In its competitive market, real estate finance management in Saudi Arabia has become pivotal for anyone seeking to invest in, own, or expand their property assets. Are you a first-time buyer or even an experienced investor? Either way, managing your financing wisely can be the difference between long-time growth and long-term stress.

Objectives of Real Estate Finance Management

Effective real estate finance management serves several key goals:

- Securing the right financing solution based on your income and property objectives

- Minimizing unnecessary debt and avoiding late-payment penalties

- Improving long-term investment outcomes through sound planning

- Aligning financing tools with both Shariah principles and your financial strategy

- Building a stable portfolio while preserving liquidity and credit health

By understanding and applying the principles of smart finance management, property owners can optimize their real estate assets and avoid the risks of over-leverage or poor cash flow planning.

Entities Involved in Real Estate Finance Management

Real estate financing in Saudi Arabia involves collaboration between several entities:

Banks and Mortgage Providers

Leading institutions such as the Saudi National Bank (SNB), Al Rajhi Bank, and others offer Islamic-compliant financing products tailored for residential and investment properties.

Government Programs

Entities such as the Real Estate Development Fund (REDF) and the Ministry of Housing support citizens through initiatives like Sakani, which provide subsidized loans and down payment assistance.

Regulatory Oversight

The Saudi Central Bank (SAMA) and the Real Estate General Authority regulate the sector, ensuring financial institutions operate within legal and ethical frameworks.

Real Estate Financing Tools

Saudi Arabia offers a wide range of financing tools that cater to both citizens and residents. These include:

- Murabaha (cost-plus-profit sale agreements)

- Ijara (leasing agreements with transfer of ownership)

- Musharaka (partnership-based finance)

- Personal housing loans and subsidized loans

- Refinancing and restructuring services for existing mortgages

Each tool is designed to fit specific borrower profiles and investment strategies. For example, a salaried individual seeking a long-term family home may benefit from fixed-profit Islamic mortgage plans, while an investor may consider bridge loans or refinancing options.

What Are the Conditions for Real Estate Financing in Saudi Arabia?

To qualify for real estate financing, most banks require the following:

- Minimum age of 21 years

- Employment in a government or private sector job with at least six months of service

- Minimum income thresholds, typically starting from SAR 3,500

- Good credit history with no defaults or late payments

- A property that meets valuation standards and lender criteria

Financing conditions can vary between banks, so it’s important to compare offers, terms, and hidden fees before signing any agreements.

Real Estate Development Fund and Citizen Financing

The Real Estate Development Fund (REDF) plays a critical role in promoting home ownership for Saudi citizens. Through partnerships with commercial banks, the REDF offers:

- Interest-free loans for eligible beneficiaries

- Mortgage support for government employees

- Financial counseling and planning tools

Programs like Sakani further enhance access by offering digital platforms to help users browse property options, simulate loan scenarios, and match with banks based on eligibility.

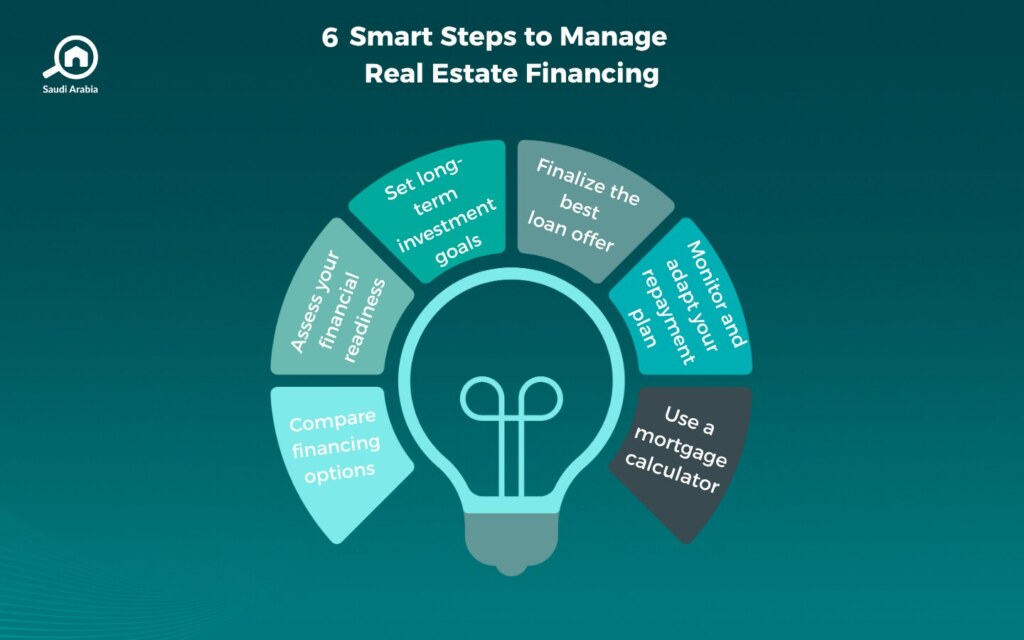

Steps of Real Estate Finance Management

A structured approach to managing your real estate financing includes the following steps:

- Assess your financial situation: Understand your income, expenses, and long-term goals before taking on any loan.

- Use planning tools: Tools like the SNB Mortgage Calculator help estimate repayment amounts and identify affordable financing limits.

- Compare lenders and financing options: Review product types (Murabaha, Ijara, etc.), profit rates, and contract terms.

- Submit a complete and accurate application: Prepare salary slips, identification documents, and property information in advance.

- Track payments and loan status: Automate repayments where possible and monitor your amortization schedule.

- Adapt your plan as needed: If your income changes or investment goals shift, consider restructuring your mortgage.

Read more: When Should You Consider Mortgage Loan Restructuring to Improve Financial Management?

Mortgage Calculator

A mortgage calculator is an essential tool for any prospective buyer or current borrower. It allows users to:

- Estimate monthly repayments based on different loan sizes and tenures

- Compare scenarios for fixed vs. variable profit rates

- Determine total financing cost over the loan duration

Visit the SNB Mortgage Calculator to begin evaluating your financing options.

Why Real Estate Finance Management in Saudi Arabia Matters

Whether you’re planning to buy a new home or restructure an existing loan, real estate finance management in Saudi Arabia gives you the power to make informed, strategic decisions. With the right tools, knowledge, and financial partners, you can avoid debt traps, secure better terms, and build long-term value through your real estate investments.

Start by assessing your financial goals, exploring available tools like mortgage calculators, and working with trusted institutions that align with your needs.

Keep your eye on Saudi Arabia’s real estate market, trends, and more, through My Bayut.