Earnings calls now talk more about servers than storefronts. Balance sheets show higher software spend than office expansion. Companies are hiring engineers at a faster rate than they are hiring sales teams. These signals matter because they indicate where money is actually being spent. For investors, investing in tech stocks is increasingly tied to these real shifts in how businesses operate and allocate capital.

In Saudi Arabia, the same pattern is visible. Payment systems scale before physical branches, and cloud capacity grows alongside new regulations. Technology spending is no longer experimental. It is embedded in operating budgets, and investors are following that trail.

What Investing in Tech Stocks Means

Tech stocks represent ownership in companies built around technology-driven products and services, including:

- Software and SaaS platforms

- Fintech and digital payments

- Cloud infrastructure and data centres

- Artificial intelligence and cybersecurity

What sets these companies apart is efficiency.

- Revenue can grow without heavy physical expansion

- Margins often scale faster than traditional sectors

- Prices tend to move more sharply

For most investors, tech stocks act as a growth layer, not a short-term trade.

The Tech Sector in Saudi Arabia

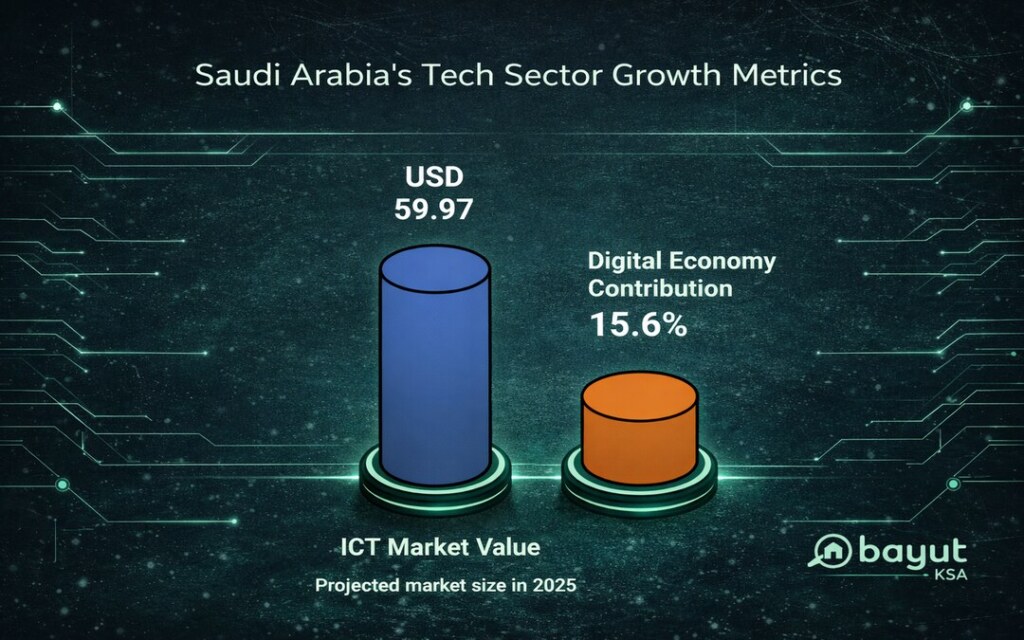

The tech sector in Saudi Arabia is no longer defined by ambition alone. It is measurable. According to sources, the Saudi ICT market was valued at USD 59.97 billion in 2025.

This growth is supported by:

- Cloud infrastructure expansion

- Rising demand for enterprise software

- Fintech adoption across payments and banking

- Increased investment in data and cybersecurity

What Changed Recently

Rules matter, and so does access. In February 2026, the Capital Market Authority (CMA) opened Saudi Arabia’s main stock market to all foreign investors.

