In Saudi Arabia’s growing rental property market, understanding Tenants’ and Landlords’ Rights in Property Insurance is essential for both parties. Whether you’re a landlord looking to protect your property or a tenant wanting to secure your belongings, knowing who is responsible for what can help prevent costly disputes and legal complications.

This guide explains the insurance landscape for rental properties in Saudi Arabia, and what rights and responsibilities each party holds.

What Are Tenant Rights in Property Insurance

Tenants’ and Landlords’ Rights in Property Insurance are important to know for anyone looking to rent or rent out. Tenants, for example, in Saudi Arabia have specific rights when it comes to property insurance. While landlords are typically responsible for insuring the building structure, tenants can (and should) obtain contents insurance to cover personal belongings that exist inside the property.

Some key rights for tenants include:

- Protection of personal property: Tenants can insure electronics, furniture, clothing, and other valuables.

- Right to transparency: Tenants should receive clear information about what the landlord’s insurance does and does not cover.

- Claim participation: If a tenant’s insured property is damaged due to a covered event (like fire or water damage), they have the right to file a claim independently.

Landlords’ Rights in Property Insurance – What You Need to Know

Landlords in Saudi Arabia are both legally and financially responsible for protecting their real estate assets. Property insurance for landlords typically includes:

- Structural coverage: Protection against damage to the building from fire, storms, or other hazards.

- Liability insurance: Covers legal expenses if someone is injured on the premises.

- Loss of rental income: In some cases, landlords may be covered if property damage makes the unit uninhabitable.

Landlords also have the right to:

- Require tenants to carry personal insurance as part of the lease.

- Be notified of any damage to the insured property reported by the tenant.

If you’re a landlord, you may also be interested in reading our article on Tenant Eviction Request via Najiz – A Complete Guide for Landlords in Saudi Arabia.

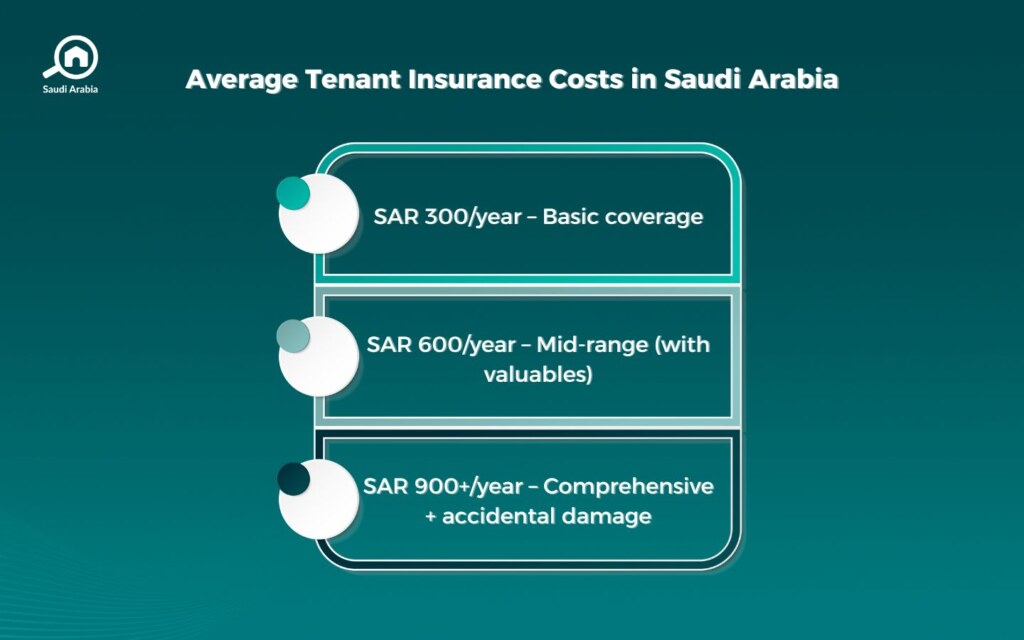

How Much Is the Insurance Amount for Tenants?

One of the most important thing when it comes to Tenants’ and Landlords’ Rights in Property Insurance is protection. Home insurance costs for tenants in Saudi Arabia can vary, but typical content insurance premiums start from SAR 300 to SAR 900 per year, depending on the total value of personal items covered, location, and policy type. For example:

- A tenant insuring SAR 50,000 worth of belongings may pay around SAR 600/year.

- Optional add-ons, such as accidental damage or theft coverage, may increase this amount.

