When it comes to long-term wealth creation, two of the most popular investment choices are real estate and stocks. Both can deliver strong returns, but they differ in terms of stability, risk, and growth potential. The big question is, which is better? Investing in Real Estate vs. Stocks ?

In Saudi Arabia, where Vision 2030 is accelerating economic diversification, understanding these two paths is essential for investors looking to build sustainable wealth.

Advantages of Real Estate Investment

Real estate remains a preferred option for many Saudi investors due to its tangible nature and long-term potential. Unlike stocks, which are paper assets, property provides ownership of a physical asset that can generate both income and appreciation. Here are some of its key advantages of Investing in Real Estate:

1. The Four Pillars of Real Estate Wealth

The strength of real estate lies in four major wealth-building factors:

- Cash Flow: Rental income creates a steady stream of passive earnings

- Capital Appreciation: Property values, especially in high-demand areas like Riyadh and Jeddah, continue to rise with major projects such as NEOM and Qiddiya

- Loan Paydown: Each mortgage payment builds equity and increases your ownership stake

- Tax Benefits: Incentives like the First Home Tax Exemption and VAT waivers reduce costs for investors

Read also: The 4 Pillars of Real Estate in Saudi Arabia : All You Need for Investment Success.

2. Hedge Against Inflation

Real estate generally appreciates over time, often at a pace that keeps up with or exceeds inflation, which helps preserve and grow your purchasing power.

3. Control and Leverage

Unlike stocks, real estate gives you more control over your investment. You can enhance value through renovations, select tenants, and even leverage financing to acquire multiple properties without paying the full amount upfront.

You may also be interested in our article on How to Increase in Real Estate Market Value in Saudi Arabia.

Investing in Real Estate vs. Stocks – Here Are the Disadvantages of Real Estate Investment

While real estate has many benefits, it also comes with certain drawbacks that investors should consider:

- High Initial Capital: Buying property in Saudi Arabia requires significant upfront investment compared to stocks.

- Limited Liquidity: Real estate cannot be sold as quickly as shares on the stock market.

- Ongoing Maintenance: Properties need regular upkeep and compliance with regulations.

Advantages of Stock Investment

Stocks offer an entirely different approach, focusing on liquidity and diversification. They can be an attractive option for those who want flexibility and faster transactions. When considering Investing in Real Estate vs. Stocks, here’s why you may think about Stock:

- High Liquidity: Stocks can be bought and sold almost instantly through the Saudi Stock Exchange (Tadawul).

- Low Entry Cost: Unlike real estate, you can start investing in stocks with a small amount of capital.

- Diversification: It’s easy to spread your investments across different sectors and companies, reducing overall risk.

- Dividend Income: Many Saudi-listed companies pay dividends, providing a consistent source of income.

Investing in Real Estate vs. Stocks – These are the Disadvantages of Stock Investment

Investing in Real Estate vs. Stocks both come with risk, but stock investing can be particularly volatile. Here are some challenges:

- Market Volatility: Prices fluctuate daily, which can lead to short-term losses.

- Emotional Investing: Rapid changes in stock prices often lead beginners to make impulsive decisions.

- No Tangible Asset: Unlike real estate, stocks don’t provide the security of owning a physical property.

Are Saudi Stocks Profitable?

Yes, many Saudi companies (especially in sectors such as petrochemicals, finance, and retail) have delivered attractive returns. However, the volatility of the stock market makes it less predictable, which is why some investors prefer real estate for long-term security.

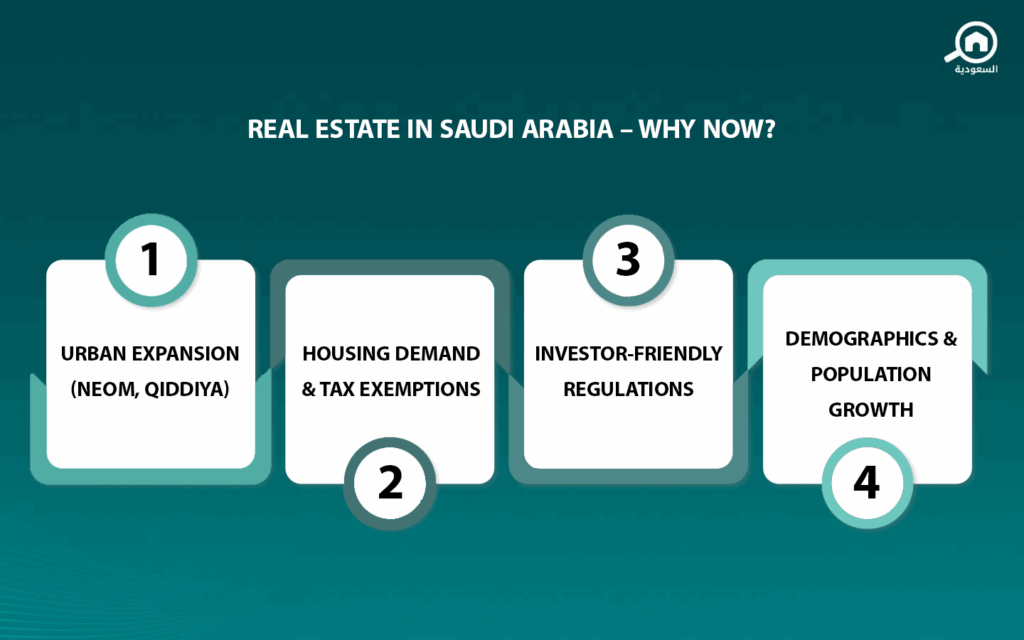

Is Saudi Arabia a Good Place for Real Estate Investment?

Absolutely. With Vision 2030 projects driving infrastructure development, tourism, and housing demand, the real estate sector in the Kingdom is experiencing strong growth. Add to this the First Home tax exemption, growing urbanization, and favorable demographics, and you have a strong case for real estate as a wealth-building tool, when comparing between Investing in Real Estate vs. Stocks.

You may also be interested in our article on why Building a Real Estate Portfolio in Saudi Arabia is Your Path to Steady Income!

Which Is Better? Investing in Real Estate vs. Stocks?

When deciding between Investing in Real Estate vs. Stocks, the decision depends on your goals, risk appetite, and timeline. For long-term stability and wealth accumulation, real estate in Saudi Arabia offers a strong advantage thanks to the four pillars of wealth, including cash flow, appreciation, loan paydown, and tax benefits.

Stocks can complement your portfolio by adding liquidity and flexibility, but real estate remains a tangible and reliable choice for sustainable wealth building.

Keep your eye on Saudi Arabia’s real estate market, trends, and more, through My Bayut.