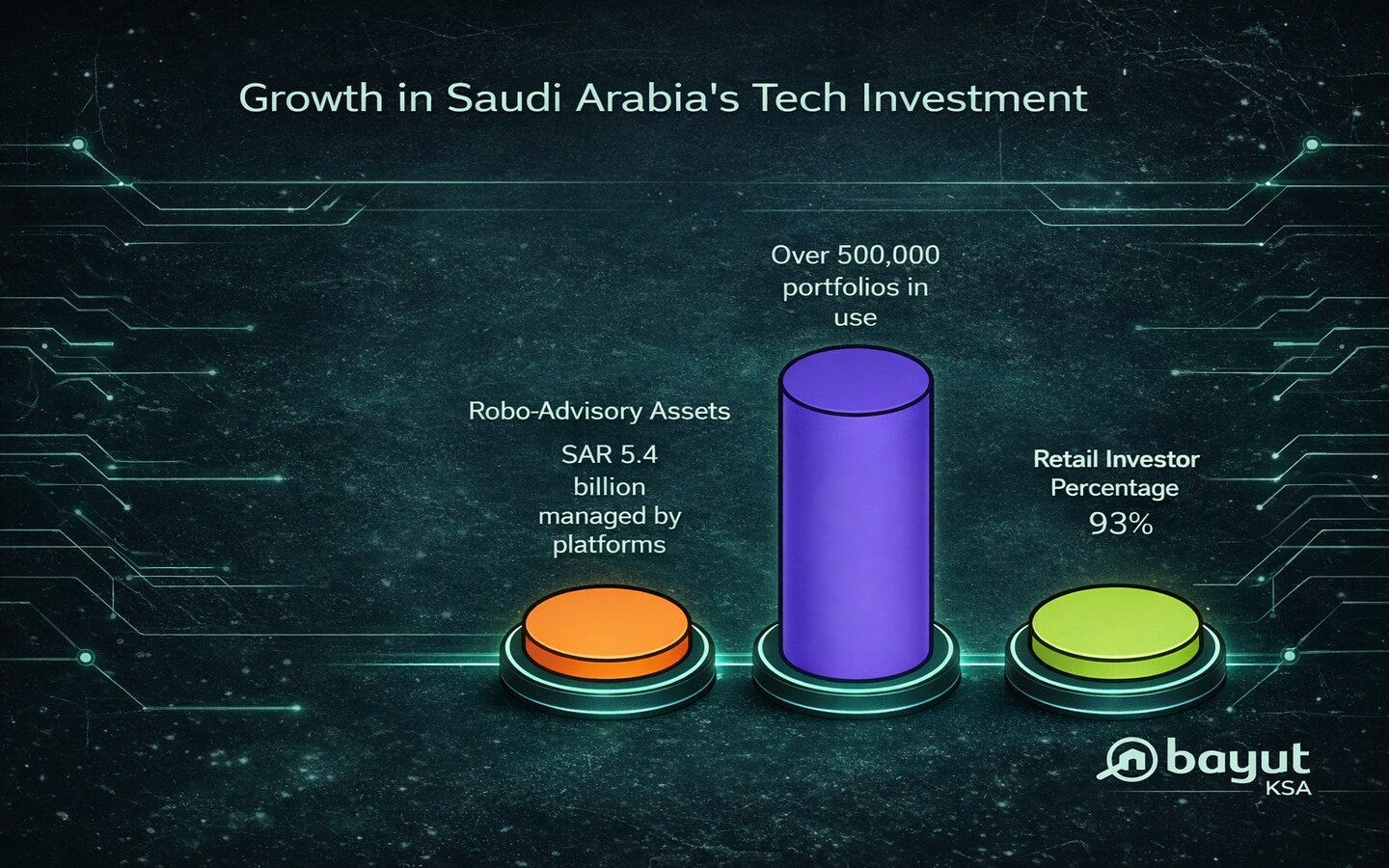

The removal of the Qualified Foreign Investor requirement widened participation and increased liquidity across Tadawul, including technology-related stocks. At the same time, retail participation in tech-led investing has grown through digital platforms.

This shows that access to tech exposure is no longer limited to institutional investors.

Investor Focus on Tech Stocks

The appeal of tech stocks lies in how they grow. Investors are drawn to:

- Scalable business models

- Demand tied to efficiency and automation

- Revenue streams that extend beyond local markets

- Long-term relevance across industries

In Saudi Arabia, ICT expansion and digital policy support provide an additional tailwind. It is forecast to grow to USD 101.3 billion by 2031, reflecting a compound annual growth rate of approximately 9.1%.

Manageable Trade-Offs

Growth comes with risk. Valuations can also rise faster than fundamentals during periods of optimism. This makes diversification and patience essential.

Tech stocks tend to respond quickly to:

- Interest rate changes

- Regulatory updates

- Shifts in global sentiment

Also read: Automated Investing in Saudi Arabia

Tips for Investing in Tech Stocks

Successful tech investing is structured, not reactive. Technology evolves quickly, but strong companies tend to compound steadily.

Key principles include:

- Focus on revenue quality and cash flow

- Diversify across tech sub-sectors

- Avoid overexposure to speculative names

- Expect volatility and plan for it

- Think in multi-year time frames

Tech Stocks Worth Considering

Tech investing works best when it follows demand, not hype. In Saudi Arabia, technology growth is tied to digital infrastructure, fintech, cloud services, and enterprise software.

Investors typically focus on:

- Saudi tech and tech-enabled companies supported by an ICT market worth USD 59.97 billion in 2025

- Telecom and infrastructure firms benefiting from near-universal internet use

- Global tech exposure through diversified international stocks or ETFs

Across all options, strong revenue, scalability, and long-term demand matter most. For many investors, tech stocks complement real estate by helping build capital before property purchases.

Bayut-KSA: Take Informed Decisions

Bayut-KSA is a property technology platform. Its tools help users understand pricing, location trends, and market timing.

Covering investment trends like tech stocks provides context. It explains why buyer behaviour is evolving and how capital flows influence property demand before listings reflect those changes.