A Feasibility Study for a Real Estate Development Project is one of the most critical steps in determining whether a development project is financially viable, strategically sound, and legally compliant.

By analyzing the economic, technical, and market aspects of a project, a feasibility study helps developers and investors make informed decisions before committing significant resources. Without this crucial step, many projects risk failure due to unforeseen challenges or poor planning. Let’s go over the main points of conducting a Feasibility Study for a Real Estate Development Project.

Are you looking for A Guide to Real Estate Investment in Saudi Arabia?

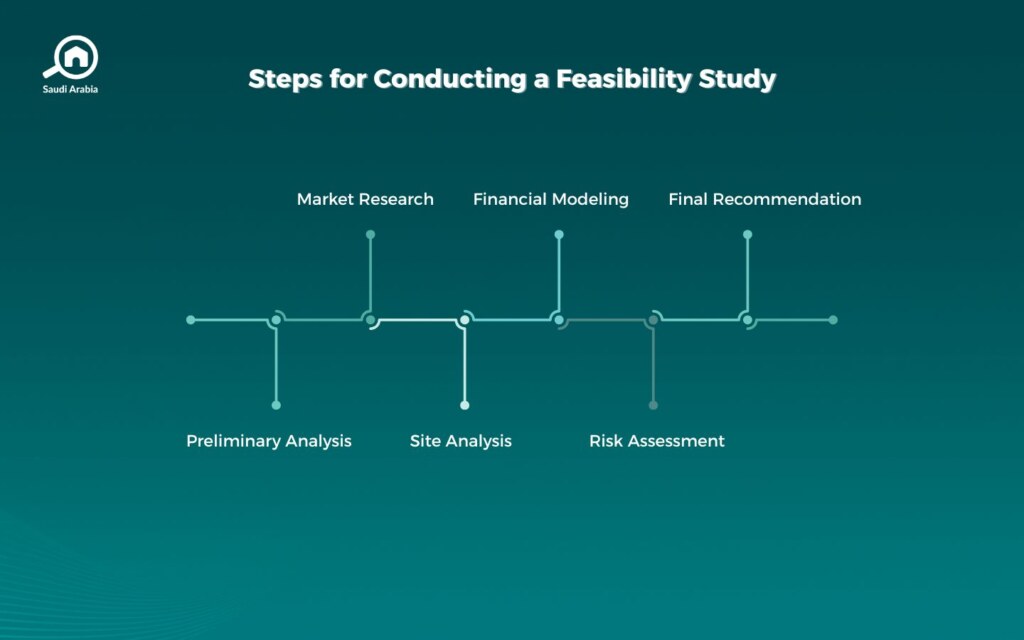

The 6 Steps for Conducting a Feasibility Study for a Real Estate Development Project

So, you’re ready to go. Conducting a feasibility study involves a structured process designed to evaluate the success potential of a project. The typical steps include the following:

Feasibility Study for a Real Estate Development Project begins with: Preliminary Analysis

Define the project’s goals, type of development, and target audience

Market Research

Assess supply and demand, analyze comparable projects, and identify market gaps

Site Analysis

Evaluate the location, zoning laws, infrastructure, and accessibility

Financial Modeling

Estimate development costs, operating expenses, projected revenues, and return on investment

Risk Assessment

Identify potential risks such as regulatory delays, financing challenges, or market fluctuations

Final Recommendation for conducting a Feasibility Study for a Real Estate Development Project

Summarize findings to determine whether the project should proceed, be revised, or abandoned.

Each of these steps ensures that a developer has a clear understanding of both the opportunities and limitations surrounding the project.

If you’re a foreign investor, find all the information you need at the Saudi Ministry of Investment (MISA) for foreign ownership and investment regulations.

Economic Feasibility Study for Projects Conducting a Feasibility Study

An economic Feasibility Study for a Real Estate Development Project focuses specifically on financial outcomes and profitability. For real estate development, this involves analyzing construction costs, land acquisition expenses, financing structures, and expected sales or rental income.

The objective is to determine whether the project is economically sustainable in the short and long term. Developers rely heavily on this component of the study to attract investors, secure financing, and justify the project’s financial foundation.

Read more about Smart Real Estate Investment Strategies In Saudi Arabia.

