Saudi Arabia and Syria are entering a new phase of cooperation. After years of limited engagement, both countries are rebuilding economic ties, reopening communication channels, and exploring long-term development opportunities. This shift has positioned Saudi Syrian Investment as one of the region’s most closely watched trends, especially as Syria moves toward reconstruction and Saudi investors look for strategic early opportunities.

For investors, the reopening of this market signals a moment where capital, policy change, and reconstruction needs are aligning.

What Is Saudi Syrian Investment?

Saudi Syrian Investment refers to the renewed economic cooperation between the Kingdom and Syria as diplomatic ties are restored. It includes:

- Participation in reconstruction efforts

- Reactivated trade and logistics discussions

- Sector-focused investment forums

- Collaboration across energy, real estate, agriculture, and services

- Early exploration of infrastructure cooperation

This movement supports Saudi Arabia’s broader diversification plans while giving Syria access to investment that can drive recovery.

What Are the Goals of Saudi Syrian Investment?

Both countries see mutual value in building a stable, long-term economic relationship. Key goals include:

- Supporting Syria’s reconstruction and essential infrastructure

- Strengthening Gulf-to-Levant connectivity

- Encouraging private sector partnerships

- Expanding trade capacity and supply chains

- Attracting cross-border investment into priority sectors

Saudi Arabia gains access to new markets, and Syria gains capital and development expertise.

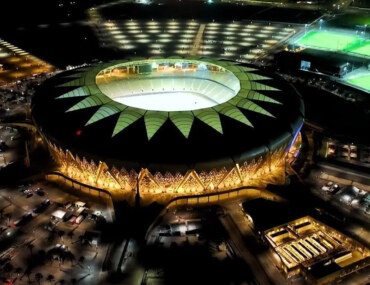

The Riyadh–Damascus Train Project

One of the most talked-about proposals is the potential Riyadh–Damascus rail connection. Although still under study, discussions align with the wider vision of connecting Gulf rail networks through Jordan toward Syria.

If developed in the future, the corridor could:

- Open new logistics routes

- Support movement between the Gulf and the Levant markets

- Stimulate commercial zones along the route

- Enhance tourism and business travel

While conceptual, it reflects long-term ambitions for integrated regional mobility.

The Syrian Saudi Investment Forum

The Syrian Saudi Investment Forum, held in Damascus in 2025, marked a major milestone in the renewed partnership. The forum resulted in:

- Around USD 6.4 billion in agreements and investment pledges

- 40+ MoUs covering construction, real estate, energy, and services

- Presentations of redevelopment opportunities in key Syrian cities

- Early-stage private-sector connections and feasibility studies

These agreements are commitments and frameworks, representing the strongest signal yet of structured economic cooperation.

Recent Developments Strengthening the Partnership

Several active developments are accelerating momentum:

- Approximately USD 2.9 billion from the forum’s agreements is directed toward real estate and infrastructure.

- Saudi banks and investment funds have signaled intentions to enter the Syrian market, improving future financing channels.

- A Saudi crude oil grant of 1.65 million barrels has begun supporting Syria’s energy sector, contributing to stability.

- Syria has introduced new economic governance measures, including the Supreme Council for Economic Development, to streamline investment processes.

These developments indicate increasing readiness on both sides for structured, long-term economic cooperation.

Where the Investment Opportunities Are

- Real estate and redevelopment: mixed-use projects, housing renewal, commercial districts, coastal expansion

- Infrastructure and transport: road upgrades, logistics corridors, industrial zones, potential rail-linked projects

- Energy and utilities: power generation, renewable energy, water infrastructure

- Agriculture and food: farmland investment, processing facilities, supply-chain hubs

- Tourism and heritage: hospitality projects, heritage-site restoration, tourism services

Real Estate Appeal

This renewed economic cooperation is already shaping the property landscape in meaningful ways:

- Reconstruction zones are attracting early interest, especially in Damascus and key coastal cities.

- Financing channels are opening up, with Saudi funds and banks signalling future involvement.

- Infrastructure improvements are moving forward, raising the appeal of mixed-use and commercial districts.

- Policy reforms are creating a more organised investment environment, making development projects easier to launch.

- Land values in targeted corridors are expected to rise as agreements transition into active projects.

Real Estate Insight with Bayut-KSA

As cross-border investment reshapes future development zones, platforms like Bayut-KSA help users understand how economic shifts influence property trends.

With clear data, neighbourhood insights, and updated market information, Bayut-KSA supports informed decisions for investors exploring opportunities within an evolving regional landscape.