Foreign investment in Saudi real estate is moving from concept to reality as the Kingdom accelerates its Vision 2030 transformation. Once largely domestic, the market is now opening to international investors, driven by landmark developments, expanding cities, and evolving ownership frameworks.

With foreign-ownership pathways expected to widen from 2026, interest is rising across Riyadh, Jeddah, and emerging coastal destinations. Understanding both the opportunities and the risks is essential for anyone looking to enter one of the region’s most ambitious and fast-developing real estate markets.

Rewards in Saudi Real Estate Investment

Saudi Arabia offers several advantages that appeal to long-term investors:

Growing demand in key cities:

Riyadh, Jeddah, and coastal regions continue to see strong development activity. Districts, infrastructure expansion, and population increases drive growth.

Download Our App

Get the app and search experience among thousands of verified properties now!

Stable rental markets:

Business expansion and a rising expatriate population support steady rental demand. This is especially evident in mid-range and premium residential segments.

Favourable tax structure:

Saudi Arabia does not impose an annual property tax or a capital gains tax for individuals. A clear and straightforward Real Estate Transaction Tax supports stronger net returns.

Access to new development zones:

As foreign ownership frameworks expand, investors are expected to access more urban and tourism-led development areas.

Long-term residency pathways:

Through the Premium Residency Program (PR.gov.sa), qualifying investors can apply for residency without a local sponsor, providing long-term stability.

Early-stage market entry:

Foreign participation is still developing. Early investors may benefit from entering the market during its initial phase of international expansion.

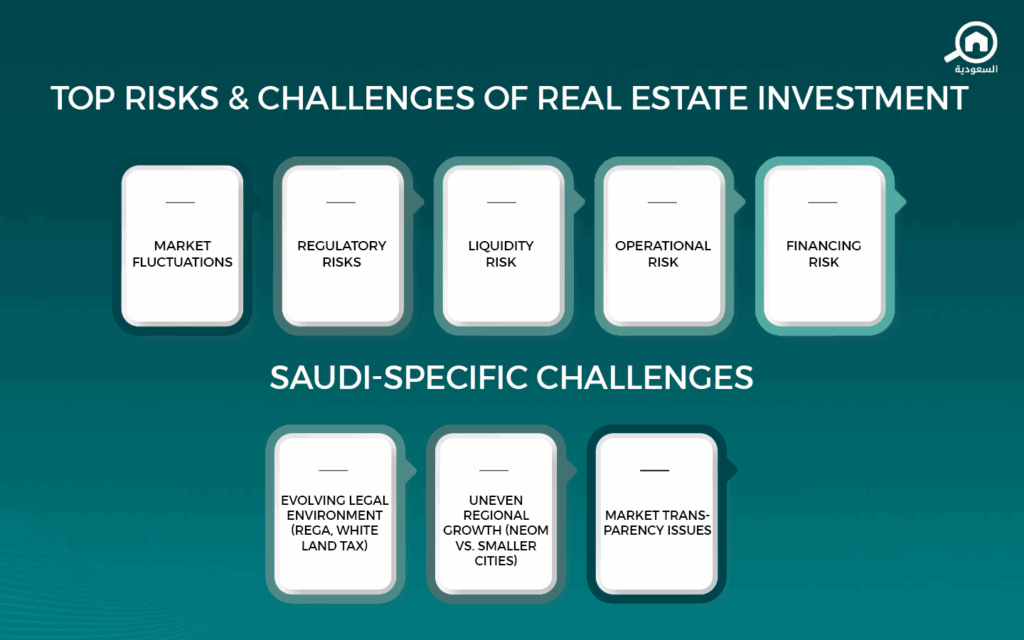

The Risks in Saudi Real Estate Investment

Saudi real estate investment brings various advantages, but some minor regulations need to be kept in check. Foreign investors should also be aware of factors that can affect purchasing decisions:

- Regulations are being phased in: While foreign ownership is set to expand in 2026, the full list of eligible zones and conditions is still under development.

- Limited access to certain cities: Restrictions remain in place for Makkah and Madinah, with exceptions only under specific, regulated circumstances.

- Variation in development timelines: The scale of ongoing projects means delivery periods can vary. Reviewing developer reputation, project status, and infrastructure plans is essential.

- Financing availability: Mortgage options for non-Saudis may evolve gradually; early investors often rely on upfront capital.

- Market variation between regions: Different cities operate at different maturities and risk levels. Understanding regional dynamics is important for informed decision-making.

- Mandatory compliance: All property acquisitions must follow REGA guidelines and be recorded in the national Real Estate Registry to ensure legal clarity.

Also, read about the Foreign Ownership Law in KSA.

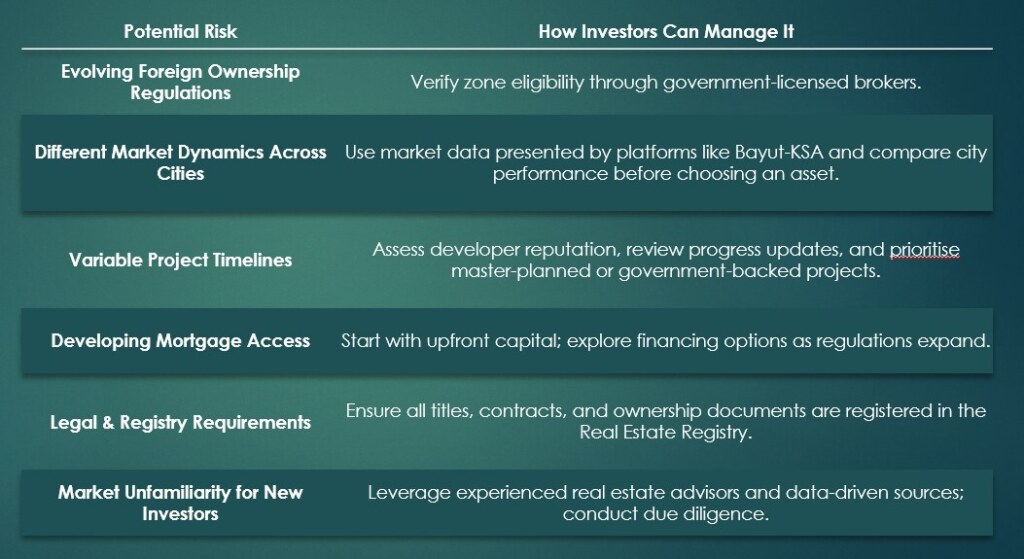

Regulating Potential Risks

Foreign investors who succeed in the Saudi market typically take a structured approach:

These considerations are not reasons for concern; they are simply part of entering a fast-growing market. With basic due diligence and guidance from credible sources, investors can manage them easily. The fundamentals remain strong, making Saudi Arabia a high-potential environment for informed, long-term investment.

What can Investors Gain?

With careful planning, foreign investors may benefit from:

- Exposure to high-growth urban districts,

- Sustained rental demand in business and residential hubs,

- Tax-efficient returns,

- Participation in major national development projects and

- Long-term residency options through qualifying programs such as the Premium Residency Program.

Where Bayut-KSA Can Support Investors

As interest grows across major cities, Bayut-KSA, operating as a real estate company within the Kingdom, supports investors by offering access to active developments and insights into evolving market trends.

Bayut-KSA’s presence across key regions helps investors understand where demand is emerging and which projects align with Saudi Arabia’s regulatory and investment landscape.