Calculating cash flow is an essential step before buying a rental property. This is to ensure it can truly generate profit over time. A positive cash flow means your rental income exceeds all expenses, with surplus going to investor equity. Rental income exceeding expenses is a vital part of Cash Flow Calculation for sound real estate investing.

Before getting started, we would recommend checking out our article on The Four Pillars of Real Estate.

What are the Steps to Prepare a Cash Flow Statement

So, you’re ready to start investing! Understanding the cash flow of a real estate investment is crucial for assessing a property’s long-term potential. A well-prepared cash flow statement provides a clear picture of the income generated and expenses incurred, ultimately revealing the net profit or loss. Here’s a detailed breakdown of the steps involved:

Project Annual Rental Income

Project all potential annual income from the property, including base rent and supplementary income sources like parking, late fees, pet fees, laundry, and storage unit fees. Ensure realistic projections, considering market rates, vacancy, and planned rent increases.

Estimate Operating Expenses

After projecting income, accurately estimate all recurring operating expenses. These are crucial for the property’s daily function and upkeep. Key categories include: Taxes, Insurance, Maintenance and Repairs, Property Management Fees, Utilities, Advertising and Marketing, HOA Fees, and Legal and Accounting Fees.

Calculate Net Operating Income (NOI)

Calculate Net Operating Income (NOI) by subtracting operating expenses from gross income. A high NOI shows the property’s strong income-generating ability before financing or taxes.

Subtract Annual Debt Payments to Determine Net Cash Flow

After calculating NOI, subtract annual debt payments (mortgage principal and interest) to determine Net Cash Flow. This figure indicates the property’s actual cash profit or loss after all expenses, with a positive result signifying profitability.

Assess Key Return Metrics

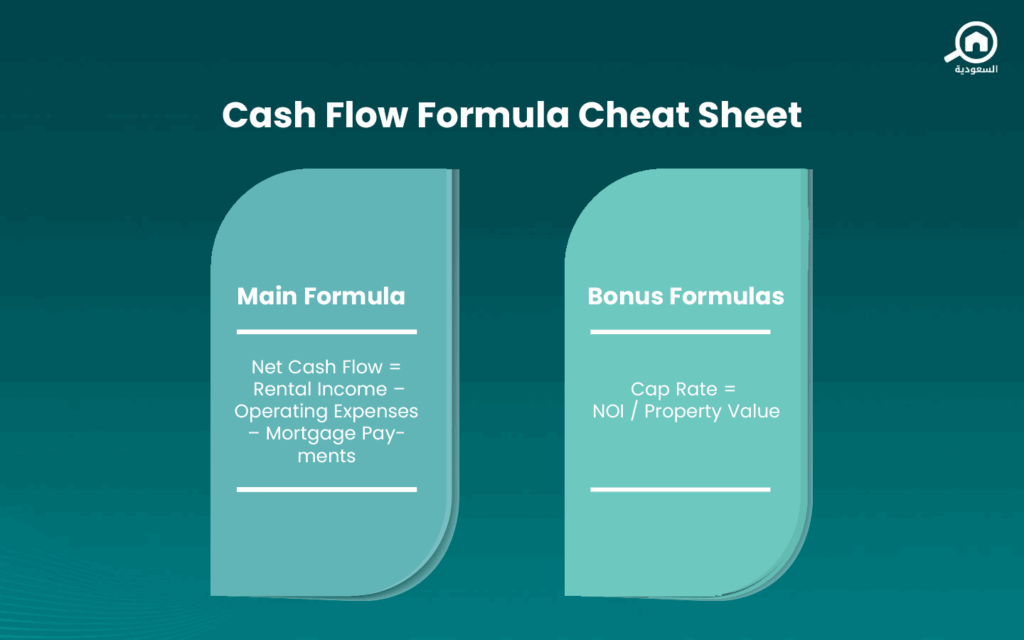

Beyond net cash flow, other return metrics provide a deeper understanding of investment performance. The Capitalization Rate (Cap Rate) compares a property’s Net Operating Income (NOI) to its current market value, helping investors assess income-generating properties.