Tenants should always compare policy options from multiple providers to ensure comprehensive yet affordable coverage.

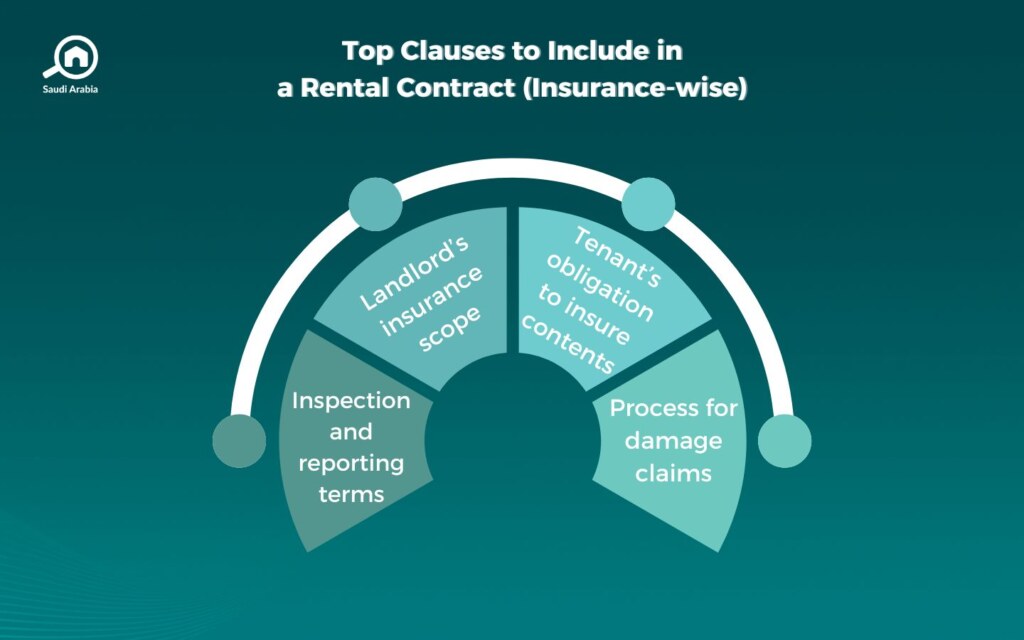

Tenants’ and Landlords’ Rights in Property Insurance: can Landlords Require Tenants to Have Insurance?

Yes, landlords can include a requirement for tenants to hold personal insurance in the lease agreement. This protects both parties from potential losses or legal issues and is increasingly common in newer tenancy contracts across Saudi Arabia.

Landlords may:

- Ask for proof of insurance before handing over the property

- Set minimum coverage requirements for personal belongings or liability

What Does Property Insurance Typically Cover for Tenants and Landlords?

For Landlords:

- Damage to building structure (walls, roof, etc.)

- Fire and natural disasters

- Water damage

- Liability for accidents on the property

- Loss of rent in case of extended vacancy

For Tenants:

- Personal items (furniture, appliances, clothing, etc.)

- Accidental damage

- Theft

- Liability for causing damage to the property or other tenants

Common Disputes Related to Insurance in Rental Agreements

Tenants’ and Landlords’ Rights in Property Insurance can get murky. Despite clear guidelines, insurance-related disputes can arise. These include:

- Damage blame: Disagreements about whether damage is the tenant’s or landlord’s responsibility.

- Lack of coverage clarity: Tenants may assume they are covered under the landlord’s insurance.

- Failure to report incidents: Both parties have the responsibility to notify insurers promptly.

Clarity in the lease agreement and good communication help prevent these issues.

Tenants’ and Landlords’ Rights in Property Insurance is Vital for Both Parties

Understanding Tenants’ and Landlords’ Rights in Property Insurance is crucial in avoiding disputes and protecting financial interests. Both parties benefit from clarity, proper coverage, and good communication. Whether you are a tenant safeguarding your belongings or a landlord protecting your investment, choosing the right policy will provide peace of mind and security.

Official and Regulatory Sources for Tenants’ and Landlords’ Rights in Property Insurance

- Saudi Central Bank (SAMA) – Licensed Insurance Companies

(Use this when talking about verifying if a company is licensed.) - Council of Cooperative Health Insurance (CCHI)

(Useful if you touch on property-related health or liability coverage.)

Be sure to follow My Bayut to stay updated with Saudi Arabia’s real estate market, trends, and more.