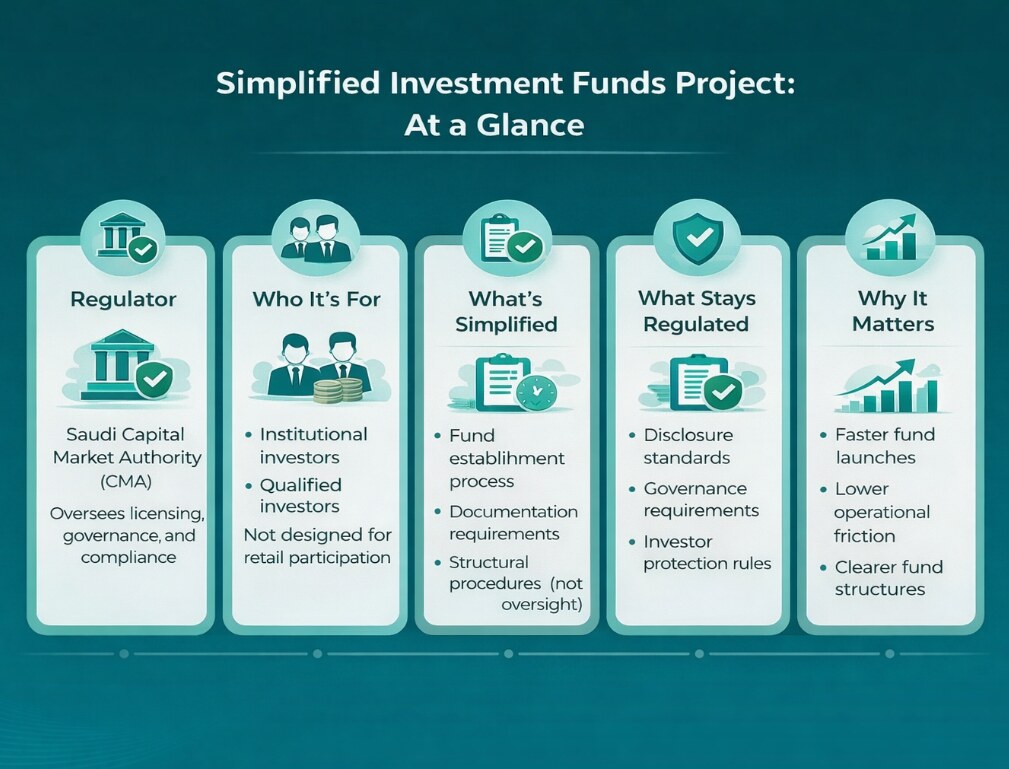

In recent years, more investors in Saudi Arabia have moved beyond simply choosing where to invest. They have started paying closer attention to how investment funds are built, how long they take to launch, and how clearly their terms are defined. This shift reflects a maturing market, where efficiency matters as much as opportunity. The Simplified Investment Funds Project, overseen by the Saudi Capital Market Authority (CMA), responds to this change by making fund creation more straightforward without weakening oversight.

It offers fund managers and investors a clearer, more practical way to participate in Saudi Arabia’s evolving investment landscape.

What Is the Simplified Investment Funds Project?

For years, launching an investment fund in Saudi Arabia meant navigating layers of approvals and documentation. That process worked, but it was not always efficient for a growing market.

The Simplified Investment Funds Project is a regulatory initiative introduced by the Saudi Capital Market Authority (CMA) to streamline how certain investment funds are established.

Key facts:

- Draft instructions published on 7 October 2025

- Opened for public consultation

- Designed for institutional and qualified investors

- Focuses on efficiency without removing regulatory oversight

The framework simplifies procedures while keeping governance and investor protection in place.

The Role of the Saudi Capital Market Authority (CMA)

As Saudi Arabia’s capital markets expand, regulation had to evolve alongside growth. The CMA sits at the centre of that balance.

The Saudi Capital Market Authority (CMA) regulates investment funds, licenses fund managers, and enforces disclosure and governance standards across the market.

According to the CMA’s 2024 Annual Report:

- 1,549 licensed investment funds were operating in Saudi Arabia

- Assets under management exceeded SAR 1 trillion

- More than 1.72 million subscribers participated in investment funds

- Subscriber numbers grew 47% year-on-year

These figures show that simplified funds were introduced during a period of strong market momentum.

Establishing Simplified Investment Funds

For fund managers, the most important question is how different this process really is. The answer lies in reduced friction, not reduced oversight.

Establishing simplified investment funds follows a more efficient pathway under the CMA’s draft framework.

The proposed process includes:

- Fund managers must already hold a CMA licence

- Use of standardised documentation

- Greater contractual flexibility with eligible investors

- Simplified structural requirements under defined conditions

The public consultation period ran for 30 days and closed on 6 November 2025, allowing market feedback before finalization.

Also, read about how to invest in logistics in Saudi Arabia.

How Many Investment Funds Are There in Saudi Arabia?

Understanding the scale of the market helps explain why simplification matters.

According to official CMA data for 2024:

- Saudi Arabia had 1,549 licensed investment funds

- These include:

- Public investment funds

- Private funds

- Real estate investment funds

- Specialised and alternative funds

The simplified framework is expected to support continued growth by lowering procedural barriers to fund creation.

Real Estate Investment Funds

Real estate investment funds in Saudi Arabia are formally regulated by the Saudi Capital Market Authority (CMA) and operate under the Investment Funds Regulations.

These funds provide structured exposure to property assets without requiring direct ownership. Specifically, CMA-regulated real estate investment funds include:

- Real Estate Investment Traded Funds (REITs) listed on the Saudi Exchange

- Private real estate investment funds offered through private placement

- Income-generating property funds focused on residential, commercial, or industrial assets

What Is the Profit Rate in Investment Funds?

This is often the first question investors ask and the one most easily misunderstood. There is no fixed or guaranteed profit rate in investment funds.

Returns depend on:

- Asset class (equities, fixed income, real estate, alternatives)

- Market conditions

- Risk profile

- Fund management strategy

Simplified investment funds follow the same return principles as traditional CMA-regulated funds. Performance depends on investments, not regulatory labels.

Why the Simplified Investment Funds Project Matters

At its core, the project addresses a practical challenge: speed without sacrificing trust.

For fund managers, it offers:

- Faster fund launches

- Reduced administrative complexity

- More flexibility in product design

For investors, it provides:

- Access to regulated investment vehicles

- Clear contractual terms

- Continued CMA oversight and governance

The framework supports a more responsive and mature investment environment.

Bayut-KSA: Take Confident Decisions

As investment markets become more structured, access to clear and reliable information becomes essential. Investors need visibility into real market activity, not fragmented or outdated data.

Bayut-KSA brings that clarity by offering verified listings and market insights, helping investors make informed decisions with confidence.