Not long ago, buying or renting property in the Kingdom involved slow payments and manual verification. Financing approvals often took time. The rise of FinTech in Saudi Arabia began changing this by digitizing payments, simplifying property financing, and reducing friction across real estate transactions.

Today, fintech tools sit at the core of the property journey. Digital mortgage approvals and secure online rent payments support faster decisions. As Saudi Arabia’s property market grows, understanding how fintech shapes financing, regulation, investment, and long-term confidence has become increasingly important.

What Is FinTech in Saudi Arabia?

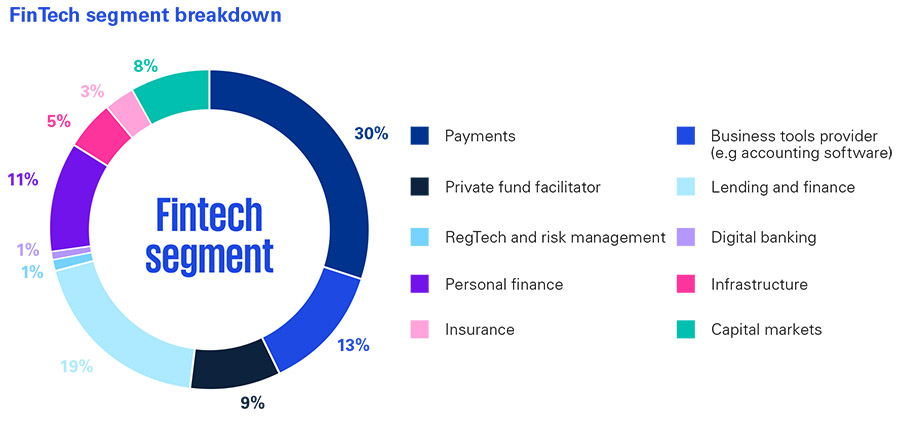

FinTech in Saudi Arabia refers to regulated digital technology that delivers financial services. It includes payments, lending, banking, insurance, and investment tools through licensed platforms.

In real estate, fintech supports practical tasks that were once slow or manual. These include:

- Digital property payments and rent collection

- Online mortgage and home financing solutions

- Secure identity verification and compliance checks

- Automated settlement and escrow-style payment flows

Rather than replacing traditional banks, fintech platforms often work alongside them. This collaboration improves speed, transparency, and access.

How Big Is the FinTech Market in Saudi Arabia?

Understanding how big the fintech market in Saudi Arabia is requires multiple data points, because different reports measure different aspects:

- One forecast predicts the market will grow from about USD 2.85 billion in 2025 to over USD 5.28 billion by 2030, with a CAGR of around 13%.

- Another estimates the total fintech assets under management could expand from around USD 67.8 billion in 2025 to approximately USD 91 billion by 2030.

- Broader industry projections suggest the market may reach over USD 100 billion by the early 2030s.

These figures vary because they measure value differently (transaction value vs. assets vs. platform revenues), but all point to rapid growth in fintech across the Kingdom.

Why Market Size Matters for Real Estate

Digital payments and mobile channels dominate adoption, with fintech technologies increasingly used for secure and compliant property-related payments. As the fintech market expands:

- Property financing becomes more accessible

- Transaction timelines shorten

- Cash dependency continues to decline

- Buyer and investor confidence improves

This growth helps real estate platforms and developers operate more efficiently, attracting both domestic and international users.

Investment in the FinTech Sector in Saudi Arabia

Investment in the fintech sector in Saudi Arabia has surged alongside broader digital growth. Recent ecosystem reviews show:

- A rapid increase in startup activity, with the number of fintech firms more than tripling in just a few years.

- Focused venture funding targeting payment platforms, credit innovations, open banking, and API-based services.

- Major tech and finance events (like Money20/20 Middle East) attracting thousands of investors and hundreds of fintech startups to Saudi Arabia each year.

