Building a Real Estate Portfolio in Saudi Arabia is one of the most reliable ways to generate long-term income while reducing investment risks. Whether you are a new investor or an existing property owner, understanding how to build a strategic portfolio is key to success in the Saudi property market.

This article walks you through the essentials of creating a diversified real estate portfolio in Saudi Arabia, from the types of properties to include to practical steps and risk mitigation tips.

What Is a Diversified Real Estate Portfolio?

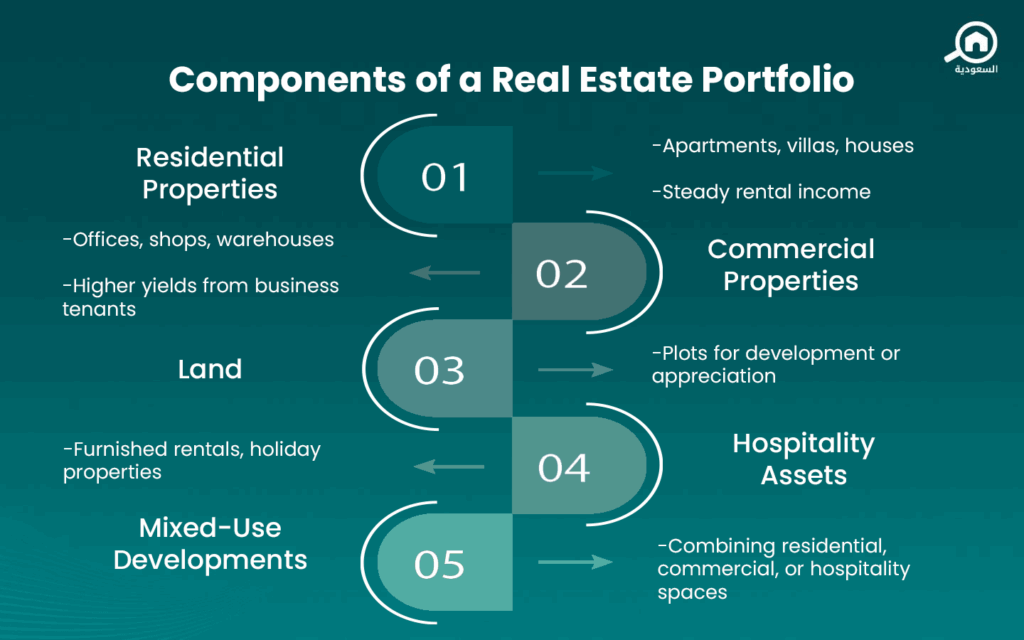

A diversified real estate portfolio is a collection of real estate assets that vary in type, location, or purpose. In Saudi Arabia, this could include:

- Residential properties like apartments or villas for rent

- Commercial properties such as offices or retail shops

- Undeveloped land that can appreciate over time or be developed later

- Short-term rental units targeting tourism hotspots like AlUla or Jeddah

Building a Real Estate Portfolio in Saudi Arabia requires diversification. The purpose of diversification is to spread your risk across different asset types and income sources. For example, if the commercial rental market slows down, your residential units may still provide stable returns. Read more in our article Building a Real Estate Portfolio in Saudi Arabia is Your Path to Steady Income.

Steps to Building a Diversified Real Estate Portfolio in Saudi Arabia

Before diving into the real estate market, it’s essential to approach your investment journey with a clear strategy that aligns with your financial vision and risk appetite.

Set Clear Investment Goals

Define your short-term and long-term financial objectives. Are you looking for passive monthly income, long-term capital appreciation, or a mix of both?

