As Saudi Arabia’s dynamic real estate market gains momentum due to Vision 2030, the Property Flipping Strategy is becoming more and more popular. This investment approach involves purchasing a property, making improvements, and then reselling it at a higher price for profit.

While it may seem straightforward, successful property flipping requires careful planning, market knowledge, and the right timing. Let’s explore what the Property Flipping Strategy strategy is, how to use it in the Kingdom’s market, and what it’s best advantages can be.

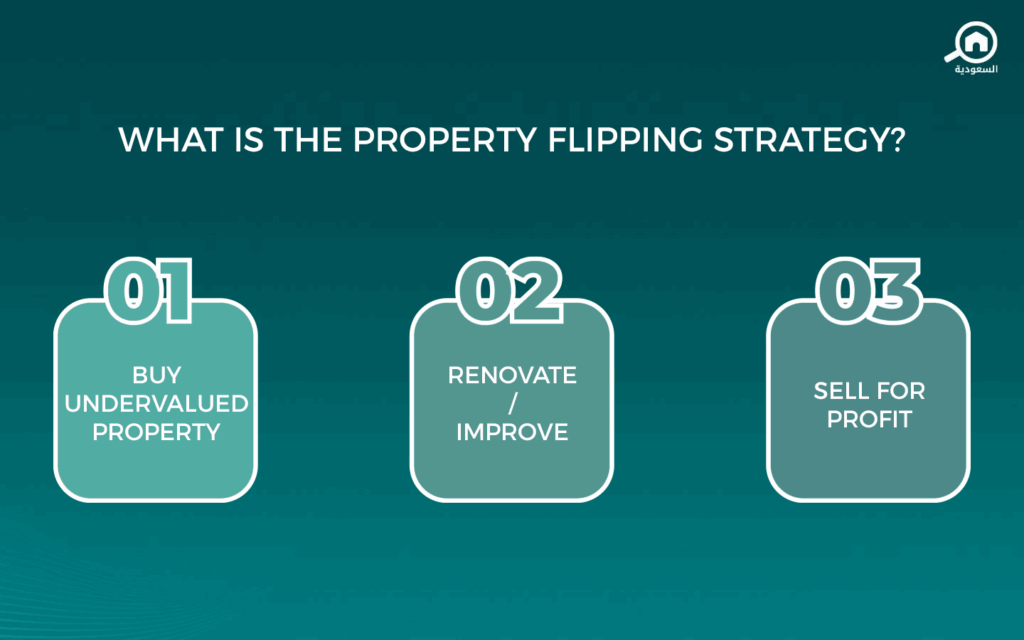

What is the Property Flipping Strategy?

In the simplest of terms, the Property Flipping Strategy is a short-term real estate investment approach where investors buy undervalued or distressed properties, enhance their value through renovations, and quickly resell them. Unlike traditional real estate investment strategies, which may focus on rental income over many years, property flipping aims for faster returns.

The success of this strategy relies hugely on accurately assessing the market and calculating renovation costs to ensure profitability.

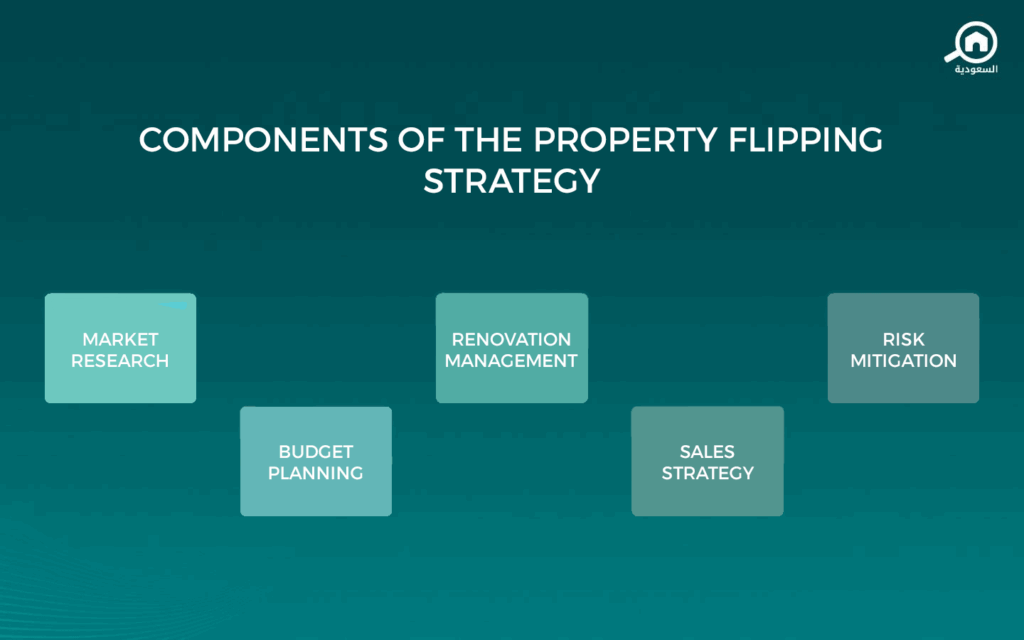

Components of the Property Flipping Strategy

There are several components of the property flipping strategy that investors should understand:

Market Research

Identifying the right location is critical. Look for neighborhoods with rising demand, infrastructure developments, or government-backed projects.

Financial Planning

Factor in the purchase price, renovation costs, taxes, and potential selling expenses.

Renovation and Upgrades

Focus on improvements that add significant value, such as modern kitchens, upgraded bathrooms, and energy-efficient features.

Timing the Sale

Selling too early or too late can affect profit margins. Monitor local market conditions closely.

Legal Compliance

Ensure that all permits, property documents, and renovations meet Saudi regulations.

You may also be interested in our article on 9 Smart Ways to Make Money from Real Estate in Saudi Arabia

Using a Real Estate Indicators Platform

One of the most effective tools for investors is a Real Estate Indicators Platform, like this one you can find on the Real Estate General Authority’s website. These platforms can provide real-time data on property prices, demand trends, and regional developments. By leveraging such data, investors can identify promising properties, evaluate potential returns, and make informed decisions.

Read also: All You Need to Know About Saudi Arabia’s General Real Estate Authority

Real Estate Investment Strategies in Saudi Arabia

The property flipping strategy is just one of many real estate investment strategies in Saudi Arabia. Others include:

- Buy-and-Hold: Purchasing properties and renting them out for steady long-term income.

- Off-Plan Investments: Buying properties during the construction phase, often at lower prices, and selling them once completed.

- Commercial Investments: Acquiring office buildings, warehouses, or retail spaces for business leasing.

By understanding these strategies and using tools like a Real Estate Indicators Platform, investors can diversify their portfolios and mitigate risks. You may also benefit from our article What Are the Main Factors Affecting Property Value in Saudi Arabia?

Final Thoughts

The property flipping strategy can be highly rewarding in Saudi Arabia’s evolving real estate landscape. However, it requires thorough research, precise timing, and strategic decision-making. By combining solid financial planning with reliable market data, investors can maximize their chances of success.

Keep exploring and learning about real estate, market trends, and more by following along our blog My Bayut.