Investing in Raw Land in Saudi Arabia has become an increasingly attractive strategy for long-term investors, developers, and those looking to align with Vision 2030’s transformation of the Kingdom’s urban and economic landscape.

While it lacks the immediate income of built properties, raw land offers flexibility, scalability, and potential high returns when approached with the right knowledge and tools. Let’s discuss more about why Investing in Raw Land in Saudi Arabia may be a good option for you…

What is Development of Raw Land in Saudi Arabia ?

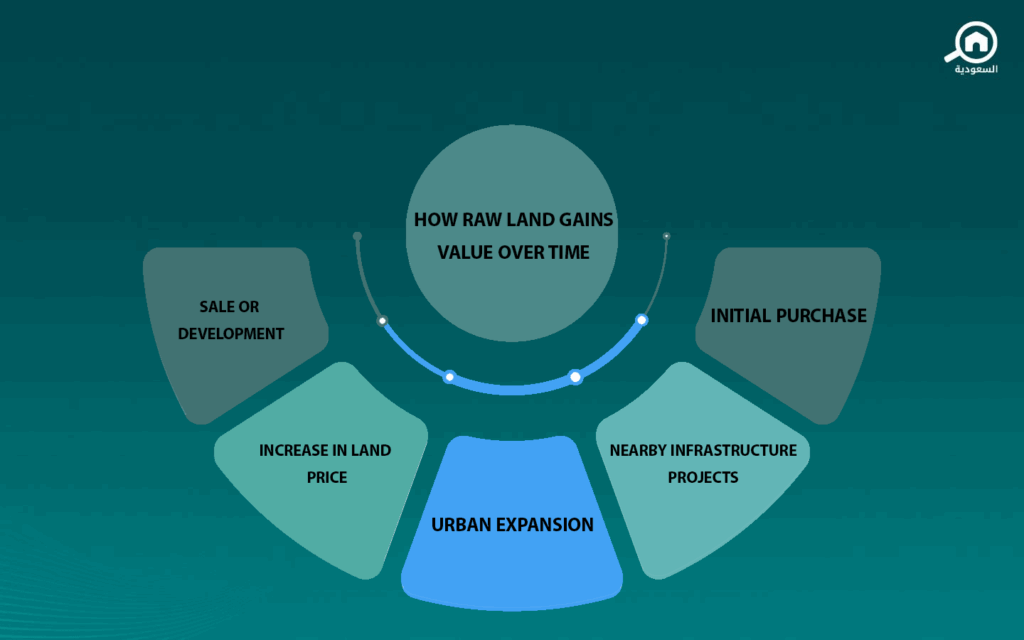

Unlike other types of real estate investments, developing raw land involves transforming a blank plot into a usable, profitable space. In Saudi Arabia, this could mean turning desert land into residential neighborhoods, logistics hubs, or agricultural farms.

Since the government is actively expanding urban boundaries and infrastructure projects, land that was once remote is now reachable and investable. This is especially true near mega-projects like NEOM, Qiddiya, and The Line, where land development is moving at a faster pace than ever before. It’s a great opportunity for those looking to invest.

Before developing raw land, however, investors must consider access to roads, water, and power, as well as zoning regulations and municipal plans. The introduction of land digitization and GIS mapping in Saudi Arabia has made it easier to assess these factors, but due diligence is still essential, especially when Investing in Raw Land in Saudi Arabia.

Importance of Investing in Raw Land in Saudi Arabia

Investing in Raw Land in Saudi Arabia provides a strategic importance for those seeking long-term value. Here’s why:

- Low Entry Cost: Raw land typically costs less per square meter compared to developed plots, especially outside major cities.

- Future-Proofing: As Saudi Arabia expands its urban areas and builds new economic zones, early investment in nearby land can yield substantial appreciation.

- No Depreciation: Land doesn’t wear out, so its intrinsic value remains stable or rises, especially when surrounding infrastructure improves.

- Less Regulation: Compared to developed real estate, raw land requires fewer permits and is not burdened with white land taxes unless it falls within serviced urban zones.

With real estate policies evolving rapidly, understanding land classifications is vital to avoid unexpected costs like the White Land Fee.

Read more about the White Land Fee in our article All You Need to Know About Raw Land and White Land.

