The BRRRR Strategy (Buy, Rehab, Rent, Refinance, Repeat) is a popular real estate approach, but it comes with its downsides, such as regulations, financing rules, and ever-evolving market dynamics. If you’re an investor or a property owner, you’ve probably been drawn to real estate due to its tangible nature and long-term potential. Are you exploring Alternatives to the BRRRR Strategy ? If that’s so, then you’ve certainly come to the right place!

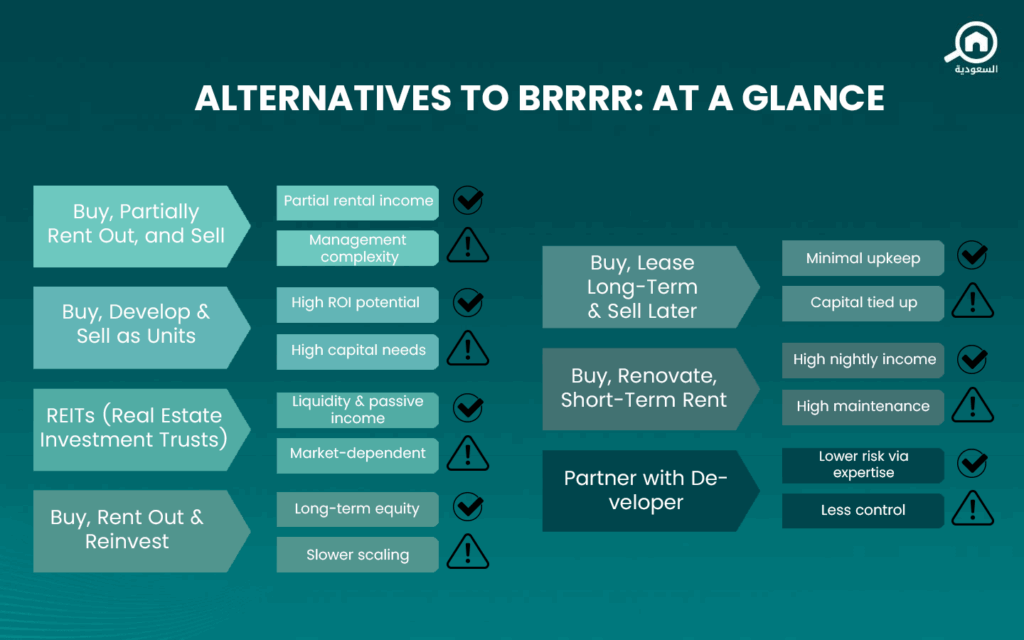

Whether BRRR fits your goals or not, let’s explore the different strategies investors can consider:

Buy, Partially Rent Out, and Sell Strategy

This strategy combines rental income with capital gains by purchasing a property, renting out a portion (e.g., a room or unit), and then selling the entire property for profit. Ideal for urban areas with strong residential demand (e.g., Riyadh, Jeddah), it offers partial rental income, lower vacancy risk, and capital gains upon sale. It’s best suited for villas, duplexes, and mixed-use buildings in urban centers.

Unfortunately, this strategy may complicate property management and privacy, it may not qualify as a full investment property for bank loans, and, notably, selling a property with a tenant may deter buyers.

Buy a Property, Develop It, and Sell as Independent Units Strategy

Buying and subdividing undeveloped land into units/apartments, then selling each, offers high ROI, especially near Vision 2030 projects where demand for modern housing is rising. This Alternatives to the BRRRR Strategy also leverages Saudi’s land-use laws. Downsides include significant upfront capital, development permits, and risks of delays or budget overruns. Unsold units can tie up capital, making it sensitive to local demand. Pre-planning, market timing, and exit planning are crucial.

Real Estate Investment Trusts (REITs) Investment Strategy

Investing in REITs on Tadawul offers a hands-off approach to real estate. These REITs provide diversification, liquidity, and regular, often high, dividend payouts (some Saudi REITs distribute over 90% of net earnings annually). While market volatility and leverage can affect performance, REITs are suitable for passive investors seeking income and portfolio diversification without operational responsibilities. Downsides include market-tied returns, limited investment control, and potential dividend taxation for non-Saudis.

Buy a Property, Rent It Out, and Reinvest in Other Properties Strategy

The traditional buy-and-hold strategy involves purchasing a move-in-ready property, leasing it long-term, and using rental income and equity for future acquisitions. Less time-intensive than BRRRR, it suits Saudi investors seeking stable income over rapid portfolio growth, offering steady cash flow and long-term wealth building with low complexity. Downsides include slower growth compared to BRRRR, strong property management requirements, and risks of vacancy or non-paying tenants.

Buy a Property. Lease It Long-Term, and Sell Later at a Higher Price Strategy

A long-term “buy and hold” strategy, suitable for low-risk, less involved investors that are searching for Alternatives to the BRRRR Strategy – it relies on capital appreciation from market growth, especially in Vision 2030 areas like NEOM. It requires minimal immediate effort or remodeling. However, capital can be tied up for years, market downturns may delay exits, and inflation can erode real gains if rent doesn’t keep pace.