Formula: Cap Rate = Net Operating Income / Current Market Value

Cash-on-Cash Return

This metric measures the annual pre-tax cash flow against the actual cash invested. It’s particularly useful for investors using leverage (financing) to purchase a property, as it focuses on the return on their actual out-of-pocket cash.

Formula: Cash-on-Cash Return = Annual Pre-Tax Cash Flow / Total Cash Invested

Now that we’ve covered the steps, let’s explore how to actually perform the cash flow calculation yourself.

So, your question now probably is: How Do I Calculate Cash Flow? And What is the Formula for Calculating Cash Net Flow?

Calculating cash flow is not as complicated as it may sound. It requires a simple formula:

Annual Cash Flow = Annual Rental Income – Operating Expenses – Annual Mortgage Payments

For example, if the property generates $3,000/month rent, with $1,000/mo expenses and $1,200/mo mortgage, your monthly cash flow is $800.

To refine returns look at the cash-on-cash return, calculated as:

Annual cash flow ÷ Total cash invested (down payment and costs). An example yield of 12% is considered excellent.

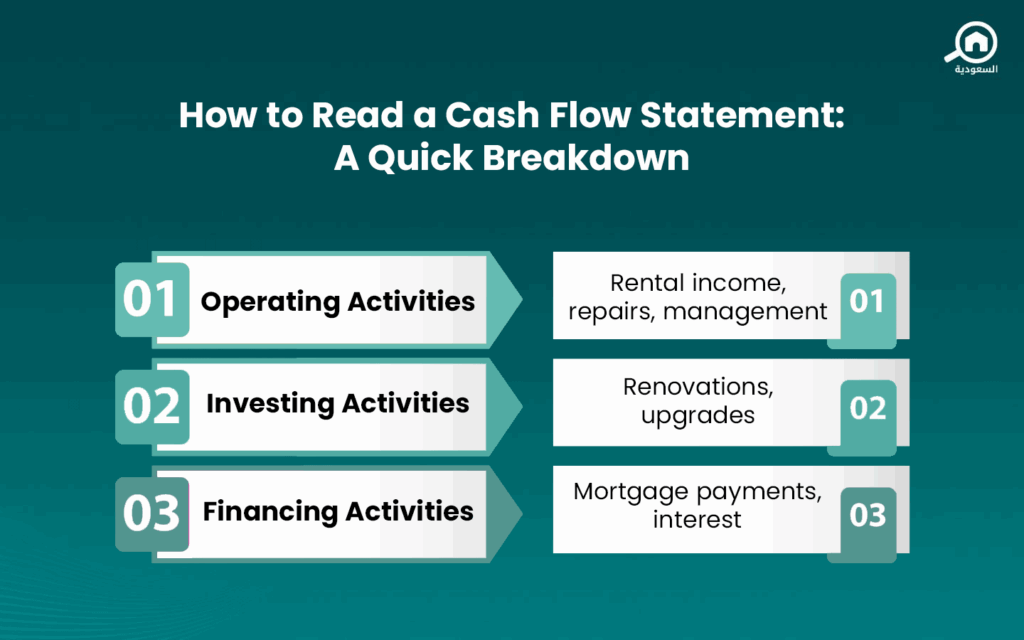

How to Read a Cash Flow Statement?

The statement typically includes:

- Operating Activities: Rental income, deductions for maintenance and management

- Investing Activities: Capital expenditures such as renovations

- Financing Activities: Mortgage payments and interest

A consistent positive operating cash flow reflects financial stability, while sustained negative flow raises red flags.

Read also: Practical Strategies to Increase Cash Flow.

Why Cash Flow Calculation Matters

It may include numbers, but Cash Flow Calculation isn’t just about them. Cash Flow is the backbone of real estate investment planning. Understanding how to calculate, interpret, and improve rental property cash flow helps you avoid negative returns and position assets for growkth.

A well-analyzed cash flow statement empowers confident decisions: securing both monthly income and long-term equity gains. We hope you’ve found this article helpful.

Keep your eye on Saudi Arabia’s real estate market by following our blog My Bayut.