When investing in real estate, understanding key performance metrics can make the difference between a profitable investment and a risky one. One of the most critical metrics for investors is the vacancy rate in real estate investment. But what does it really mean, and how can it affect your returns? In this article, we’ll break it down in simple terms, show you how to calculate it, and explain why it’s a must-know for any property investor.

What is the Vacancy Rate in Real Estate Investment?

The vacancy rate is the percentage of unoccupied units in a property compared to the total number of units available. In other words, it measures how many units are sitting empty.

- High vacancy rate → many units are unoccupied → potential risk or lower income.

- Low vacancy rate → most units are rented → stronger income and demand.

It is the inverse of the occupancy rate, which measures how many units are occupied. For example:

Metric | Example |

|---|---|

Metric Occupancy Rate | Example 80% of units rented |

Metric Vacancy Rate | Example 20% of units vacant |

This simple relationship highlights the importance of tracking both metrics when analyzing a property’s performance.

You may also benefit from reading our article on How to Use Cash Flow Calculation before Investing in a Property.

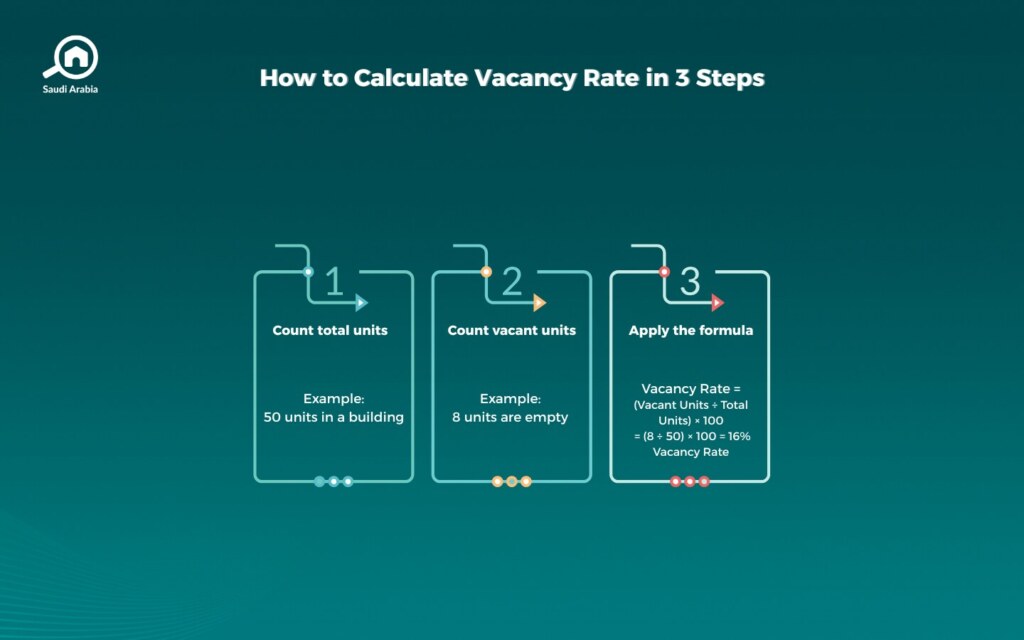

How to Calculate the Vacancy Rate in Real Estate Investment

Calculating the vacancy rate is simple and gives investors a clear picture of how much rental income is being lost due to empty units. Here is the formula:

Vacancy Rate (%) = (Number of Vacant Units ÷ Total Number of Units) × 100

Example:

If a building has 50 rental units and 8 of them are currently vacant:

Vacancy Rate = (8 ÷ 50) × 100 = 16%

This means that 16% of the property is not generating income.

Tip for investors: Track vacancy trends over time to identify seasonal patterns, management issues, or market demand changes.

Vacancy Rate vs Occupancy Rate: Understanding the Difference

Many new investors confuse vacancy rate with occupancy rate, but they serve different purposes:

- Occupancy rate: Shows how well a property is performing in terms of rental income. Higher occupancy = stronger cash flow.

- Vacancy rate: Highlights risk and helps investors understand potential income loss. Higher vacancy = higher risk.

Here’s a quick comparison:

| Metric | Focus | High vs Low |

| Occupancy Rate | Income performance | High is good |

| Vacancy Rate | Risk management | Low is good |

Understanding both metrics together provides a more complete picture of a property’s health.