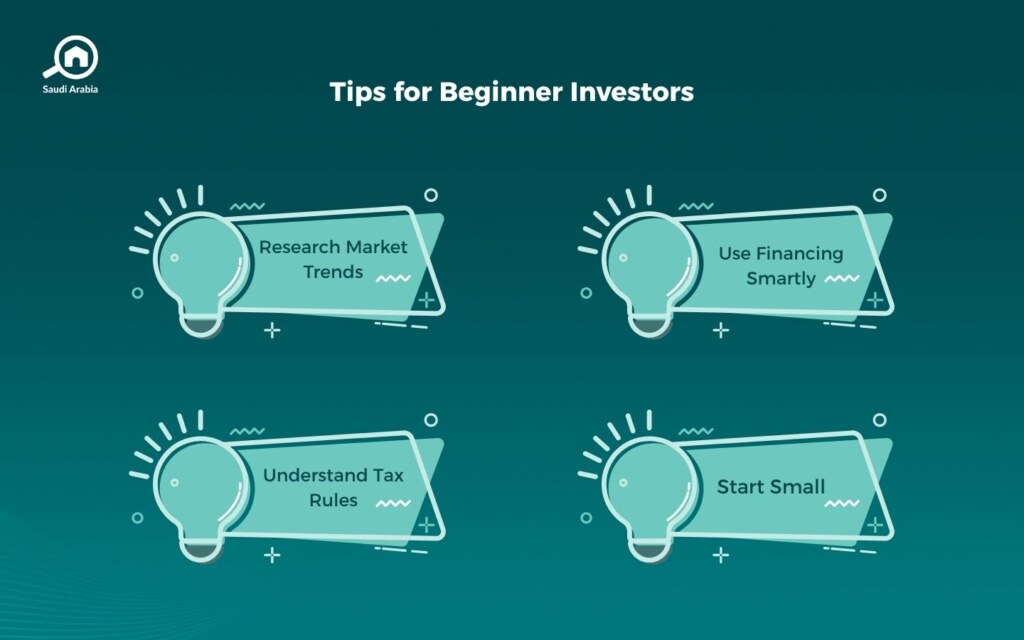

Study Local Market Trends

Each region in Saudi Arabia has different dynamics. Riyadh may be suitable for residential and commercial investments, while Makkah and Madinah may offer religious tourism rental opportunities.

Start with One Property Type

Begin with a manageable investment such as a residential apartment in a growing area. Once it’s stable and generating income, you can move to diversify.

Expand Into Other Asset Classes

Once comfortable, diversify into commercial or land investments. Consider properties near infrastructure projects, industrial zones, or university areas.

Reinvest Earnings Strategically

Use the cash flow from your properties to reinvest and expand your portfolio without taking on excessive debt.

Tips for Creating a Diversified Investment Portfolio

- Avoid Over-Concentration: Don’t invest all your capital in one city or sector.

- Leverage Local Expertise: Consult with real estate advisors.

- Monitor Regulatory Updates: Remember that Saudi Arabia’s Vision 2030 reforms continue to affect the real estate market.

- Prioritize Liquidity: Ensure part of your portfolio remains liquid or easily sellable in case of emergency.

What Is the Best Investment Portfolio in Saudi Arabia?

There is no one-size-fits-all solution, but the best portfolio balances income-generating properties with long-term assets. A sample well-diversified Real Estate Portfolio in Saudi Arabia portfolio might look like:

- 40% Residential units in Riyadh or Dammam

- 30% Commercial property in Jeddah

- 20% Land in expanding zones like NEOM or the Red Sea Project

- 10% Short-term rentals in Makkah or AlUla

This mix offers a blend of rental income, capital appreciation, and long-term speculative growth.

How Do You Make Money from Real Estate?

Building a Real Estate Portfolio in Saudi Arabia can generate income in several ways:

- Monthly rental income from tenants

- Value appreciation as property prices rise

- Flipping undervalued properties for a quick profit

- Land leasing for commercial or agricultural use

- Tax advantages including the absence of income tax on rental income

If you’d like to know more about making money from real estate, explore 9 Smart Ways to Make Money from Real Estate in Saudi Arabia.

The Four Pillars of Real Estate – The Heart of Building a Real Estate Portfolio

When building your portfolio, it helps to consider the four pillars of real estate investing:

- Cash Flow: Consistent rental income after expenses

- Appreciation: Long-term value growth

- Debt Paydown: Reducing loan balances over time

- Tax Efficiency: Benefiting from Saudi Arabia’s low-tax environment

These pillars provide a framework for choosing which properties to add and how to measure long-term success. Read more about these pillars in our article The 4 Pillars of Real Estate in Saudi Arabia : All You Need for Investment Success.

Building a Real Estate Portfolio in Saudi Arabia is a Strategic Path to Wealth

With the right planning and diversification, building a real estate portfolio in Saudi Arabia offers investors financial stability, growth, and minimized risk. Whether you’re just starting or expanding, focusing on balance, cash flow, and market awareness is essential. By following the steps outlined here, you can craft a sustainable and profitable investment strategy tailored to the Saudi market.

You can also keep exploring and learning about real estate, market trends, and more by following along our blog My Bayut.