When people think of wealth-building through real estate, they often focus on buying, renting, or flipping properties, but one of the most overlooked ways to grow your net worth is mortgage loan repayment. Understanding the importance of mortgage repayment is essential to unlocking long-term financial security and property equity, so let’s explore how it works.

Importance of Mortgage Loan Repayment

Repaying your mortgage on time doesn’t just keep the bank happy, it also increases your equity in the property. With every payment you make, a portion goes toward reducing the main loan amount. Over time, this means:

- You own more of your home

- Your net worth increases

- You reduce long-term interest expenses

In essence, each mortgage payment is a step closer to turning your debt into personal wealth.

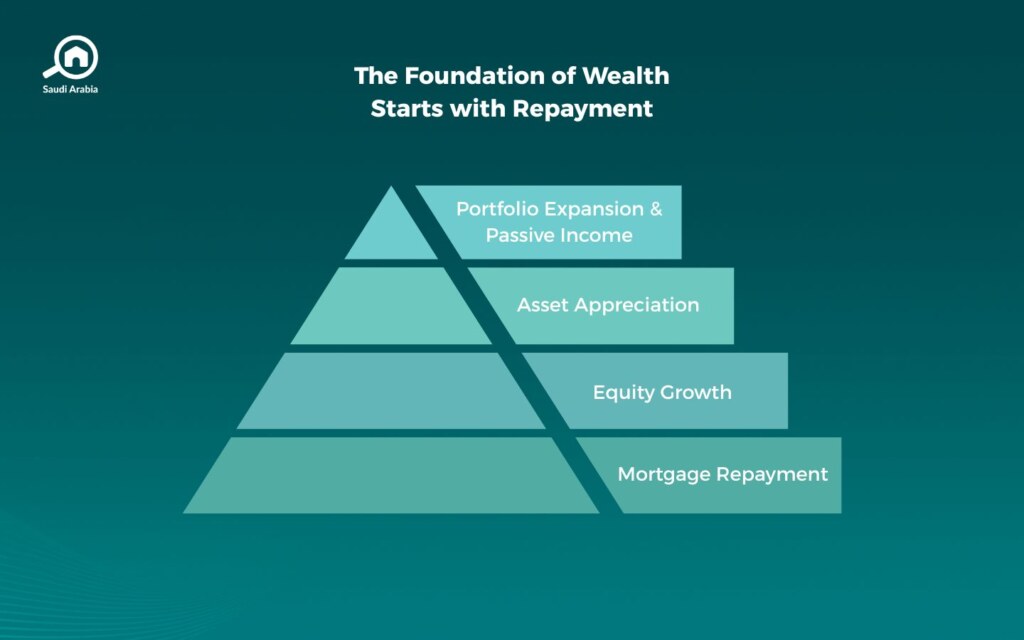

How Does Loan Repayment Contribute to Building Real Estate Wealth?

Mortgage repayment is not just about reducing what you owe, it’s about increasing your financial stake in a valuable asset. Here’s how it contributes to your wealth:

Equity growth

As you repay your mortgage, you gain ownership of a higher share of the property.

Leverage potential

A fully or partially repaid property can be used as collateral for new investments.

Cash flow benefits

Once you repay your debt, rental income becomes pure profit.

Appreciation advantage

The property’s value rises over time, increasing your return on equity.

See also: The 4 Pillars of Real Estate in Saudi Arabia.

Early Repayment of a Mortgage Loan: Is It Worth It?

In Saudi Arabia, early mortgage repayment is a popular financial goal for many property owners. By paying off your loan ahead of schedule, you:

- Save on interest charges

- Eliminate debt faster

- Boost your credit profile

- Free up future income for other investments

However, you must be sure to check your mortgage terms carefully, as there are some banks that impose early repayment penalties, which may affect whether early payment is financially beneficial.

What Is the Penalty for Not Repaying a Mortgage Loan in Saudi Arabia?

Failing to repay your mortgage on time can result in serious consequences, including:

- Late payment penalties

- Increased interest rates

- Negative credit scoring

- In extreme cases, property repossession

Banks in Saudi Arabia follow a strict process for handling defaults, and legal action is, of course, possible. That’s why consistent repayment is not just about building wealth, but it’s also about protecting your existing assets, which is extremely important.

