The free zones started to embody an interesting opportunity to start a special trip in investment. So, we introduce you to the real estate investment in Saudi free zones and how to begin with it in detail.

What are the Free Zones in Saudi Arabia?

Free zones are known as special economic zones. In other words, they are designated areas governed by a legal and regulatory framework distinct from the rest of the Kingdom.

These zones are established to attract both local and global investment, including real estate, industrial and commercial investments within them. Also, they were developed as part of 2030 Vision which seeks:

- Enhance foreign investment.

- Diversify the economy.

- Reduce reliance on oil as the primary source of national income.

Also, the government launched these free zones according to the 2030 Vision, establishing them all over the country to leverage the distinctive resources and strengths of them. In addition, these zones comprise multiple industries like sea activities, production, technology and logistics services.

Also read about: The Social Investment in Saudi Arabia.

Prominent Free Zones in Saudi Arabia

Saudi Arabia comprises numerous free zones that offer to invest in the real estate sector. Each one is different according to the targeted sector.

In addition, it includes a comprehensive infrastructure that presents to the investors plenty of opportunities and options, here are the prominent ones:

- Jazan City for Primary and Downstream Industries.

- King Abdullah Economic City.

- Special Integrated Logistics Zone (Riyadh)

- Special Cloud Computing Area.

- Ras Al Khair Special Economic Area.

Benefits of Real Estate Investment in Saudi Free Zones

The impressive investment benefits stand behind various points that made it one of the trendy types of investing in Saudi, for example:

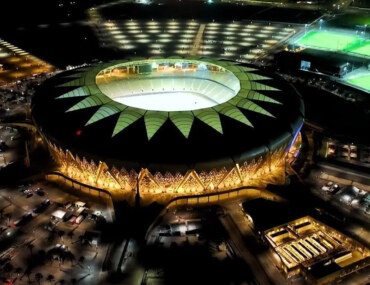

Strategic Location and Comprehensive Infrastructure

Usually, the free zones are surrounded by highways and vital road networks, international key ports and a logistics connection with global markets.

This feature allows investors to leverage the growing demands of logistics services, housing and supportive companies facilities.

Extensive legislative and Tax Incentives

Free zones in Saudi Arabia provide a legal framework that includes attractive tax benefits, such as exemptions on profits repatriated outside the Kingdom, relatively low corporate tax rates of around 5% for:

- Extend periods.

- Customs and fee exemptions on goods movement within the zone.

These incentives reduce operational costs for real estate projects, allowing developers to allocate more capital toward:

- Diversifying property offerings.

- Enhancing project quality.

- Expanding their investment portfolios.

Also read about: Direct and Indirect Real Estate Investment in Saudi Arabia.

Attractive and Collaborative Work Environment

This type of investment concentrates on presenting simplified procedures, facilitating the integration of foreign talent and streamlining licensing processes. This lowers entry barriers, making the market more attractive to developers and real estate companies.

In the same context, it provides a stable legal environment and easy access to skilled professionals serves as an additional incentive for long term investments, while enhancing the competitiveness of Saudi real estate projects at the regional level.

How to Start Investment in Saudi’s Free Zones?

As usual, before committing to any project, we have essential procedures that have to be done, such as understanding the legal framework of each zone. This also includes property rights, tax laws and import-export requirements to ensure full compliance.

Additionally, a thorough analysis of expected cash flows and development costs should be conducted, which will reduce risk of starting a new business or project.

On the other hand, it is important to study the demand for residential or commercial services at the target location to ensure the project’s feasibility before execution.

Also, collaborating with government authorities, experienced consultants and developers in free zones can provide operational insights and best practices, reducing operational risks and increasing the likelihood of success.

(FAQ)

Here are the most frequently asked questions about the free zones in Saudi:

Is Real Estate Investment in Saudi Free Zones Allowed to Foreigners?

Yes, the free zones provide facilitation for foreign direct investment, including property ownership and operational licenses, along with clear legal protection for investors interests.

Finally, real estate investment in Saudi free zones offers a unique opportunity for local and global investors. With strategic locations, modern infrastructure, legal protections and tax incentives.

With Bayut Blog you can discover all of its features that encourages you to invest in Saudi .