Real estate is often seen as a stable path to wealth, but like any other sector, it’s not without its risks. Understanding the Risks of Real Estate Investment is essential, especially for those entering the Saudi property market, where Vision 2030 continues to reshape urban landscapes and create new opportunities.

While the promise of returns can be appealing, not every investment is guaranteed to succeed. So, what are the pitfalls to watch out for? Investors protect themselves in an evolving market when knowing about the Risks of Real Estate Investment. Let’s discuss!

A Common Question: What Are the Risks of Real Estate Investment?

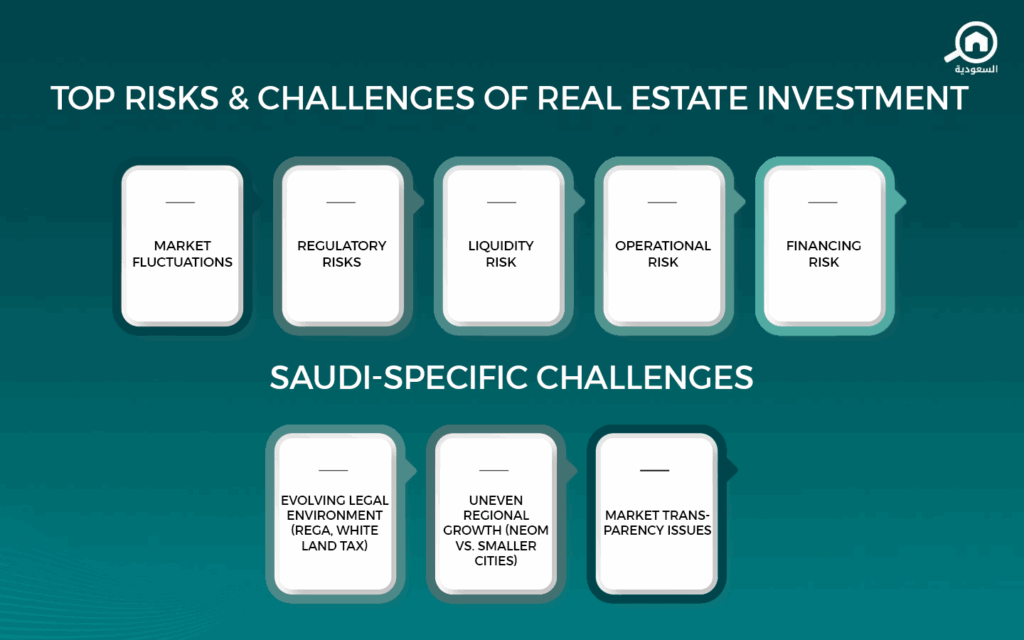

Investing in property sounds straightforward, but the reality is much more complex. You need to be vigilant, open to learning, and most of all: have a mindset that adjusts to the changes that come with an evolving sector. Some key risks include:

- Market Fluctuations, in which property prices can decline due to economic downturns, oversupply, or reduced demand. In Saudi Arabia especially, regional variations play a role – prices in Riyadh may rise while other areas stagnate.

- Legal and Regulatory Risk means people may misunderstand zoning laws, foreign ownership rules, or even miss new government regulations can lead to penalties or delays.

- Liquidity Risks also pose a problem. Real estate is not easy to sell quickly, that is a rarity. If you need urgent cash, unloading a property may take time or involve selling at a loss.

- Financing Risks come into play. Rising interest rates or a drop in rental income can make it hard to cover mortgage payments.

- Operational Risks are a big one. From poor property management to unexpected maintenance costs, operational challenges can drain profits quickly.

Another Query You May Have: What are the Challenges of Real Estate Investment in Saudi Arabia ?

As we’ve mentioned many times before, Saudi Arabia’s real estate sector is developing rapidly, but that pace introduces new complexities. What unique Risks of Real Estate Investment do investors face?

- Evolving Legal Frameworks, such as the introduction of the Real Estate General Authority and updates to the White Land Tax reshape how property is managed and taxed.

- Regional Disparities, with Mega-projects like NEOM attracting investor attention – they also come with uncertainty. Not all areas will see the same level of growth.

