The 4 pillars of real estate in Saudi Arabia form the foundation of successful property investment. Whether you’re new to real estate or aiming to scale your portfolio, understanding these core principles (cash flow, appreciation, loan paydown, and tax benefits) can help you make smarter, more profitable decisions in the Kingdom’s dynamic property market.

Saudi Arabia, with its ambitious Vision 2030, growing tourism sector, and evolving residential and commercial markets, offers opportunities for long-term wealth building through real estate. These pillars provide a framework for evaluating any property and maximizing returns over time.

What Are the Pillars of Real Estate in Saudi Arabia?

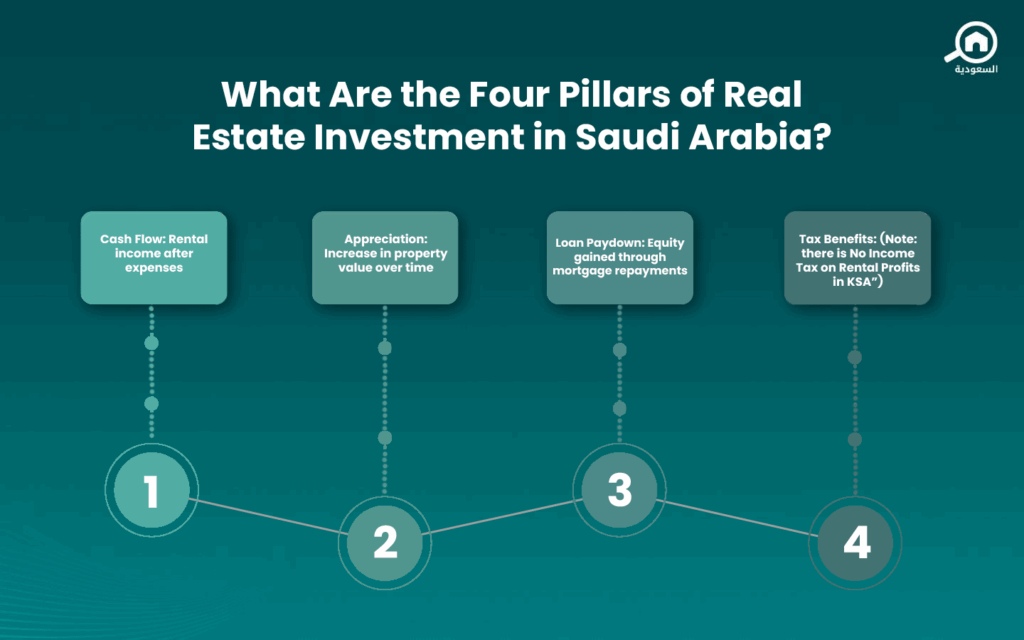

The four pillars of real estate are:

- Cash Flow: The income that remains after deducting expenses from rental revenues

- Appreciation: The increase in property value over time due to market dynamics or improvements

- Loan Paydown: The reduction in mortgage balance through regular payments, which builds equity

- Tax Benefits: Incentives or exemptions that reduce the investor’s tax burden

In Saudi Arabia, while there are no tax deductions on mortgage interest or depreciation as in some other countries, the absence of income tax on rental profits is in itself a tax advantage.

What’s the Importance of Real Estate Pillars ?

Well, each of the 4 pillars contributes to a different dimension of real estate success, like so:

- Cash flow ensures short-term financial sustainability

- Appreciation drives long-term wealth growth

- Loan paydown creates equity and financial leverage

- Tax advantages, especially in Saudi Arabia where rental income is not taxed, increase net profitability

A balanced portfolio should take all four pillars into account. Relying solely on one pillar does not make for good returns.

Read also: 9 Smart Ways to Make Money from Real Estate in Saudi Arabia

What is the Real Estate System in Saudi Arabia?

