Real Estate Investment Trusts (REITs) in Saudi Arabia have become an increasingly popular option for investors seeking exposure to the real estate market without the need to purchase or manage physical property.

If you haven’t heard about REITs yet, you’ve come to the right place. In summary, REITs are investment funds that let you invest in real estate properties and earn income without owning the properties directly.

REITs offer a strategic, lower-risk entry point into Saudi real estate while delivering steady returns through dividend income and long-term capital appreciation. But let’s delve deeper.

What are the best investment funds in Saudi Arabia?

While Saudi Arabia offers various investment vehicles, REITs are among the top performers due to their accessibility and strong dividend potential. Some of the leading real estate-focused funds include:

These funds typically invest in income-generating properties such as commercial buildings, malls, hotels, and logistics centers, and are regulated by the Capital Market Authority (CMA) to ensure transparency and investor protection.

What are the top real estate investment platforms in Saudi Arabia?

To invest in REITs, individuals can access a range of digital platforms and financial institutions. Some of the most reliable platforms include:

- Tadawul (Saudi Stock Exchange)

- SNB Capital, Alinma Investment, Riyad Capital

- SARIE and Absher Integration

These platforms allow both residents and eligible international investors to buy REIT shares with minimal paperwork and relatively low capital requirements.

If you’re an international investor, you may also be interested in our article on the Approval of Saudi’s Property Ownership Law for Foreigners and Investment Regulations in 2025

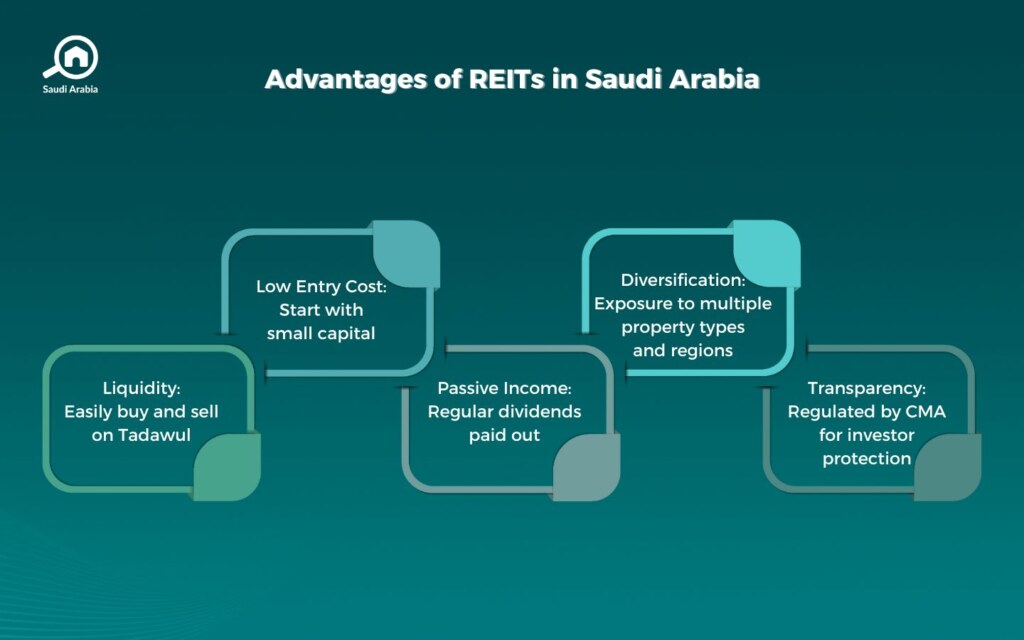

The Advantages of Real Estate Investment Trusts (REITs)

REITs in Saudi Arabia offer several advantages that make them an attractive alternative to direct property ownership:

- Liquidity: REITs can be traded on the stock exchange like shares, offering quick exit options

- Low Entry Barriers: Investors can get started with small amounts, unlike traditional real estate

- Passive Income: Regular dividend payments from rental revenues

- Diversification: Exposure to a portfolio of properties across sectors and regions

- Transparency and Regulation: Oversight by the CMA ensures accountability and compliance

These factors make REITs ideal for investors seeking a hands-off, income-generating asset with lower risk than direct real estate ownership.

