Saudi Arabia is opening new doors for global investors. Since the Kingdom has relaxed ownership rules and upgraded its residency system, foreign investors can now use qualifying real estate assets as part of their application for Saudi Premium Residency. It is a residency category that does not require a local sponsor.

As new cities rise and the economy diversifies, the country needs residents, not just visitors, but investors who will live, invest, and grow with it. This policy signals a confident, outward-looking Saudi Arabia ready to compete on the global stage.

Why is Saudi Arabia Offering Residency now?

Saudi Arabia is introducing this policy to support several social, economic, and political objectives:

- Attract long-term investors: The Kingdom wants financially committed residents rather than short-term, employer-dependent expatriates.

- Support new city development: Projects like Jeddah Central, and the Red Sea require stable communities, not transient workforces.

- Boost economic diversification: Foreign capital strengthens real estate, tourism, and infrastructure as Saudi Arabia shifts away from oil dependency.

- Enhance global competitiveness: Residency-by-investment aligns Saudi Arabia with modern models used in markets like the UAE and Qatar.

- Strengthen international confidence: The policy signals openness and positions Saudi Arabia as a more globally integrated, investment-friendly economy.

What Is the Premium Residency Program?

Saudi Premium Residency program provides foreign nationals with the right to:

- Live and work in Saudi Arabia without sponsorship

- Own residential, commercial, or industrial property (within permitted zones)

- Sponsor spouse and children

- Travel freely in and out of the Kingdom

- Establish and own businesses

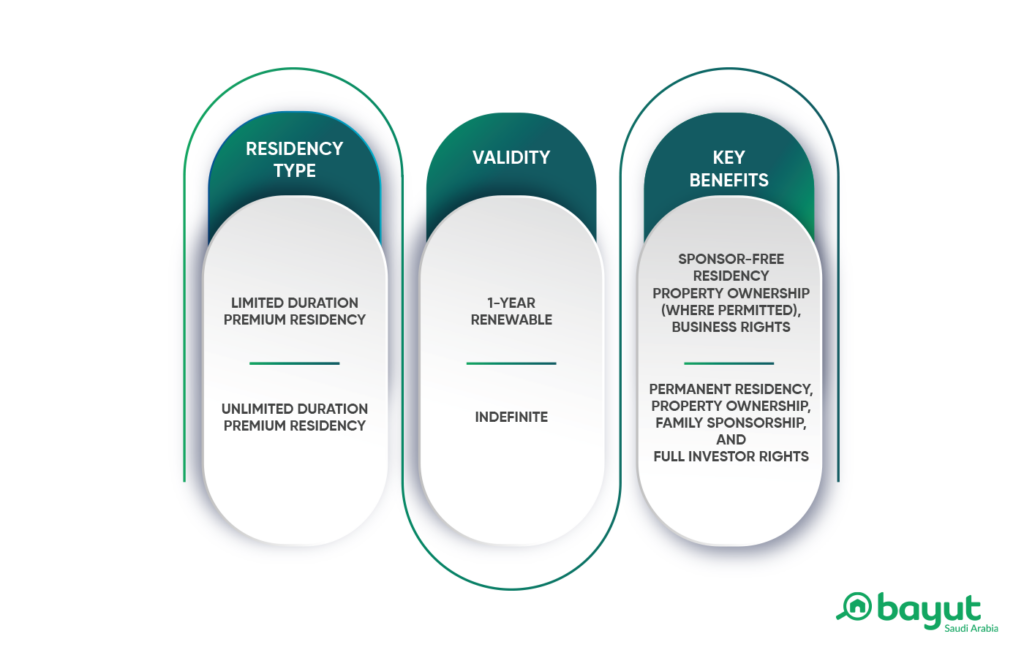

The program offers:

Real Estate Ownership as a Residency Pathway

The Premium Residency Center includes a specific route. To qualify under this category, the applicant must own property that meets the program’s requirements. The sources state that the property must:s

- Be located inside Saudi Arabia

- Be residential and usable

- Be fully owned by the applicant

- Be registered in the national Real Estate Registry

- Meet the financial value threshold set by the Premium Residency Center

- Be located in areas where foreign ownership is legally permitted

Properties in restricted zones (such as Makkah and certain areas of Madinah) remain subject to longstanding limitations.

Also, read about the Foreign Ownership Law of KSA to get ultimate investment insights.

Eligibility Requirements (Verified Criteria)

According to official Saudi Premium Residency Center guidelines, applicants must provide:

- A valid passport

- Proof of financial solvency

- A clean criminal record

- A valid medical report

- Proof of qualifying property ownership

- Payment of the residency fees

If applying from inside Saudi Arabia, the applicant must hold a valid legal status.

What Kind of Properties are Typically Eligible?

Foreign investors generally focus on:

- Apartments or villas in foreign-ownership zones (active & upcoming)

- Units in major master-planned developments across Riyadh and Jeddah

- Properties in coastal and emerging tourism zones

- High-demand residential communities offering long-term rental potential

Based on market activity observed by real estate companies such as Bayut-KSA, investor interest is strongest in Riyadh, Jeddah, and emerging Red Sea zones, areas expected to align most closely with future foreign-ownership regulations

What do the Investors Gain?

Before investors commit to a new market, the first question is always the same: What kind of returns can I expect?

In Saudi Arabia, the answer is increasingly compelling, especially for those securing residency through property ownership.

- High capital appreciation in cities like Riyadh and Jeddah, driven by rapid urban development.

- Strong rental demand from growing expatriate, business, and tourism sectors.

- Tax-efficient market, with no annual property tax or capital gains tax on individuals.

- Access to early-stage zones in mega-project areas, where long-term value typically rises fastest.

- Government-backed infrastructure growth lifts surrounding real estate values.

Investors seeking to capitalize on these changes will find a diverse selection of high-potential projects across Saudi cities, many of which are now available through Bayut-KSA’s expanding portfolio.