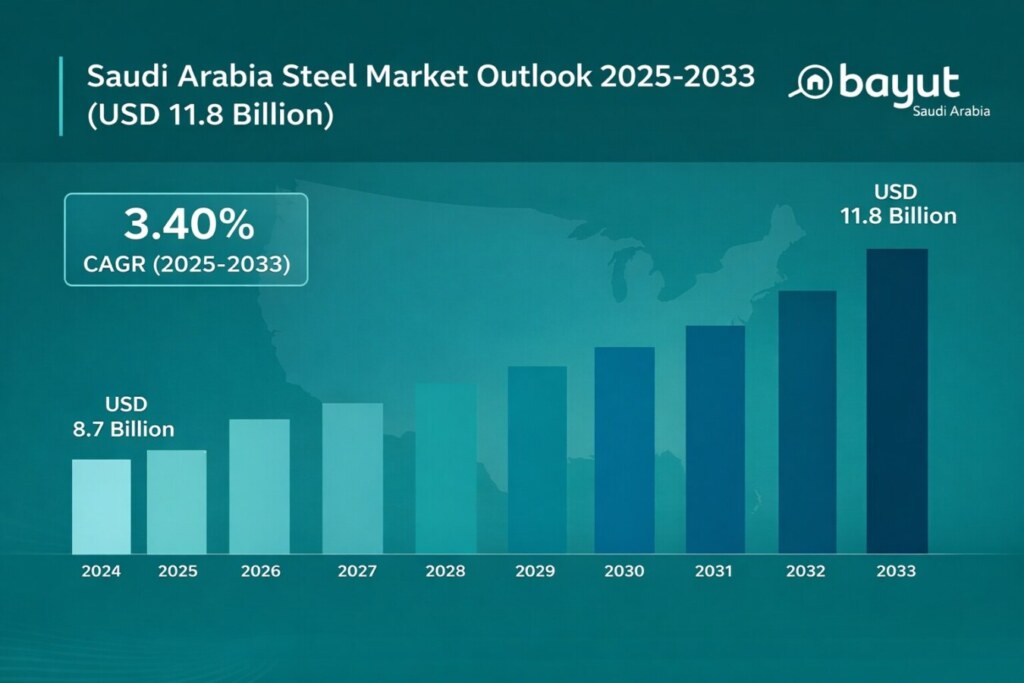

Large economies do not grow in isolation; they grow through systems. When development accelerates, the pressure is initially evident in logistics, energy, and materials. Saudi Arabia’s growth under Vision 2030 has made iron one of those pressure points. Since 2020, construction and industrial activity have expanded simultaneously across the Kingdom, turning iron demand into a constant rather than a variable. This shift has led to increased investment in the Saudi iron sector, positioning it as a key component of supply-chain resilience and economic continuity.

Rising Iron Demand

Saudi Arabia’s growth cycle is defined by overlap. Housing, transport, industrial development, and giga-projects are advancing at the same time, and iron sits at the centre of all of them.

Iron is essential for:

- Residential and mixed-use development

- Transport and logistics networks

- Industrial cities and manufacturing clusters

Because this growth is driven mainly by domestic demand, iron demand has become more predictable and long-term.

Saudi Arabia’s Shift to the Iron Sector

Rising demand highlighted a reliance on imports for a critical material. In response, Saudi Arabia introduced a national plan for restructuring the Saudi iron sector under the Ministry of Industry and Mineral Resources.

The National Industrial Development and Logistics Program (NIDLP) supports the department.

The restructuring focuses on:

- Expanding local production capacity

- Modernising manufacturing processes

- Supporting downstream fabrication

- Attracting private and foreign investment

By 2023, the sector generated around USD 5.4 billion in production value, accounting for over 7% of MENA steel output. Around 27% of production was exported, signalling growing regional competitiveness.

The Investment Opportunity

As reforms progress, investment opportunities in the Saudi iron sector are emerging across the value chain.

Key areas include:

- Iron and steel manufacturing aligned with construction demand

- Structural steel fabrication, projected to grow from USD 2.65 billion in 2025 to USD 3.46 billion by 2030

- Industrial land and logistics assets

- Public-private partnerships linked to national projects

Despite growing capacity, Saudi Arabia imported around USD 6.15 billion worth of iron and steel products in 2024, highlighting strong potential for import substitution.

From Local to Regional

Saudi Arabia is also strengthening its role beyond its borders. With strong logistics infrastructure, competitive energy availability, and access to key regional markets, the Kingdom is positioning itself as a regional iron and steel hub.

Its largest producer, Hadeed, operates with a finished steel capacity of around 7 million tonnes per year, the largest in the GCC. As a result, Saudi Arabia is increasingly relevant to regional construction and manufacturing supply chains.

What This Means for Real Estate Investors

Iron demand does not exist in isolation. It directly supports:

- Housing supply and affordability

- Industrial and logistics real estate

- Mixed-use and infrastructure-linked developments

For this reason, tracking industrial trends like iron production helps investors better understand where demand for land, warehouses, worker housing, and commercial assets is heading.

Find Investment-Ready Opportunities with Bayut-KSA

Bayut-KSA helps investors, developers, and businesses explore verified listings across residential, commercial, and industrial property segments. Whether you are assessing land near industrial hubs, exploring logistics-linked assets, or tracking growth corridors tied to national projects, Bayut-KSA provides market visibility for investment decisions.

Explore Saudi Arabia’s property opportunities today on Bayut-KSA.