Investing in real estate in Saudi Arabia requires more than just picking a property – it demands understanding the potential returns. One of the most critical metrics investors rely on is the Internal Rate of Return (IRR) in Saudi Arabia. This measure helps you gauge the real annual return you can expect and determine whether an investment is truly worth committing to.

In this article, we’ll explore what the Internal Rate of Return (IRR) is, how it differs from ROI, how to calculate it for real estate investments, and why it’s crucial for making informed investment decisions in the Kingdom.

What is the Internal Rate of Return (IRR)?

The Internal Rate of Return (IRR) is the annualized rate that shows the expected return on your investment based on projected cash flows over time. Put simply, it’s the rate that makes the Net Present Value (NPV) of all future income and expenses equal to zero.

Imagine you invest in a property and expect annual rental income, then plan to sell it after a few years. The IRR tells you: “If these cash flows occur as planned, what will be the true annual return on this investment?”

The higher the IRR, the more attractive the investment, as it indicates higher annual profits relative to the initial cost.

You may also be interested in reading out article on Career Opportunities Through Real Estate Specializations.

Download Our App

Get the app and search experience among thousands of verified properties now!

The Importance of IRR in Saudi Arabia

In the Saudi real estate market, returns vary significantly depending on location and property type. That’s why IRR is a key indicator for assessing the true value of an investment.

Here’s why IRR matters:

- Long-term project profitability: Especially relevant for real estate development.

- Comparing investment opportunities: Helps you evaluate multiple projects based on expected returns and timeframes.

- Making informed decisions: Guides investment in construction, development, or rental projects.

Calculating the Internal Rate of Return for Real Estate Investment (IRR)

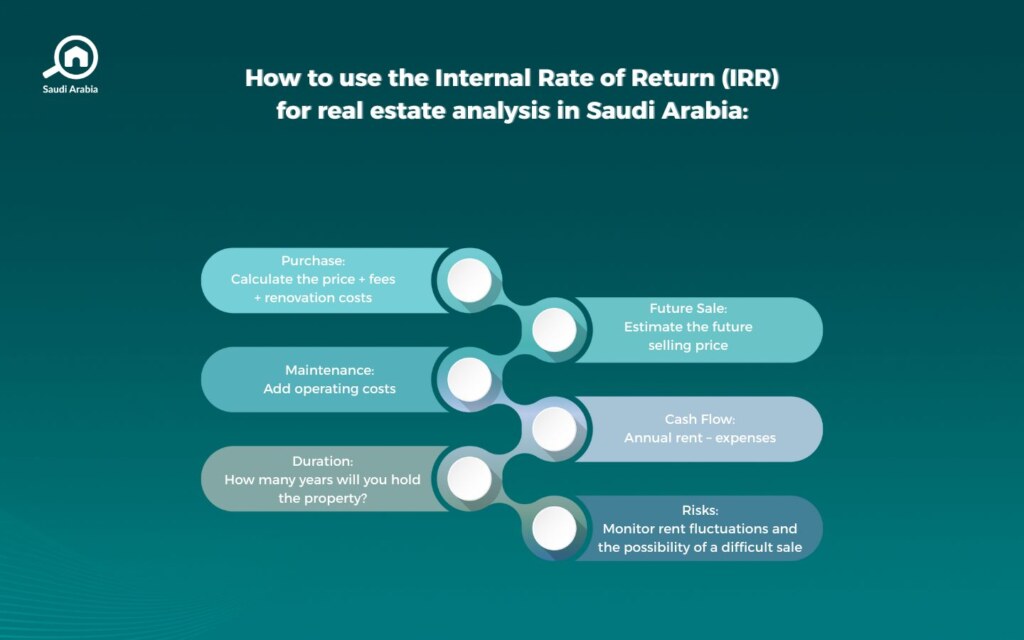

To calculate IRR, you need:

- Initial investment: For example, the cost of buying or constructing the property.

- Expected annual cash flows: Such as net rental income.

- Expected sale value: At the end of the investment period.

Example:

- Initial investment: SAR 1,000,000

- Annual cash flow: SAR 120,000 for 5 years

- Sale price at the end of year 5: SAR 1,100,000

You can calculate IRR to find the compound annual growth rate for this investment.

How is IRR Calculated?

Calculating IRR manually is tricky because it requires trial and error to find the rate that makes NPV = 0. Luckily, there are easy tools:

1. Excel or Google Sheets

- Input cash flows starting with the investment (negative value), followed by annual inflows.

- Use the formula: =IRR(range)

- The tool calculates the IRR automatically—fast and simple for most investors.

2. Financial calculators or investment apps

Specialized calculators, whether physical or mobile apps, allow you to enter investment amounts and cash flows for an instant IRR result.

3. Advanced real estate analysis software

Professional programs like Argus or RealData provide comprehensive analysis models that automatically calculate IRR, accounting for costs, rents, taxes, and expenses, giving you a complete picture of expected returns.

Read also: A Guide to Conducting a Feasibility Study for a Real Estate Development Project.

What is the Difference Between ROI and IRR?

Both ROI and IRR measure profitability, but they are fundamentally different:

Factor | ROI | IRR |

|---|---|---|

Factor What it measures | ROI Profit as a percentage of total investment | IRR Expected annual compound return over the investment period |

Factor Time consideration | ROI No | IRR Yes |

Factor Accuracy | ROI Simple, less detailed | IRR More precise, accounts for multiple and timed cash flows |

In short, ROI gives a quick snapshot, while IRR provides a deep, time-sensitive analysis of expected profits.

What is a Good Internal Rate of Return in Saudi Arabia?

There’s no fixed IRR that’s universally “good,” as it depends on property type, location, risk level, and investment period. However, general benchmarks for Saudi real estate are:

- 8%–12%: Good and stable for low-risk residential properties

- Above 12%: Excellent for commercial or high-risk development projects

- Below 7%: Usually unattractive unless the property has strategic value or future potential

Always compare IRR against financing costs and alternative returns available in the market.

Practical Application of IRR in Saudi Real Estate

The IRR is an advanced metric used alongside other analytical tools to evaluate long-term investment feasibility. For example, in a hypothetical case study, you can compare two properties using multiple indicators, including IRR, to identify the better investment.

Make Smarter Investments: The Power of IRR

The Internal Rate of Return (IRR) in Saudi Arabia is a vital financial metric for real estate investors. By understanding IRR, you can evaluate projects more accurately, compare opportunities logically, and make confident, informed investment decisions in a dynamic market like Saudi Arabia, especially as Vision 2030 drives the country toward unprecedented growth.

Explore more insights on real estate metrics and investment tools at My Bayut Blog to sharpen your investment strategy.