You may also be interested in: Project NEOM .. A Place on Earth Like No Other

Buy a Property, Renovate It and Convert It into a Short-Term Rental Platform Strategy

Investors buy and renovate properties for short-term rentals (e.g., Airbnb). This high-management strategy, suitable for tourism hubs like NEOM and the Red Sea Project, can yield premium nightly rates, especially from business travelers and tourists. It offers potential tax and utility benefits if legally registered, providing higher income than long-term rentals.

However, challenges include strict licensing, high maintenance, significant management time, and potential long vacancies due to seasonality. Additionally, it might not be permitted in all Saudi neighborhoods, limiting location choices.

Partnership with a Real Estate Developer Strategy

When looking for Alternatives to the BRRRR Strategy, you should consider joining a joint venture or co-investment with licensed Saudi developers. You can provide capital or expertise while developers handle planning and execution. This approach reduces operational burden and builds trust on high‑scale projects aligned with Vision 2030 policies.

Quick Comparison Table

Strategy | Saudi Applicability | Pros | Cons |

|---|---|---|---|

Strategy Buy & Partial Rent, Then Sell | Saudi Applicability High: urban family housing | Pros Short-term rent + exit gain | Cons Requires good tenant selection |

Strategy Develop into Units, Then Sell | Saudi Applicability High: new development areas | Pros High individual value sales | Cons Capital-intensive, regulatory approvals |

Strategy REITs | Saudi Applicability Growing: via Tadawul | Pros Diversified, liquid, low effort | Cons Dependent on fund performance |

Strategy Long-Term Rental & Reinvest | Saudi Applicability Moderate: steady housing demand | Pros Stable cash flow, equity build | Cons Slower scaling, management workload |

Strategy Lease Long-Term & Sell at Appreciation | Saudi Applicability High: aligned with infrastructure growth | Pros Low maintenance until sale | Cons Timing risk, market dependence |

Strategy Short-Term Rental (e.g. Airbnb) | Saudi Applicability Niche: tourist zones under development | Pros Higher potential nightly rates | Cons Licensing, management overhead |

Strategy Developer Partnership | Saudi Applicability High: co-invest in major projects | Pros Leverage expertise/resources | Cons Relies on developer reputation and terms |

Conclusion

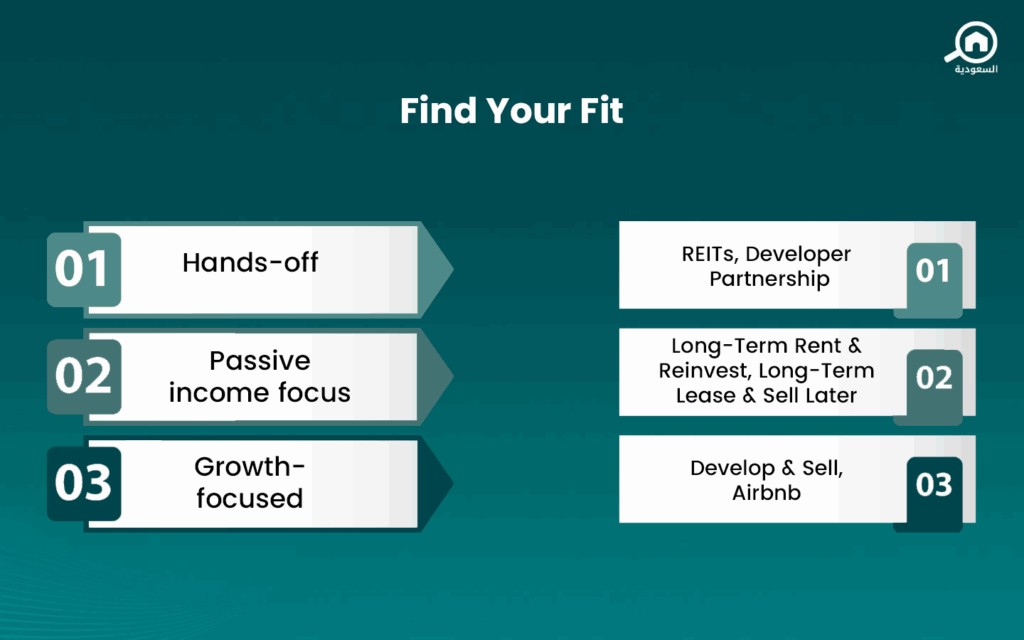

If the BRRRR strategy doesn’t suit your resources or local regulations, there are plenty of viable Alternatives to the BRRRR Strategy in Saudi Arabia. From hands-off REIT investment to high-growth land development and joint ventures with developers, each approach offers a path to wealth-building—adapted to local market dynamics under Vision 2030. Choose the method that aligns with your capital, risk tolerance, and investment goals.

Keep your eye on Saudi Arabia’s real estate market, trends, and more, by keeping up with My Bayut.