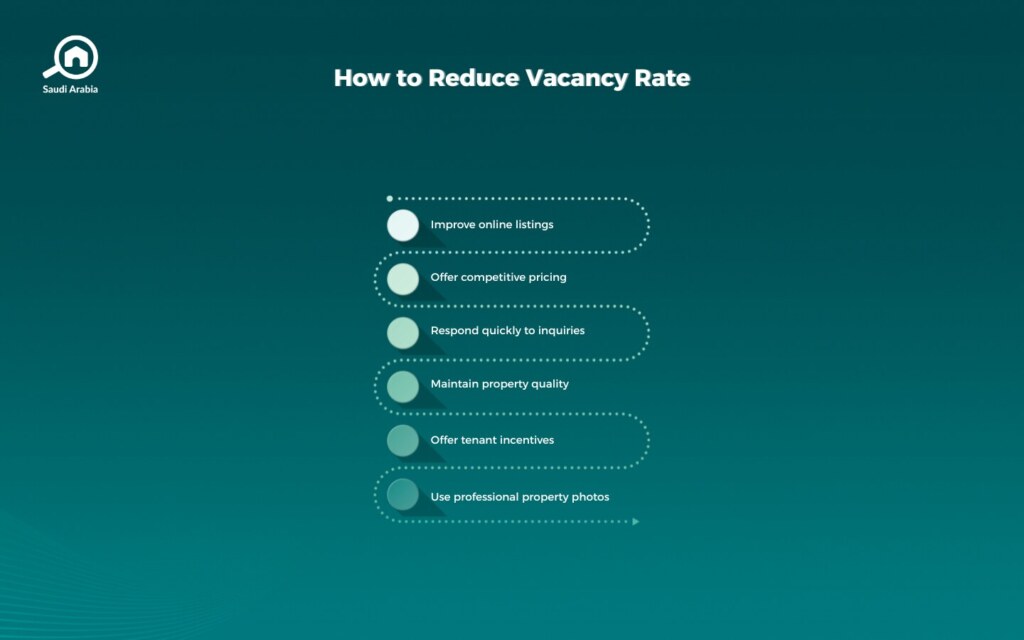

Factors Affecting Vacancy Rate in Real Estate Investment

Several factors can influence the vacancy rate of a property, such as:

- Location: Prime locations often have lower vacancy rates due to high demand.

- Property condition: Well-maintained properties attract more tenants.

- Rental price: Competitive pricing ensures units are occupied.

- Market trends: Economic shifts can increase vacancies across an area.

- Management quality: Efficient property management reduces turnover and vacancies.

Investors can use these insights to make data-driven decisions, adjust strategies, and maximize returns.

Further reading: The 4 Pillars of Real Estate in Saudi Arabia: All You Need for Investment Success.

Why Vacancy Rate Matters for Real Estate Investors

Understanding the vacancy rate in real estate investment is not just about numbers—it’s about making smarter investment choices. Here’s why it matters:

- Predicting income: Helps estimate rental revenue more accurately.

- Risk assessment: High vacancy rates signal potential market weakness or property issues.

- Investment comparison: Compare different properties or markets to find the best opportunities.

- Portfolio planning: Lower vacancy rates improve cash flow and reduce dependency on high tenant turnover.

Fun fact: In some markets, a 5–10% vacancy rate is considered normal and even healthy, allowing for tenant turnover and property maintenance.

Tools and Resources to Monitor Vacancy Rates

To stay on top of your investments, you can use tools like:

- Property management software to track occupancy.

- Real estate market reports to analyze trends.

- Excel or Google Sheets to calculate and visualize vacancy rates over time.

- Real Estate General Authority (REGA) – https://rega.gov.sa

- General Authority for Statistics – https://stats.gov.sa

Including infographics or comparison charts can make these insights more digestible and engaging for investors.

Mastering Vacancy Rate for Smarter Investments

The vacancy rate in real estate investment is a key metric that every investor should understand. By knowing how to calculate it, comparing it with occupancy rates, and analyzing the factors that influence it, you can make smarter, more profitable decisions. Monitoring vacancy trends helps you reduce risk, maximize rental income, and ensure your real estate portfolio thrives.

Investing wisely isn’t just about buying property—it’s about understanding the numbers behind it. Keep your finger on the pulse of vacancy rates, and your investments will thank you.

Explore more insights on real estate metrics and investment tools at My Bayut Blog to sharpen your investment strategy.