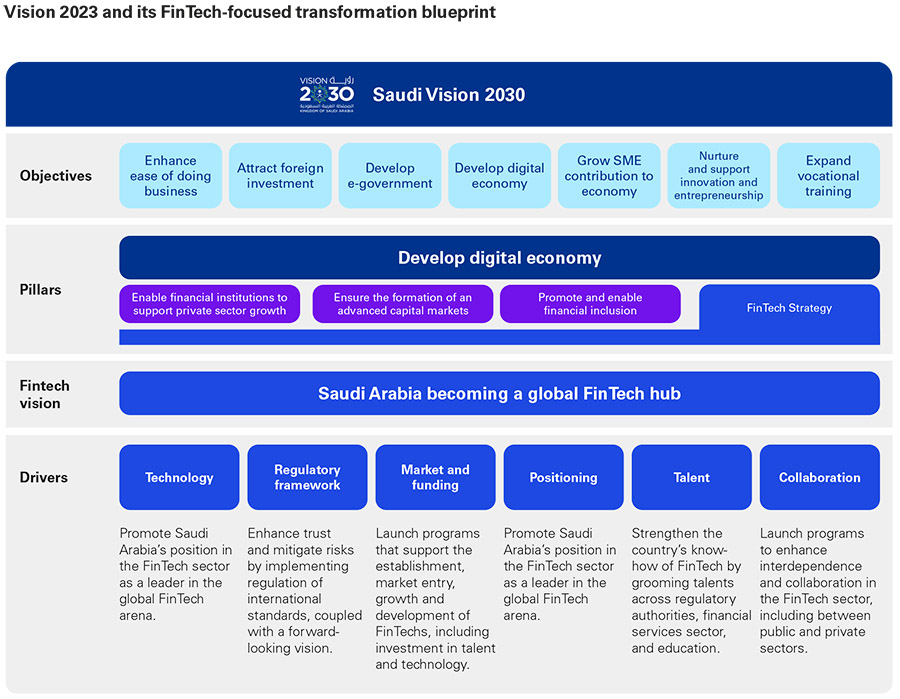

FinTech Regulations in Saudi Arabia

Who Regulates FinTech?

FinTech regulation in Saudi Arabia is structured and intentional:

- Saudi Central Bank (SAMA) oversees payments, digital wallets, open banking, and lending fintechs.

- Capital Market Authority (CMA) regulates investment-related fintech, including crowdfunding, robo-advisory, and digital securities.

This dual-regulatory framework ensures fintech platforms used in real estate transactions meet strict compliance standards, protecting users and funds.

Why Regulation Matters for Property Transactions

Strong regulation delivers clear benefits in property contexts:

- Protects buyers, tenants, and investors

- Reduces fraud risk through compliance checks

- Ensures secure payment and settlement flows

- Builds public trust in digital property services

Also read: Investment in Tech Stocks across KSA

Future of FinTech in Saudi Arabia and Real Estate

Saudi Arabia has launched a national-scale blockchain infrastructure for real estate tokenisation, marking a global first for property markets. This system enables property ownership rights to be represented as digital tokens on a secure blockchain backbone.

Key highlights include:

- A national digital property register managed by the Real Estate Registry, providing end-to-end digital records and marketplace connectivity.

- Support for fractional ownership, allowing multiple investors to hold tokenised shares of a single property.

- The first official tokenisation transaction completed under regulatory oversight, positioning Saudi Arabia among the earliest adopters of regulated digital property assets.

This infrastructure aims to enhance investment access, liquidity, and transparency in the real estate market.

Bayut KSA in a FinTech Property Market

As FinTech in KSA continues to improve payments, financing, and transparency, real estate platforms must keep pace. Bayut-KSA supports this shift by making property discovery clearer, faster, and more accessible in a digital-first market.

By reducing friction and supporting informed decisions, Bayut-KSA fits naturally into Saudi Arabia’s evolving fintech-driven real estate ecosystem.