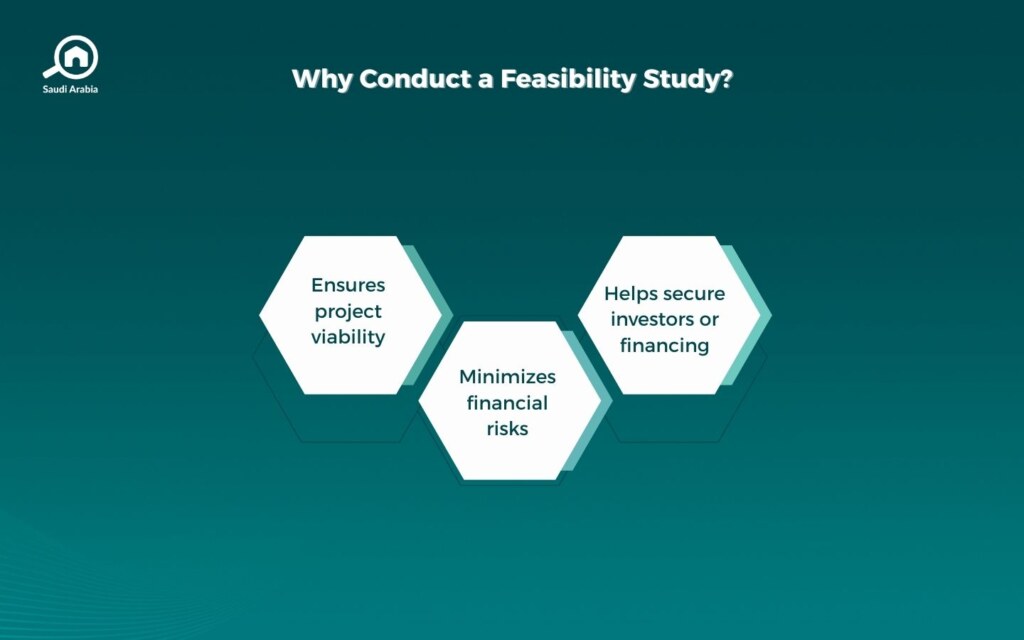

What’s the Importance of a Feasibility Study ?

The importance of a Feasibility Study for a Real Estate Development Project cannot be overstated. It reduces uncertainty, prevents costly mistakes, and provides a roadmap for execution. By conducting a feasibility study, developers can:

- Confirm whether a project aligns with market demand

- Understand regulatory and legal requirements before starting

- Secure financing with confidence by presenting solid data to investors and lenders

- Identify risks early and plan mitigation strategies

In essence, Feasibility Study for a Real Estate Development Project transforms an idea into a structured, evidence-based investment plan. You can also check out Saudi General Authority for Real Estate for real estate market regulations and updates.

What are the Components of a Feasibility Study ?

A complete Feasibility Study for a Real Estate Development Project includes several essential components:

- Market Analysis identifies potential buyers or tenants and evaluates competition

- Technical Analysis reviews design, engineering, and construction requirements

- Legal and Regulatory Review ensures compliance with zoning laws, building codes, and permits

- Financial Analysis provides cash flow projections, return on investment calculations, and sensitivity testing

- Operational Plan outlines long-term property management and maintenance strategies

By combining these components, developers gain a holistic view of the project’s viability.

Feasibility Study for a Real Estate Development Company Project

For a real estate development company, a Feasibility Study for a Real Estate Development Project is not just a one-time exercise; it is a standard practice that guides strategic growth. Whether planning residential complexes, commercial spaces, or mixed-use developments, companies must integrate feasibility studies into their business model to remain competitive.

A well-prepared feasibility study also enhances the company’s reputation, demonstrating professionalism and reliability to stakeholders.

Maximizing Returns Through a Feasibility Study for Real Estate Projects

A feasibility study for a real estate development project is the foundation of successful real estate investment and development. By carefully analyzing market conditions, financial projections, and operational requirements, developers can minimize risks and maximize returns.

The process not only ensures the economic feasibility of projects but also underscores the importance of planning, research, and due diligence. For any real estate development company, incorporating a comprehensive feasibility study into project planning is essential to achieving sustainable growth and long-term success.

Follow along the My Bayut Blog to stay updated with Saudi Arabia’s real estate market, trends, and more.