The Kingdom’s real estate system is governed by various regulatory bodies including the Ministry of Municipal and Rural Affairs and Housing (MOMRAH), the Real Estate General Authority, and the Saudi Central Bank (SAMA). It has undergone significant reforms to improve transparency, streamline property registration, and open up investment to non-Saudis.

Key features of the current system include:

- A mortgage market regulated by SAMA

- The Real Estate Registry system for secure property transactions

- The availability of off-plan sales under supervision

- Special Economic Zones (SEZs) that attract foreign investment

These frameworks support a structured and increasingly investor-friendly environment.

Real Estate Fundamentals in Saudi Arabia

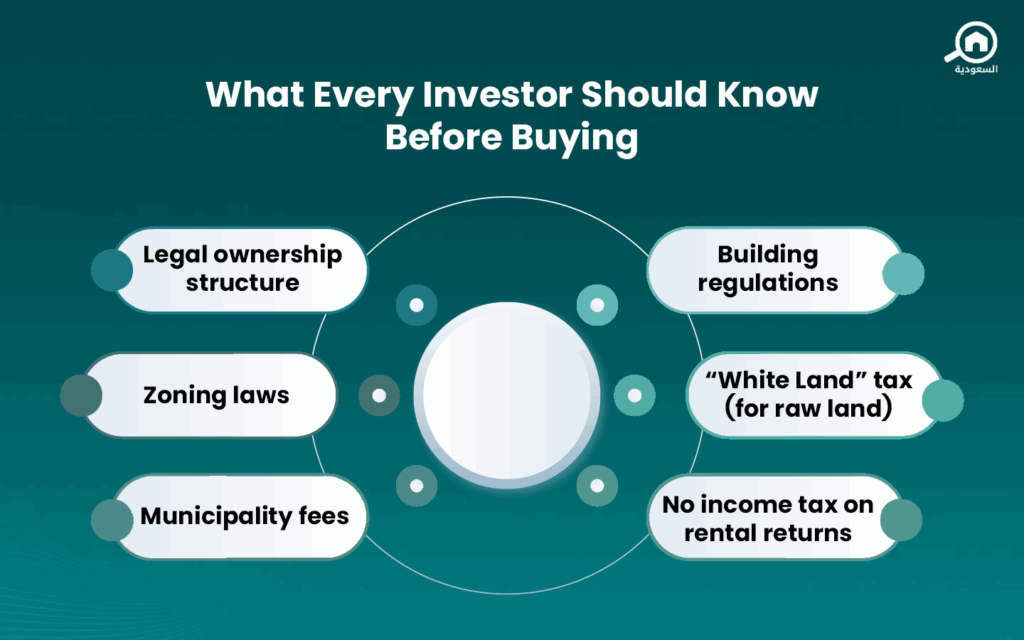

To invest wisely, it is essential to grasp key real estate fundamentals in Saudi Arabia:

- Location matters: Proximity to infrastructure, economic projects, or tourism zones influences value.

- Yield expectations: Rental yields vary by city and property type.

- Legal clarity: Understand zoning, ownership rights, and whether foreigners are allowed to invest in certain areas.

- Financing options: Mortgages are widely available, often with fixed-rate terms.

- Tax considerations: As noted, rental income is not taxed in Saudi Arabia, a significant advantage over other global markets.

Understanding these fundamentals helps align your investments with market conditions and long-term goals. You may also find our article How to Increase in Real Estate Market Value in Saudi Arabia helpful.

Mastering These Pillars Builds Lasting Wealth

The pillars of real estate in Saudi Arabia (cash flow, appreciation, loan paydown, and tax advantages) offer a proven approach to evaluating and growing real estate investments. By mastering these principles, investors can build a sustainable strategy tailored to the Saudi market.

With a stable regulatory framework and unique tax-free rental income, Saudi Arabia presents a compelling case for investors seeking long-term returns. Whether you’re targeting residential, commercial, or tourism-linked properties, applying these pillars will help guide your decisions and build lasting value.

Keep your eye on Saudi Arabia’s real estate market by following our blog My Bayut.