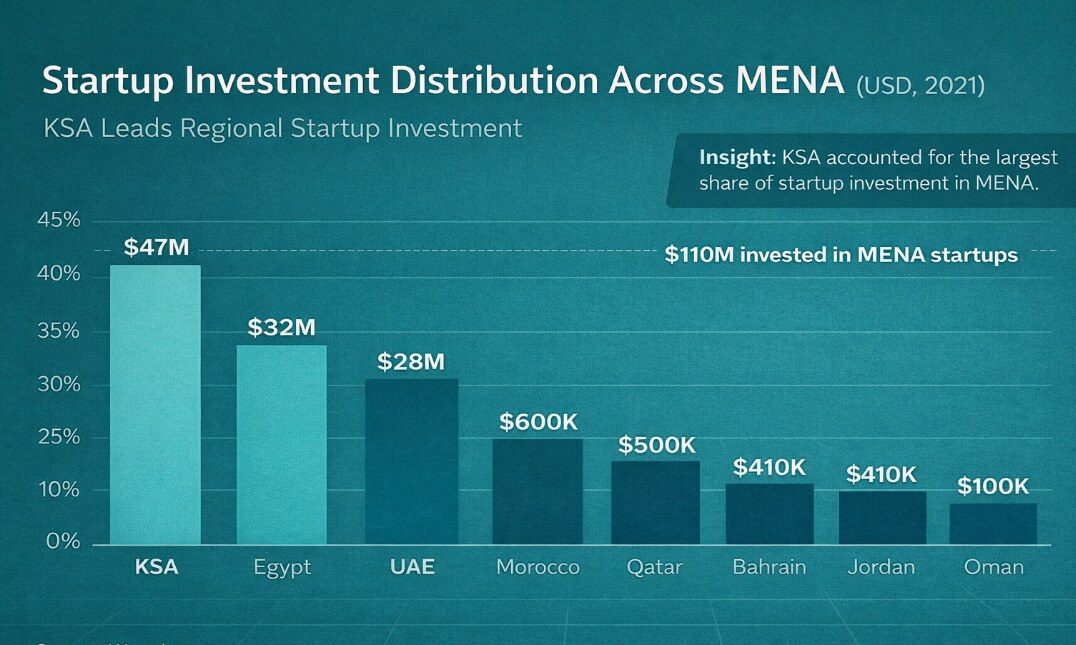

A few years ago, investors in Saudi Arabia looking for growth opportunities usually turned to familiar options, such as real estate, listed equities, or private businesses with long operating histories. Today, that mindset is shifting. As new digital services, fintech platforms, logistics solutions, and software companies emerge from within the Kingdom, investors are increasingly asking a different question: how to participate early? This change in thinking has brought investment in startup companies in KSA into sharper focus, not as speculation, but as a structured, long-term investment strategy.

The Rise of Startup Investing in KSA

In Saudi Arabia, investment in startup companies typically involves providing capital to privately held, Saudi-licensed businesses in exchange for equity or equity-linked instruments.

These startups are usually registered through the Ministry of Commerce, licensed by MISA (Ministry of Investment) where applicable, and operate under sector-specific regulators such as:

- Saudi Central Bank (SAMA) for fintech

- Capital Market Authority (CMA) for equity crowdfunding and investment platforms

- Communications, Space & Technology Commission (CST) for technology and digital services

This regulatory framework gives investors greater visibility and governance compared to many emerging startup markets.

Inside a Startup Investment

The details of investment in startup companies in KSA vary by stage and funding structure.

Common startup stages in KSA

- Seed stage: Often supported by programs backed by Monsha’at, MISK Accelerator, and Flat6Labs Saudi Arabia

- Early stage: Startups with early revenue raising capital from angel investors or seed funds

- Growth stage: Companies scaling across Saudi Arabia or the GCC, often backed by institutional capital

Typical investment instruments

- Equity shares

- Convertible notes

- SAFE (Simple Agreement for Future Equity) agreements

Many startups supported under Vision 2030 operate in sectors that directly shape real estate usage, from logistics hubs to smart residential developments.

How Investors Choose the Right Startups

A practical guide to investing in startup projects begins with structured due diligence.

What investors should assess

- Business model: Ability to scale within the Saudi market

- Founding team: Execution experience and sector knowledge

- Market alignment: Fit with Vision 2030 priority sectors

- Financials: Burn rate, runway, and funding history

- Regulatory readiness: Compliance with CMA, SAMA, or CST

- Exit potential: Acquisition, regional expansion, or IPO

Startups that meet regulatory and market expectations tend to attract stronger investor confidence.

Where and How to Invest?

Saudi Arabia offers regulated entry routes.

Recognised investment channels

- Angel investor networks registered with Monsha’at

- Venture capital funds such as STV, Riyadh Valley Company, and Vision Ventures

- CMA-licensed equity crowdfunding platforms, including Manafa, Scopeer, and Sukuk Capital

- Accelerator-led investment programs like MISK Accelerator and Flat6Labs KSA

Each option offers different levels of diversification, ticket size, and involvement.

Benefits of Investing in Startup Companies

The benefits of investing in startup companies in KSA extend beyond potential financial returns.

Key benefits

- Exposure to high-growth sectors such as fintech, healthtech, logistics, and SaaS

- Portfolio diversification beyond real estate and listed equities

- Early participation in companies aligned with Vision 2030

- Access to structured deal flow through licensed platforms

Vision 2030’s focus on SME growth and urban development means startup expansion often translates into new demand for commercial and residential property across emerging cities.

Real Estate Outlook

Startup growth in Saudi Arabia is creating real, measurable demand for physical space, influencing several real estate segments:

- Office space: Early-stage startups increase demand for flexible offices and co-working spaces, while scaling companies move into small and mid-sized office units, especially in Riyadh.

- Logistics and industrial: E-commerce and logistics startups drive demand for warehouses, fulfilment centres, and light industrial properties near key transport routes.

- Residential housing: Startup hiring supports steady rental demand for workforce housing close to employment hubs.

- Proptech impact: Technology-led startups are improving property management, leasing efficiency, and building operations, indirectly supporting asset value.

Investor takeaway:

Startup activity often signals future real estate demand, helping investors identify locations and asset types driven by real economic growth rather than speculation.

Bayut-KSA: Trusted Real Estate Intelligence

Startup investing can feel abstract. Real estate, by contrast, offers a clearer and more familiar lens, especially as many Saudi startups directly influence demand for offices, logistics hubs, and commercial space.

Bayut-KSA help bridge this gap. By providing verified listings and real market data, Bayut KSA allows investors to explore startup-driven growth through a practical real estate perspective.