- Cultural Shifts are significant. Changes in family structures and work patterns are affecting the types of properties in demand.

- Limited Market Transparency affects real estate investment, certainly in Saudi Arabia as well. Compared to developed markets, data on pricing trends and returns can be harder to access.

Types of Real Estate Investment Risks

It’s helpful to categorize the risks to better manage them. The main types include:

- Economic Risk: Related to inflation, interest rates, or economic contraction.

- Location Risk: Tied to the specific area’s infrastructure, amenities, and safety.

- Tenant Risk: Especially in rental properties, poor tenant selection can lead to late payments or property damage.

- Construction Risk: For off-plan or development investments, there’s a chance of project delays, cost overruns, or even cancellation.

- Valuation Risk: Overpaying for a property due to poor due diligence or market hype.

Some Tips to Avoid Risks of Real Estate Investment :

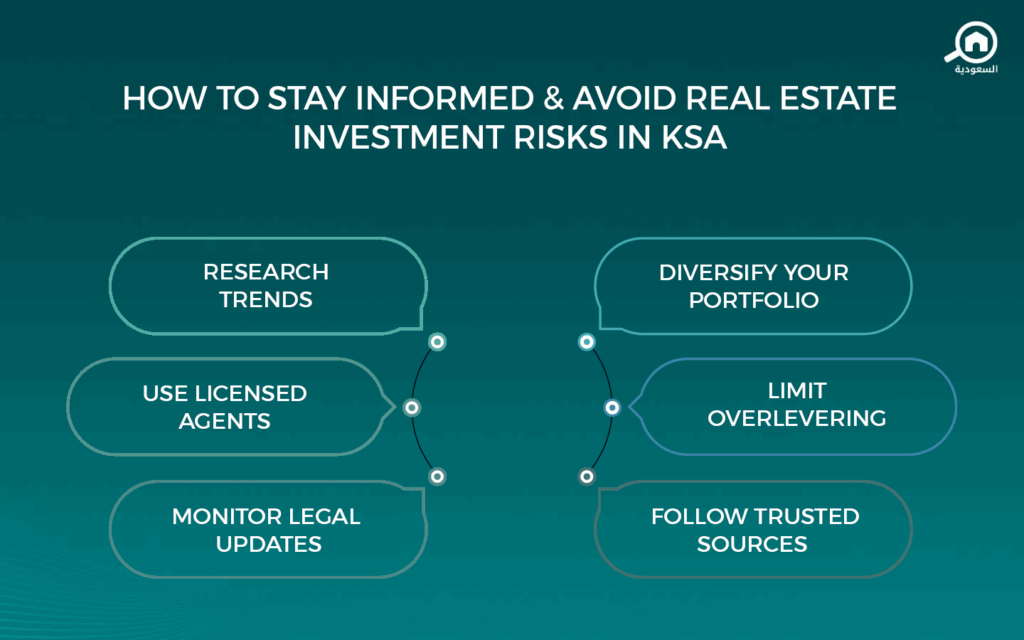

How can investors protect themselves? Here are some practical strategies:

Do Thorough Research

Study market trends, project developers, and neighborhood dynamics before committing.

Work with Licensed Agents

Saudi Arabia’s real estate market now requires agent licensing, so choose professionals who understand the laws.

Diversify Your Portfolio

Don’t place all your capital in one type of property or one region.

Use Financing Strategically

Don’t overleverage. Understand your loan terms and plan for interest rate increases.

Stay Updated on Regulations

Platforms like the Real Estate General Authority and the Saudi Ministry of Municipal and Rural Affairs and Housing provide essential updates.

Read also: All You Need to Know About Saudi Arabia’s General Real Estate Authority

Stay Informed, Adaptable, and Strategic

Understanding the risks of real estate investment is the first step toward building a strong and sustainable portfolio. In Saudi Arabia, where the landscape is changing fast under Vision 2030, investors must be informed, adaptable, and strategic. By learning the types of Risks of Real Estate Investment and applying practical tips, you can navigate challenges and turn uncertainty into opportunity.

Keep your eye on Saudi Arabia’s real estate market, trends, and more, by keeping up with My Bayut.