Feasibility Study for Selling Raw Land Based on Map Planning

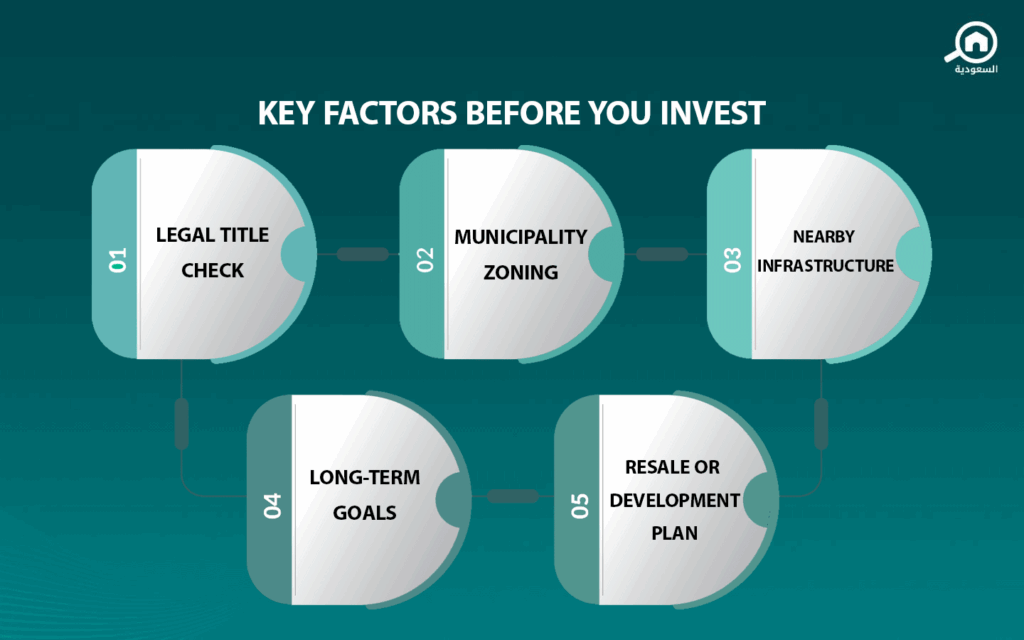

Selling raw land profitably depends on how well it aligns with government zoning and urban masterplans. A feasibility study should include:

- Location Analysis: Is the land near a growing city, major road, or infrastructure project?

- Map Planning Compatibility: Check if the land fits within the Ministry of Municipal and Rural Affairs’ urban plans.

- Potential Use Cases: Can the land be subdivided for villas, warehouses, or commercial plots?

- Access to Utilities: Are water, electricity, and sewage services reachable?

- Legal & Ownership Checks: Ensure title clarity and absence of tribal or municipal claims.

Feasibility studies not only reduce risk but increase the likelihood of attracting buyers or joint development partners in the future.

Our article on Real Estate Development Projects in Saudi Arabia – Explore Opportunities and Success Stories may also be helpful.

Key Factors to Consider When Investing in Raw Land in Saudi Arabia

Before committing to a raw land purchase, investors should evaluate:

- Zoning Laws: Not all land is buildable. Ensure it’s zoned for your intended use.

- Topography & Soil: Flat, stable land is easier and cheaper to develop than rocky or flood-prone areas.

- Surrounding Development: Proximity to urban expansion zones often signals strong future demand.

- Infrastructure Plans: Review Vision 2030 maps and municipal projects that may increase land value.

- Holding Costs: While taxes are minimal on raw land, fees for registration, fencing, or initial development can add up.

Taking a cautious and research-driven approach helps avoid common pitfalls in land speculation. You may also be interested in reading our article Common Problems of Real Estate Investment in Saudi Arabia.

So, Is Raw Land Right for You?

Investing in raw land in Saudi Arabia isn’t just about buying cheap plots and waiting; it’s about making strategic decisions informed by urban development plans, government policy, and your long-term goals.

Whether you aim to develop, subdivide, or resell land in the future, understanding how to assess feasibility, value, and risk is the first step toward building wealth through land.

You can also keep exploring and learning about real estate, market trends, and more by following along our blog My Bayut.