Across global markets, real estate investors are becoming more selective. Rising interest rates in developed economies, inflation volatility, and regulatory uncertainty have pushed capital toward markets that offer economic stability, legal clarity, and long-term growth fundamentals. Saudi Arabia has quietly emerged as one of those markets. But opportunity alone is not enough. In a market growing at this pace, the ability to protect real estate investment in Saudi Arabia is what separates speculative buyers from long-term investors.

KSA: An Investor-Grade Market

From an investor’s perspective, Saudi Arabia’s real estate appeal is not speculative; it is structural. The Kingdom now operates on a SAR 3.9 trillion economy, the largest in the Middle East, with real estate and construction increasingly embedded as core growth engines rather than cyclical add-ons.

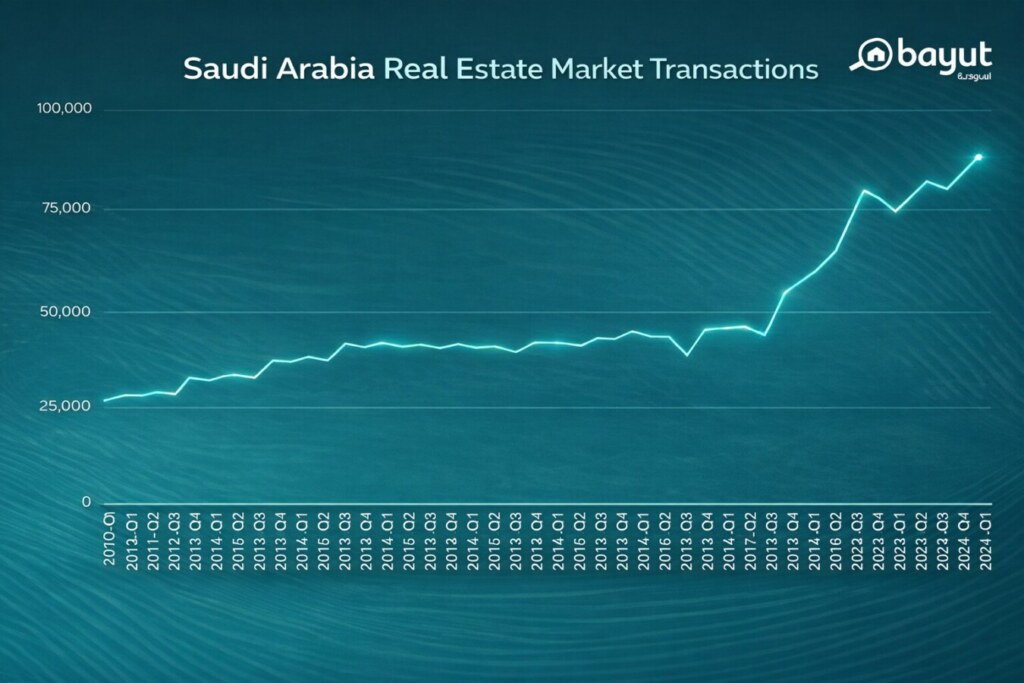

Market activity tracked by Bayut-KSA reflects this structural shift, with sustained investor interest concentrated in Riyadh, Jeddah, and emerging Vision 2030 corridors rather than short-term speculative pockets.

For investors, this matters because:

- Real estate demand is tied to economic output and employment, not short-term sentiment

- Development activity is supported by public investment and long-term planning

- Asset growth is aligned with population expansion and urbanisation

Protect Investor Capital Via Legal Procedures

Protection starts with compliance. Saudi Arabia has significantly strengthened its real estate legal framework, making procedural discipline a core investment advantage.

What Investors Must Get Right

To protect investment in Saudi Arabia, investors should ensure:

Real Estate Registry Law

- Requires all properties to be registered in the national Real Estate Registry

- Establishes legal ownership only upon registration

- Prevents duplicate ownership claims and fraud

- Enables resale, financing, inheritance, and legal enforcement

Foreign Ownership of Real Estate Regulations

- Allows foreign investors to own property in approved zones

- Defines eligible property types (residential, commercial, industrial)

- Restricts ownership in specific areas such as Makkah and parts of Madinah

- Provides regulatory clarity and predictability for international investors

Premium Residency Law

- Grants sponsor-free residency to qualifying investors

- Permits real estate ownership within approved zones

- Allows family sponsorship and business ownership

- Supports long-term, legally structured investment strategies

Off-Plan Sales Law (Wafi Program)

- Requires developers to be licensed and projects approved

- Regulates the sale of properties before completion

- Monitors buyer payments based on construction progress

- Reduces project delay, abandonment, and fund misuse risks

Real Estate Brokerage Law

- Limits property marketing and sales to licensed brokers and agents

- Enforces professional standards and compliance requirements

- Imposes penalties for misrepresentation or violations

- Protects investors at the transaction stage

Standardised Sale and Lease Contract Regulations

- Promotes government-approved contract templates

- Clearly defines ownership transfer and payment terms

- Reduces contractual ambiguity

- Strengthens enforceability in dispute resolution

Zoning and Land Use Regulations

- Regulate permitted property use and development rights

- Define residential, commercial, and mixed-use classifications

- Protect income-generating and redevelopment potential

- Safeguard long-term asset value and exit strategies

Judicial Enforcement and Dispute Resolution Framework

- Supports the enforcement of registered ownership and contracts

- Provides formal dispute resolution channels

- Strengthens investor confidence in legal recourse

Structural Protection of Investors

What distinguishes Saudi Arabia from many emerging markets is that investor protection is now systemic, not optional.

Mechanisms reinforcing this include:

- Increasing use of digitised property records, reducing documentation risk

- Greater oversight of developers and off-plan sales

- Escrow-style payment structures becoming standard practice

- Clearer judicial pathways for real estate dispute resolution

For investors, these mechanisms translate into lower execution risk and stronger enforceability two factors global capital prioritises heavily.

Protection Is the New Performance

For investors, success now depends less on timing the market and more on structuring investments correctly:

- Legally compliant

- Strategically located

- Economically supported

- Policy-aligned

Saudi Arabia’s real estate framework is anchored by institutions such as the Real Estate General Authority (REGA), the Ministry of Municipal and Rural Affairs and Housing (MOMRAH), and the national Real Estate Registry, all of which play a central role in standardising transactions and enforcing ownership rights.

For investors seeking verified listings and market intelligence aligned with Saudi Arabia’s evolving regulatory framework, Bayut-KSA provides a trusted platform to support confident, long-term investment decisions.