Investing in real estate can be one of the most rewarding decisions in Saudi Arabia, but only if you navigate the tax landscape wisely. Buying Property Under the Tax Regulation requires clear planning, especially if your goal is long-term return and security. Understanding how taxes apply to property transactions can protect your investment and help you avoid unexpected costs.

Is There a Tax on Property Purchase in Saudi Arabia?

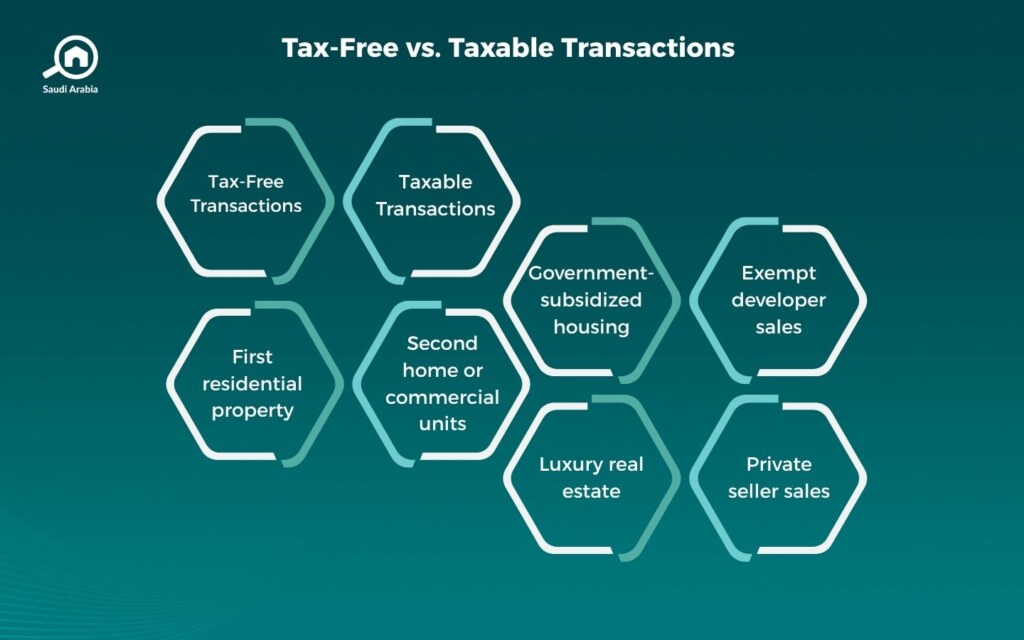

Yes, several types of taxes and fees may apply when Buying Property Under the Tax Regulation. The most important are:

- Real Estate Transaction Tax (RETT): A 5% tax imposed on the total value of the property sale. It applies to most real estate transactions, whether residential or commercial.

- Value-Added Tax (VAT): Typically 15%, but not all real estate purchases are subject to VAT. New commercial properties and some investment assets might be.

- White Land Tax: A separate annual tax on undeveloped urban lands, intended to prevent land hoarding and promote development.

These taxes can significantly affect your investment’s total cost, which is why understanding when and how they apply is critical.

What Are the Conditions for Real Estate Tax Exemption in Saudi Arabia?

Certain exemptions can ease your tax burden if you meet the requirements:

- First Home Buyers: Saudi citizens purchasing their first residential property (up to SAR 1 million) may qualify for RETT exemption.

- Donations and Inheritance: Transfers of property between family members (e.g., inheritance) are often exempt from RETT.

- Real Estate Funds: Properties purchased under qualified real estate investment funds may benefit from favorable tax treatment.

Understanding these exemption rules is key for strategic planning and reducing unnecessary costs.

When Buying Property Under the Tax Regulation , Who Pays the Tax: the Seller or the Buyer?

- RETT is officially the responsibility of the seller, but in practice, the buyer often ends up covering the cost, especially in off-plan or investment projects.

- VAT, if applicable, is also usually passed on to the buyer by the developer or seller.

Buyers should always confirm with their real estate agent or legal advisor how taxes are structured in the sales agreement. Negotiating who pays what can make a big difference in your financial planning.

Real Estate Transaction Tax in Saudi Arabia – How It Works

The Real Estate Transaction Tax (RETT) applies to the transfer of property ownership. It is:

- Fixed at 5% of the property value

- Payable through the ZATCA portal (Zakat, Tax and Customs Authority)

- Required to complete title transfer

It is different from VAT and is considered a stand-alone tax. If RETT applies, VAT does not, and vice versa. Proper classification of your property is essential to avoid double taxation.

Read more: What are the real estate taxes in Saudi Arabia?

Steps to Calculate Taxes Before Buying Property

To plan effectively, follow these steps:

- Determine the property type (residential, commercial, undeveloped land).

- Check if VAT applies – for example, new commercial units or office spaces.

- Use official calculators, such as:

- RETT Calculator

- White Land Tax Platform

- Confirm tax liability with your real estate broker or legal advisor.

- Include all taxes and fees in your budget to avoid surprises at closing.

You may also be interested in: Real estate tax calculator in Saudi Arabia

Tips to Reduce Tax Impact on Your Investment

Even if you can’t avoid Buying Property Under the Tax Regulation, you can plan smartly:

- Invest in first-home exemptions if you’re a Saudi national

- Bundle transactions, which means buying property with development or renovation plans can sometimes qualify for adjusted tax rates

- Choose undeveloped land for long-term planning, but factor in the white land tax

- Work with licensed brokers who understand current tax regulations

Plan Ahead When Buying Property Under the Tax Regulation

Buying Property Under the Tax Regulation in Saudi Arabia requires more than just financial resources, it demands knowledge and strategy! Understanding your tax obligations, using the right tools, and taking advantage of exemptions can ensure a safer, more profitable investment. Smart tax planning should always be part of your decision-making process.

Keep your eye on Saudi Arabia’s real estate market, trends, and more, through My Bayut.