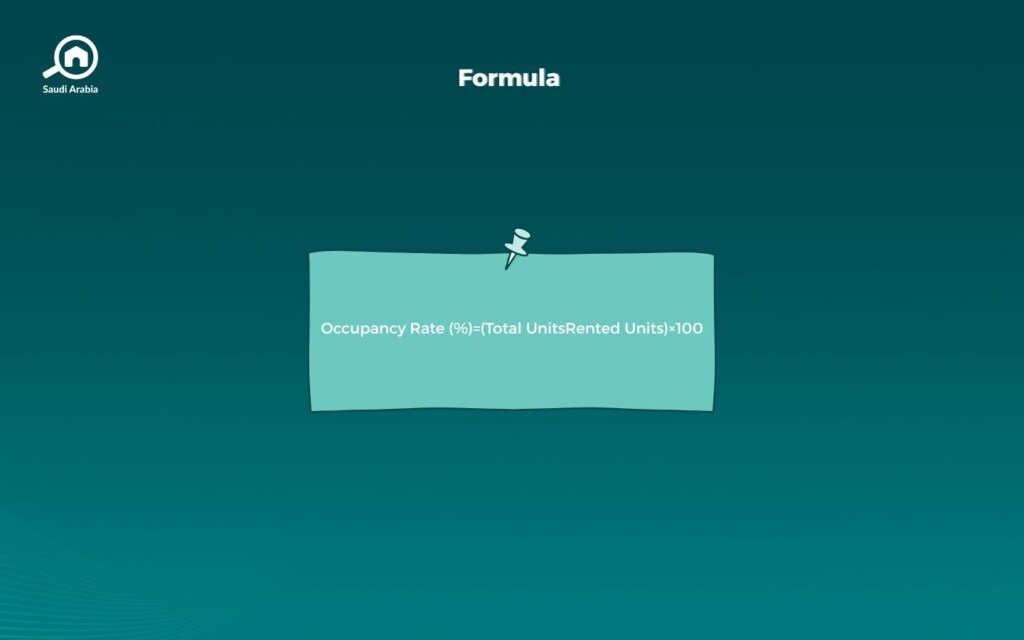

How to Calculate Occupancy Rate

The basic formula is:

Occupancy Rate (%)=(Rented UnitsTotal Units)×100Occupancy Rate (%)=(Total UnitsRented Units)×100

Example:

- Residential building: 10 units total

- 8 units rented

- Occupancy Rate = (8 ÷ 10) × 100 = 80%

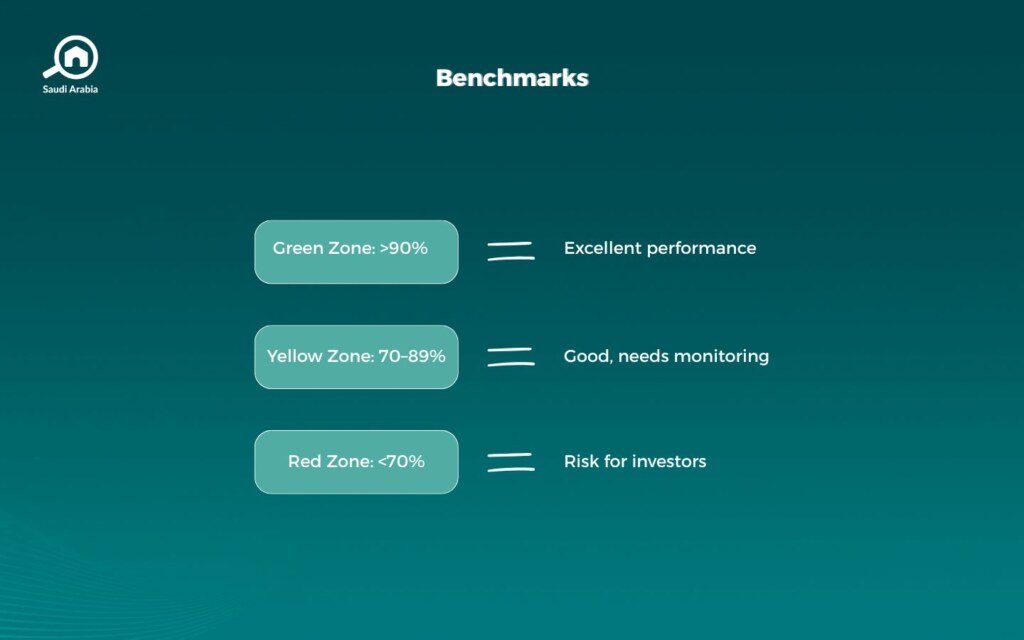

Why Occupancy Rates Matter for Investors

- Low occupancy: Warning sign of marketing or demand issues.

- High occupancy (>90%): Excellent performance.

- Moderate occupancy (70–89%): Good, but needs monitoring.

- Low occupancy (<70%): Potential investment risk.

Occupancy rates also feed into other investment metrics such as Net Operating Income (NOI) and Cap Rate, helping investors evaluate property yield effectively.

You may also be interested in our article on Property Management in Saudi Arabia.

Conclusion

Occupancy rates in Saudi real estate are a crucial metric for evaluating the health and profitability of any investment property. By understanding the types of properties calculated for occupancy and applying the proper formulas, investors can make informed decisions, spot potential risks, and maximize returns. Whether dealing with commercial, residential, hospitality, or industrial assets, monitoring occupancy is key to long-term success in the Saudi real estate market.

For more insights on the Saudi real estate market, career opportunities, and industry updates, visit Bayut Saudi Blog and follow us on social media for the latest trends.