The Saudi economy has undergone a remarkable transformation in recent years, driven by Vision 2030’s focus on innovation, diversification, and private investment. At the heart of this shift stands Saudi Venture Capital Company , supporting the growth of SMEs and fueling technological advancement across the Kingdom.

In this article, we explore its role in shaping the private capital ecosystem and empowering startups nationwide.

What is the Saudi Venture Capital Company ?

The Saudi Venture Capital Company (SVC) is an investment company established in 2018 as a subsidiary of the SME Bank, which operates under the National Development Fund (NDF). The company was founded with a clear mission to stimulate and sustain financing for startups and SMEs across all growth stages, ranging from pre-seed to pre-IPO.

SVC plays a unique role in strengthening Saudi Arabia’s private capital industry, with a total investment capacity of $3 billion. This capital is distributed through fund investments and direct investments, both designed to encourage innovation and empower the private sector.

Through its strategic initiatives, SVC contributes to building a robust entrepreneurial ecosystem that enhances financial inclusion and accelerates the growth of high-potential enterprises.

Venture Capital in Saudi Arabia

Venture capital has become an essential driver of economic diversification and innovation in Saudi Arabia. As part of Vision 2030, the Kingdom aims to transform into a global hub for entrepreneurship and investment. Venture capital plays a key role in this transformation by funding early-stage startups, particularly those in technology, sustainability, and digital sectors.

With increasing support from both government entities and private investors, the Saudi venture capital landscape is rapidly maturing. SVC’s contribution is central to this development, as it helps bridge the funding gap for entrepreneurs while attracting international investors to the Saudi market.

Small and Medium Enterprises General Authority (Monsha’at)

The Small and Medium Enterprises General Authority (Monsha’at) serves as the cornerstone for SME development in Saudi Arabia. It works to create a competitive business environment, support entrepreneurship, and enhance access to financing opportunities.

SVC operates in close alignment with Monsha’at’s vision by stimulating private investment and ensuring sustainable financial resources for SMEs. Together, they strengthen the national economy by empowering small businesses to grow, innovate, and expand globally.

The Development of Venture Capital in Saudi Arabia

SVC leads the development of the private capital ecosystem in Saudi Arabia through two main investment programs: Fund Investments and Direct Investments.

Fund Investments

Saudi Venture Capital Company invests in several types of funds to catalyze venture investments and lower fundraising barriers for fund managers seeking to support promising Saudi companies.

- Venture Capital Funds: Invest in high-growth startups through accelerator and startup studio funds.

- Private Equity Funds: Focus on SMEs with significant growth potential.

- Venture Debt and Private Debt Funds: Provide debt financing for startups and SMEs in expansion stages.

Investment Guidelines:

- Sector: Impact-driven with a focus on strategic sectors.

- Stage: From pre-seed to pre-IPO.

- Contribution: SVC may contribute up to 65% of the total fund size, with all Saudi government-related entities collectively capped at the same percentage.

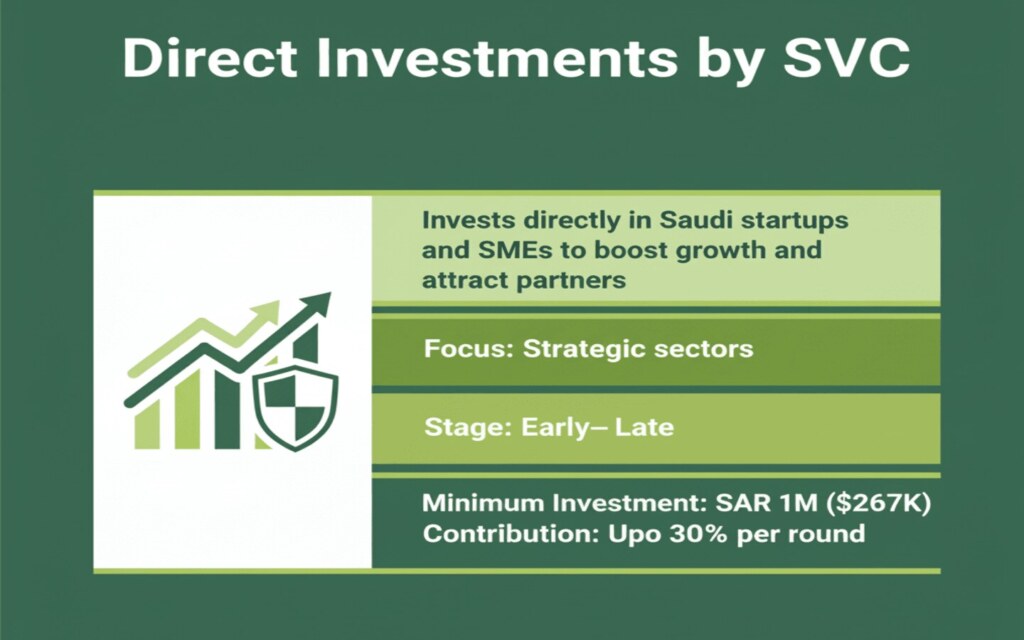

Direct Investments

SVC also makes direct investments in startups and SMEs to accelerate their growth and attract co-investors.

Investment Guidelines:

- Geography: Saudi-based companies or those expanding to the Kingdom.

- Sector: Impact-driven with a focus on strategic sectors.

- Stage: Early to late stages.

- Minimum Ticket Size: SAR 1,000,000 ($267,000).

- Contribution: Capped at 30% of each round.

Through these programs, SVC continues to drive innovation, support emerging entrepreneurs, and build a sustainable investment environment that aligns with the Kingdom’s long-term economic vision.

Also read: Tourism Real Estate Investment in Saudi Arabia is Your Pathway to Long-term Growth

Contact Information

For inquiries or partnership opportunities, you can reach the Saudi Venture Capital Company (SVC) at:

- Location: KAFD Wadi, Al Aqiq, King Abdullah Financial District, Area 5, Building 5.08, Riyadh 11564, Saudi Arabia

- Working Hours:

- Sunday–Thursday: 8 AM – 6 PM

- Friday & Saturday: Closed

- Contact Page: svc.com

FAQs

Below are some of the most common questions about the Saudi Venture Capital Company:

Who owns SVC Saudi Arabia?

SVC is owned by the SME Bank, which operates under the National Development Fund (NDF) of Saudi Arabia.

Who is the CEO of SVC Saudi Arabia?

The CEO of SVC is Dr. Nabeel Koshak, a prominent figure in Saudi Arabia’s entrepreneurship and investment ecosystem.

Who is the CEO of Saudi Venture Capital Company ?

The Chief Executive Officer (CEO) of the Saudi Venture Capital Company is Dr. Nabeel Koshak.

Who are the biggest VCs?

Some of the largest venture capital entities in Saudi Arabia include SVC, STV, Raed Ventures, and Impact46, all contributing significantly to the Kingdom’s growing startup ecosystem.

To conclude, this article explored the Saudi Venture Capital Company (SVC), its role in developing the venture capital ecosystem, and its contribution to empowering startups and SMEs in Saudi Arabia. Through strategic investments and partnerships, SVC continues to strengthen the Kingdom’s innovation economy and drive sustainable growth.

We also recommend visiting the Bayut KSA Blog for further comprehensive insights and updates on investment opportunities in the Kingdom, and to explore how to Invest in Saudi.