Types of REITs in Saudi Arabia

REITs in the Kingdom typically fall into the following categories:

- Equity REITs: The most common type, investing directly in income-generating properties

- Hybrid REITs: Combine property ownership with mortgage financing activities

- Specialized REITs: Focus on niche markets such as hospitality, logistics, or healthcare real estate

Most Saudi REITs are equity-based, offering a stable mix of income and appreciation potential.

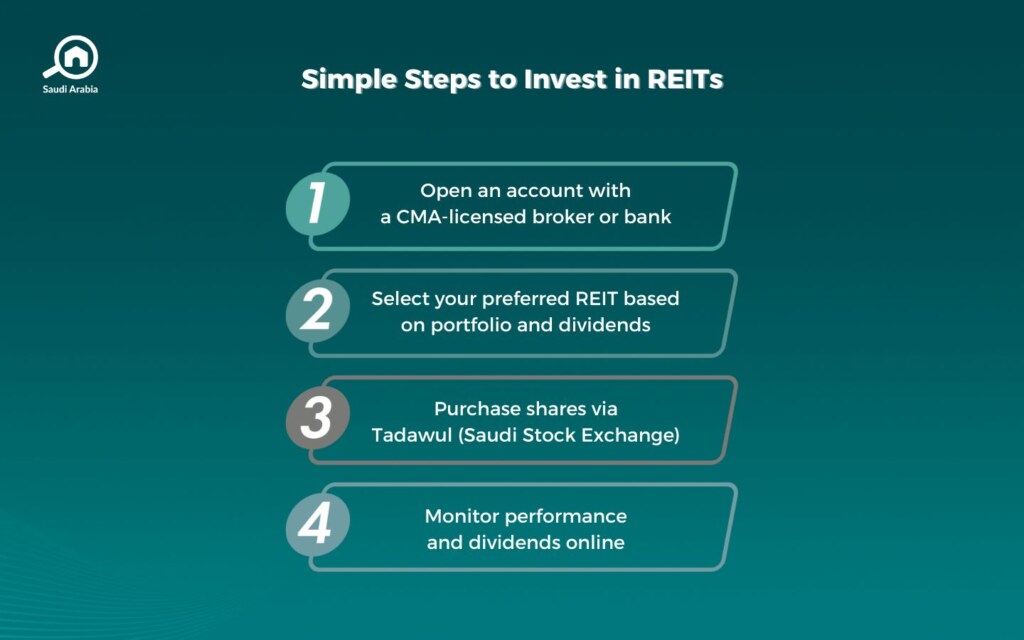

How to invest in Real Estate Investment Trusts (REITs)

Investing in REITs is a straightforward process in Saudi Arabia. Here’s how to get started:

- Open an investment account with a CMA-licensed broker or bank

- Choose your REITs based on their performance, portfolio composition, and dividend history

- Place orders through your trading platform during Tadawul market hours

- Track performance via Tadawul or your broker’s dashboard

Some brokers also offer Sharia-compliant REITs for investors seeking Islamic investment options.

Read also: 9 Smart Ways to Make Money from Real Estate in Saudi Arabia

Best dividend-paying investment fund in Saudi Arabia

If your goal is to maximize passive income, consider these REITs known for consistent dividends:

- Al Rajhi REIT provides strong performance and reliable payouts

- Derayah REIT has diverse portfolio and regular distributions

- Jadwa REIT Saudi Fund focuses on high-yield commercial assets

Dividend yields may vary depending on market conditions, fund strategy, and tenant performance, so always review each fund’s financial reports before investing.

So, Should You Invest in REITs?

Real Estate Investment Trusts (REITs) in Saudi Arabia provide a flexible and regulated gateway into the booming real estate sector. Whether you’re seeking steady income, diversification, or access to high-potential commercial property, REITs offer a powerful tool for building wealth without the hassle of direct ownership.

As Saudi Arabia continues to reshape its economic and urban landscape, REITs will remain a key part of any smart investor’s portfolio.

Keep your eye on Saudi Arabia’s real estate market, trends, and more, by keeping up with My Bayut.