When it comes to choosing the right property insurance company in Saudi Arabia, making an informed decision is absolutely essential. It protects your investment, and it also offers long-term peace of mind. Furthermore, the right coverage can shield you from unexpected and costly surprises in the future. Taking the right steps early on is crucial.

Whether you’re a homeowner or a landlord, selecting a reliable insurer is a smart move. In fact, it ensures your property is properly covered against common risks such as fire, theft, water damage, and more. As a result, you can manage potential threats with greater confidence.

Steps to Choosing the Right Property Insurance Company in Saudi Arabia

Before signing any policy, consider the following:

Assess Your Needs

Are you insuring a residential villa, an apartment, or a commercial property? The type of property determines the type of coverage you need.

Compare Coverage Options

Look beyond the price. Focus on what’s included:

- Fire and flood damage

- Theft and vandalism

- Liability protection

- Temporary accommodation

Read the Fine Print

Understand exclusions. Many policies don’t cover natural disasters or damage caused by tenant negligence.

Choosing the Right Property Insurance Company in Saudi Arabia – Check Company Reputation

Use online reviews, forums, and the Saudi Central Bank (SAMA) website to check for customer complaints and resolution speed.

Consider the Claims Process

A fast, transparent, and user-friendly claims process is essential. Choose insurers that offer digital claim submissions and clear response timelines.

Verify Licensing

Make sure the insurer is licensed by SAMA to operate in Saudi Arabia.

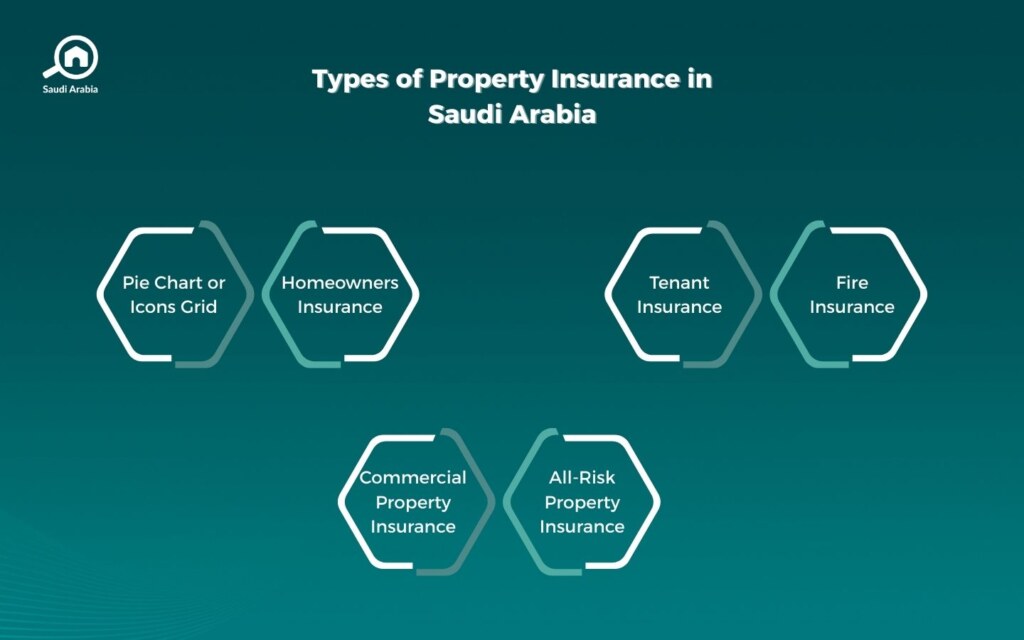

Types of Property Insurance in Saudi Arabia

There are several categories of property insurance available in the Kingdom that will help when Choosing the Right Property Insurance Company in Saudi Arabia. Each type is designed to meet different needs, depending on your property use and level of risk.

- All-Risk Property Insurance: Offers comprehensive protection against multiple risks. Therefore, it’s a preferred option for those seeking broad and flexible coverage.

- Homeowners Insurance: This policy covers structural damage and personal belongings. As such, it is ideal for those who own their home and want protection against unforeseen incidents.

- Tenant Insurance: This type of insurance protects renters’ possessions and liability. In other words, it ensures that tenants are not left financially vulnerable in case of accidents or theft.

- Commercial Property Insurance: Designed for office buildings, warehouses, and retail properties. Moreover, it’s essential for businesses that want to safeguard their assets and maintain operational stability.

- Fire Insurance: This policy focuses solely on fire-related damages. Consequently, it is suitable for high-risk areas or buildings where fire hazards are a major concern.

Each type comes with different coverage limits, so it’s essential to match your needs with the right policy. You may also be interested in our article on What You Need to Know About Tenants’ and Landlords’ Rights in Property Insurance.

Recommended Property Insurance Companies in Saudi Arabia

Based on customer satisfaction, coverage options, and market presence, here are some of the best options to consider Choosing the Right Property Insurance Company in Saudi Arabia:

- Tawuniya: Known for its comprehensive property and fire insurance plans

- Bupa Arabia: Offers flexible home insurance packages and great customer service

- GIG Saudi (formerly AXA Gulf): Offers both basic and premium plans

- Al Rajhi Takaful: Competitive pricing with a good range of property insurance policies

These companies are licensed by the Saudi Central Bank and have strong reputations for customer care and transparency.

How to Choose an Insurance Company?

When evaluating insurance providers, there are several key factors to keep in mind:

- Financial Strength: A strong financial foundation is crucial, as it ensures the company can reliably pay out claims.

- Policy Flexibility: Consider whether you can add extra coverage or adjust limits. This is important because your needs may change over time.

- Customer Support: Check if the provider is responsive in case of emergencies. After all, timely assistance can make a big difference during stressful situations.

- Digital Services: Look for online portals or mobile apps. These tools can simplify claims and policy management, making your experience more efficient.

Read also: Why Every Property Owner Should Have Real Estate Insurance in Saudi Arabia

Final Thoughts

Choosing the right property insurance company in Saudi Arabia requires careful research, comparison, and understanding of your specific needs. Don’t focus solely on price—consider coverage depth, customer service, and ease of claim processes.

Be sure to follow My Bayut to stay updated with Saudi Arabia’s real estate market, trends, and more.