Saudi Arabia’s startup scene is growing for reasons beyond funding rounds and new tech hubs. A young workforce, supportive regulations, and national programs make it easier for founders to launch companies. At the same time, global investors are seeking strong emerging markets, and Saudi Arabia has become a top destination for new ventures. Together, these factors are pushing investment in startups in Saudi Arabia to record levels.

As founders set up operations and talent clusters expand, demand for modern offices, co-working spaces, and housing near active business corridors is rising. The result is a direct link between startup growth and increasing real estate demand under Vision 2030.

Guide to Investing in Startup Projects

Saudi Arabia has built a supportive foundation that encourages new ideas to flourish. Investors entering the ecosystem benefit from a landscape designed to help startups scale with clarity and structure.

Key ecosystem features include:

- Startup hubs in Riyadh, Jeddah, and Dammam

- Government-backed accelerators and funding programs

- Simplified digital licensing for investors

- Rising demand for tech-driven services

- Access to talent and global expertise

These components allow new projects to grow with confidence.

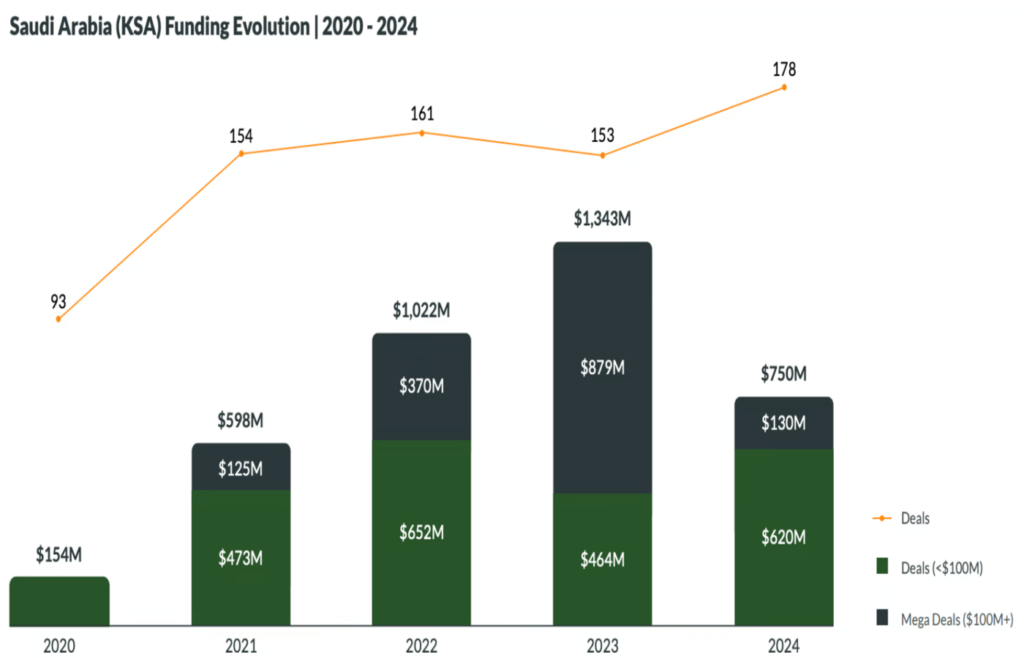

Recent Funding Growth in the Kingdom

Funding growth reflects the Kingdom’s rising economic activity. Over the past year, the startup ecosystem has recorded significant progress.

Notable developments:

- USD 1.34 billion raised in early 2025, showing over 340 percent year-on-year growth

- increased investor participation in fintech, AI, logistics, cloud, and health-tech

- More international funds entering the Saudi market

These numbers show that Saudi Arabia’s innovation economy is no longer emerging. It is accelerating.

What Investors Should Look For

Every strong investment begins with understanding the business and the people behind it. Investors often take time to study the startup’s journey before committing capital.

Key details include:

- Company stage: seed, early growth, or advanced

- Founder experience and team capabilities

- Revenue model and scalability

- Competitive landscape and market need

- Share structure and governance

- Financial planning and operating runway

These insights help build trust and guide smarter decisions.

Ways You Can Invest in Saudi Startups

The Kingdom offers several pathways for individuals and companies ready to support early-stage ventures.

Investment routes include:

- Licensed angel platforms

- Venture capital firms

- Government co-investment schemes

- Startup accelerators and incubators

- Direct investment in founders

- Corporate venture programs

Riyadh leads in deal volume, making it the gateway for active investors.

Benefits of Investing in Startups

Investing in startups allows individuals to participate in the Kingdom’s innovation story while exploring high-growth sectors.

Key benefits:

- Early access to emerging industries

- Potential for significant equity appreciation

- Long-term portfolio diversification

- Involvement in new technologies shaping daily life

- Alignment with national innovation goals

- Contribution to regional economic development

This combination makes startup investment appealing across investor types.

Also read about the Digital economy in Saudi Arabia with Bayut.sa.

Startups: The Drivers of the Saudi Economy

Investment in startups in Saudi Arabia is now one of the Kingdom’s strongest economic drivers. It supports national progress by:

- Diversifying the economy beyond oil

- Increasing GDP contribution from tech and digital services

- Creating specialised jobs in engineering, data, and product development

- Attracting global venture capital and strategic partners

- Strengthening digital infrastructure and cloud capacity

- Supporting Vision 2030’s innovation-led development

These outcomes build a resilient and globally competitive economy.

Start Up Growth & Real Estate Demand

The rise of startups is reshaping urban development and property demand across the Kingdom. New companies and talent clusters influence how cities grow and evolve.

Impact on real estate includes:

- Demand for modern office spaces and co-working centres

- Expansion of innovation districts in major cities

- Higher residential demand near business zones

- Increased value in mixed-use communities

- Growth in commercial and retail services around startup hubs

This connection positions real estate as a direct beneficiary of the Kingdom’s innovation movement.

Bayut KSA: Making Decisions Easier For You

As new business districts and innovation clusters develop, Bayut-KSA helps residents and investors understand how these economic shifts influence property markets.

With updated listings, neighbourhood insights, and easy search tools, Bayut-KSA supports confident decision-making in a rapidly evolving economy.