More information on bank rules can be found on the official website off Saudi Central Banks.

How Is a Mortgage Loan Repaid?

In Saudi Arabia, mortgage repayment typically follows these structures:

- Monthly installments that include both principal and interest

- Variable or fixed interest rates, depending on your agreement

- Options for balloon payments or early lump-sum reductions

- Online bank management systems that allow automated payments

Always track your repayment schedule and explore opportunities to pay off the principal faster when financially feasible.

Are Interest Charges Waived with Early Mortgage Repayment?

Not always. In Saudi Arabia, whether interest is waived or recalculated depends on:

- The bank’s terms and conditions

- Whether you’re on a fixed or floating rate

- The time remaining on the mortgage

Some banks offer interest savings on early repayment, while others include a small penalty. Always negotiate and review the fine print before making large payments, to ensure zero losses.

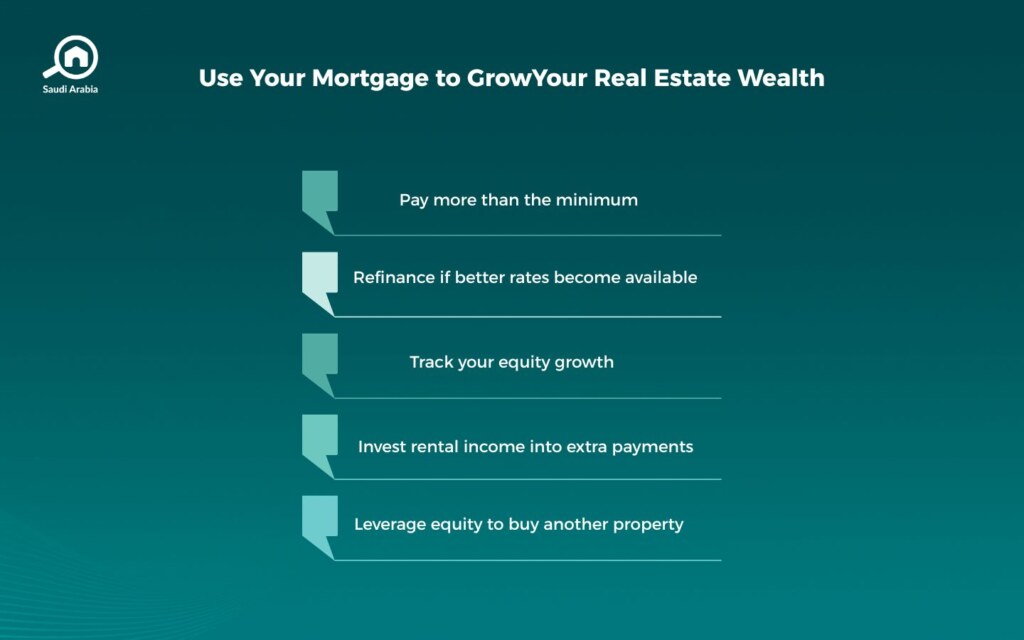

Tips for Building Your Real Estate Wealth

Mortgage repayment is just one part of a broader wealth-building strategy. Here’s how to grow your net worth faster:

- Leverage equity to buy more income-generating properties

- Invest in property improvements to increase value and rent

- Focus on high-yield locations within Saudi Arabia

- Avoid over-leveraging; only borrow what you can repay comfortably

As your loans shrink and your property portfolio grows, so does your financial freedom.

So, the Final Question: Is Mortgage Loan Repayment the Secret to Long-Term Wealth?

Absolutely, it can be. Mortgage loan repayment is more than a financial obligation, but an incredibly powerful tool for building lasting real estate wealth in Saudi Arabia. Every payment you make turns borrowed capital into owned equity, reduces your debt exposure, and sets you up for future investments.

Whether you choose to repay steadily or aggressively pursue early repayment, all in all, you’ll be strengthening the foundation of your financial independence.

Keep your eye on Saudi Arabia’s real estate market, trends, and more, through My Bayut.