The Saudi real estate market in 2030 is moving through one of the most significant transformations of any emerging market today. What once felt like distant Vision 2030 ambitions are now the reality shaping daily economic activity, migration patterns, and investment flows.

By 2030, the country is expected to operate on a completely different economic footing. Therefore, real estate is no longer cyclical but structurally tied to population growth, tourism, logistics, and non-oil expansion. For long-term investors, this is the moment to understand not just where the market is heading, but why.

A Market on a Clear Upward Trajectory

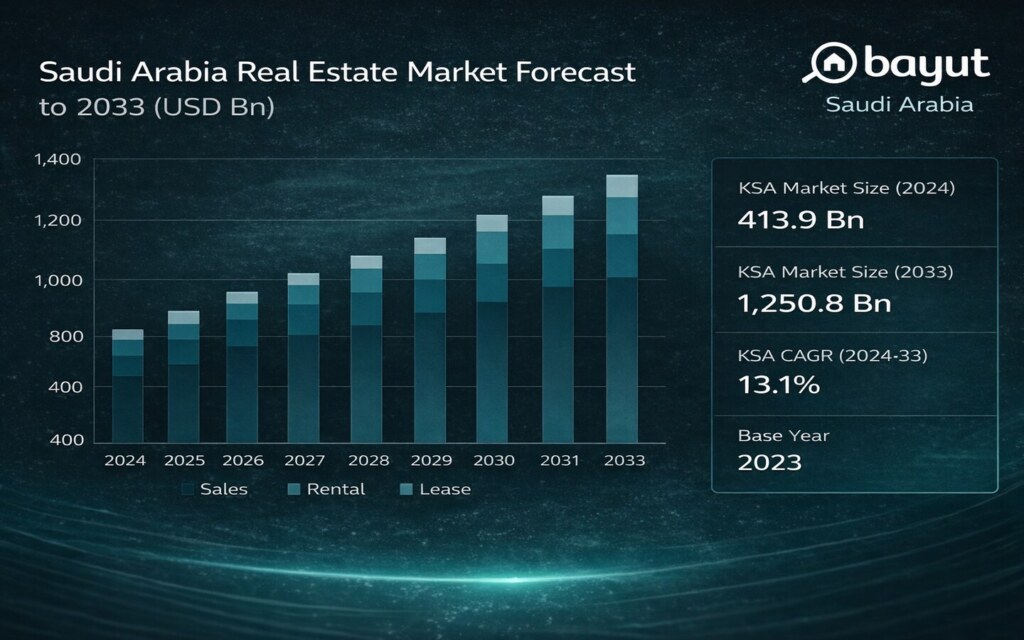

The Kingdom of Saudi Arabia (KSA) Real Estate Market size is expected to grow by 788.4 billion, at a CAGR of 13.1%, during the forecasted period of 2025 to 2033.

- This growth is driven by coordinated policy reforms, large-scale infrastructure spending, and sustained demographic expansion, rather than short-term fluctuations.

- The Kingdom is already outperforming long-term targets.

- Tourism surpassed 100 million annual visitors in 2023, achieving the Vision 2030 goal seven years ahead of schedule.

- The target has now been raised to 150 million visitors by 2030.

Saudi Arabia’s market is not moving sideways. It is building upward with structural momentum backed by data, policy, and demand.

Riyadh 2030: The New Economic Gravity Center

Riyadh is undergoing one of the most intentional economic transformations in the region. The city is being positioned as the Middle East’s business capital, driven by:

- A surge in multinational HQ relocations

- Deep regulatory and business reforms

- Mega-projects like New Murabba, Diriyah, and King Salman Park

Riyadh’s non-oil private sector consistently posts top-tier PMI readings, signaling strong economic activity. This directly fuels real estate demand, with rising absorption in:

- Grade-A office space

- Upscale residential communities

- Integrated mixed-use districts

This growth is not speculative. Corporations are moving in, people are moving in, and real estate must scale to meet the pace of a city preparing to double in size.

Jeddah & the Western Seaboard

Jeddah’s strategic advantage is twofold:

- It sits on the Red Sea, one of the world’s busiest shipping lanes.

- It serves as a cultural and tourism gateway, especially with the rise of post-Umrah tourism and coastal regeneration.

Saudi Arabia’s National Transport & Logistics Strategy aims to triple port capacity by 2030.

This positions Jeddah as the logistical backbone of the western region, and logistics real estate tends to mature into one of the most stable asset classes in any economy.

Add beachfront redevelopment and large-scale mixed-use districts, and Jeddah becomes a multi-vertical investment market rather than a single-sector play.

Tourism & Hospitality

Saudi Arabia’s tourism statistics are the backbone of one of the strongest upcoming hospitality markets globally.

Key realities:

- 100+ million visitors already achieved in 2023 (7 years ahead of schedule).

- New target: 150 million visitors by 2030.

- Tourism contributed 11.5% of GDP in 2023, projected to reach 16% by 2034.

This is an astonishing pace of expansion. It includes hotels, serviced apartments, branded residences, resort villas, and tourism-led mixed-use districts in destinations like Red Sea, Diriyah, and AlUla.

Industrial & Logistics

Saudi Arabia’s industrial and logistics sectors are no longer “emerging”; they are central to the Kingdom’s economic future.

Key structural drivers:

- Saudi Arabia aims to rank among the top 10 global logistics hubs by 2030.

- MODON now manages 36 industrial cities covering 196+ million sqm.

- Demand for Grade-A warehousing in Riyadh and Jeddah continues to outpace supply.

Investors are increasingly moving into logistics because it offers:

- Long leases,

- Stable yields,

- High tenant retention,

- And infrastructure-backed value appreciation.

The Macro Picture: A Non-Oil Economy Redefining the Market

Saudi Arabia is in the middle of a structural economic shift. By the mid-2020s, non-oil GDP is expected to surpass 50% of total GDP, driven by reforms, private sector growth, and strategic investments.

This matters for real estate because non-oil sectors, such as tourism, logistics, tech, entertainment, and finance, are heavy users of real estate.

More non-oil activity = More tenants, More development demand, Stable long-term Performance.

What Investors Should Expect by 2030

- With forecasts ranging from USD 200–250 billion, liquidity and scale will deepen.

- HQ relocation policies + population expansion = long-term appreciation.

- Red Sea, Diriyah, and AlUla will anchor hospitality and lifestyle-led real estate.

- Supported by trade expansion and manufacturing localization.

- 2026+ reforms will make entry clearer, faster, and more regulated.

Manageable Considerations

Saudi Arabia’s scale of change means certain variables must be monitored:

- Gradual rollout of foreign ownership zones,

- Phased development timelines,

- Varied performance between major and secondary cities.

These are not red flags; they are the natural characteristics of a fast-expanding emerging market.

Let Bayut-KSA be your partner in providing data, due diligence, and a long-term view to deal with these easily manageable risks.