With the rapid growth of the Saudi real estate market, understanding real estate investment regulations in Saudi Arabia is essential for making profitable decisions. Simply buying a property is no longer enough; your choices must be based on careful evaluation of location, returns, and financing.

In this guide, we’ll cover the key real estate investment regulations in Saudi Arabia, helping investors make smart, secure decisions. From selecting the ideal location to analyzing yields and managing financing, you’ll get the foundations for a successful, sustainable investment.

What Are the Real Estate Investment Regulations in Saudi Arabia?

Real estate investment in Saudi Arabia goes beyond choosing a good property. It relies on a deep understanding of the “Four Pillars of Real Estate”: market insight, return analysis, risk assessment, and knowledge of legal and financial regulations. Ignoring any of these can turn a profitable opportunity into a loss.

Read more about the Four Pillars in our article The 4 Pillars of Real Estate in Saudi Arabia.

Download Our App

Get the app and search experience among thousands of verified properties now!

Start with Location: Discover Profitable Properties in Saudi Arabia

Location is the cornerstone of any successful real estate investment and is a primary principle in real estate investment regulations in Saudi Arabia. Even a small or older property can yield excellent returns if it’s strategically located. Key high-demand areas include:

- Major infrastructure projects: Like Riyadh Metro and highways, which attract residents seeking accessible commuting options.

- Commercial hubs: Large malls like Dhahran Mall and Granada Mall, where nearby properties are highly sought after.

- Educational districts: Areas around universities like Princess Nourah University, ideal for rental properties catering to students.

Here, the principle of “profit at purchase” is clear: buying in a prime location at a good price sets the stage for immediate investment success.

Why Smart Investors Profit from the Moment They Buy

Profits in real estate start at purchase, not just at sale. Buying below market value or in a location expected to appreciate ensures early gains.

Don’t Forget Operational Expenses

High rent doesn’t guarantee net profit. Operational costs like maintenance, insurance, vacancy periods, and management fees must be considered.

Use Real Estate Financing Wisely

Real estate financing can amplify purchasing power but can become a burden if mismanaged. Key rules:

- Don’t over-leverage beyond your repayment capacity.

- Calculate monthly installments versus expected returns carefully.

- Avoid relying solely on loans.

Learn more about financing strategies in our guide to Smarter Real Estate Finance Management in Saudi Arabia.

Evaluate Returns and Plan for Long-Term Profit

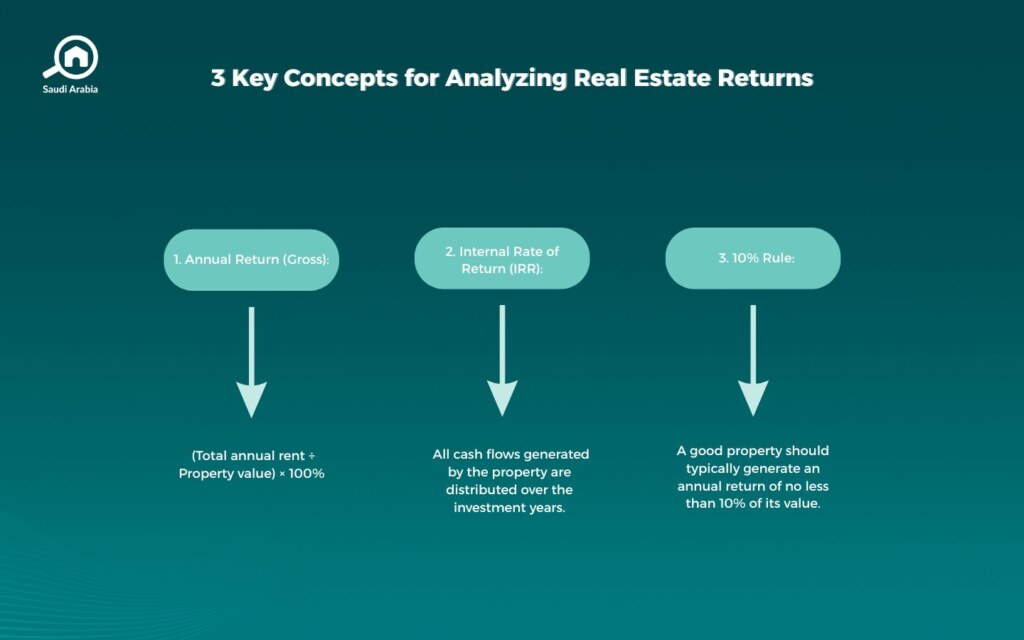

A successful property generates steady, substantial income. Assess annual yield, operating costs, and net profit before investing. See below the 3 Key Concepts for Return Analysis:

- Gross annual yield – e.g., a property costing 1,000,000 SAR generating 80,000 SAR annually yields 8%.

- Internal rate of return (IRR) – A precise long-term profitability measure.

- 10% rule – Some investors consider properties with at least 10% annual yield as good investments, though this varies in Saudi Arabia based on property type, location, and supply-demand dynamics.

Frequently Asked Questions About Real Estate Investment Regulations in Saudi Arabia

Some frequently asked questions and their answers:

Can foreigners invest in Saudi real estate?

Yes, under the newly approved system, foreigners can own residential property in designated areas with prior approval. Commercial and industrial properties also have regulated ownership options. You may benefit from reading our article on the Approval of Saudi’s Property Ownership Law for Foreigners.

What is the new investment system in Saudi Arabia?

Part of Vision 2030, this system aims to attract local and international investors through simplified licensing, financial support, and greater transparency in market data, building confidence for real estate investment.

Smart Investment Requires Knowledge

Investing in Saudi real estate demands awareness of regulations and careful analysis at every step. Location, price, yield, and financing aren’t minor details; they’re the keys to success.

We also recommend visiting the Bayut KSA Blog for further comprehensive insights and updates on investment opportunities in the Kingdom, and to explore how to Invest in Saudi.