Global trade does not run on maps alone anymore. It runs on how quickly goods move, how reliably they arrive, and how well supply chains respond when things go wrong. As congestion and disruption challenge traditional logistics hubs, attention is slowly shifting toward markets that are building flexibility into their systems from the ground up. That shift helps explain the growing interest in logistics in Saudi Arabia.

The Kingdom is reshaping how logistics works by investing in digital tools, automation, and integrated networks. The goal is simple: move from being a regional gateway and become a logistics platform that global companies and investors can rely on over the long term.

Logistics in Saudi Arabia and Global Trade

Global logistics hubs are under strain. Congestion, rising costs, and repeated supply chain shocks are prompting companies to explore alternative routes.

Logistics in Saudi Arabia is gaining relevance at this moment because it aligns with what global trade now demands:

- Alternative routes between Asia, Europe, and Africa

- Faster, more predictable cargo movement

- Logistics systems designed for resilience and scale

This momentum is already attracting international capital, including a recent joint venture between European logistics developer Garbe Industrial and Saudi firm ARTAR. It aims to develop next-generation logistics real estate across the Kingdom.

How is Digitization Shaping Logistics in Saudi Arabia?

Digitization is changing how logistics works in practice, not just how it is planned. Across ports, warehouses, and transport networks, technology is being used to improve visibility, speed, and reliability. These are three things global supply chains now depend on.

For logistics in Saudi Arabia, this shift is showing up in a few clear ways:

- Real-time tracking using IoT and data platforms to monitor cargo, vehicles, and warehouse operations

- Smarter planning through analytics and AI that improves routing, inventory positioning, and capacity use

- Automation in warehouses and terminals to reduce manual errors and handle higher volumes efficiently

What matters is not the technology itself, but the impact. Digitization shortens turnaround times, reduces uncertainty, and makes logistics operations more predictable.

Also, read about what long-term investors can expect from Saudi Real Estate till 2030.

The Investment Case for Saudi Logistics

Demand is also being driven by scale. Saudi Arabia’s delivery sector handled more than 100 million orders in a single quarter in 2025, increasing pressure on warehousing, last-mile delivery, and distribution capacity.

Several data-backed signals stand out:

- Saudi Arabia has committed over $100 billion under Vision 2030 to logistics and supply-chain digitization

- The logistics market is projected to reach $38.8 billion by 2026, growing at around 5.8% CAGR

- Logistics currently contributes about 6% of GDP, with a stated target of 10% by 2030

- Saudi Arabia improved its position in the World Bank Logistics Performance Index, indicating measurable gains in efficiency

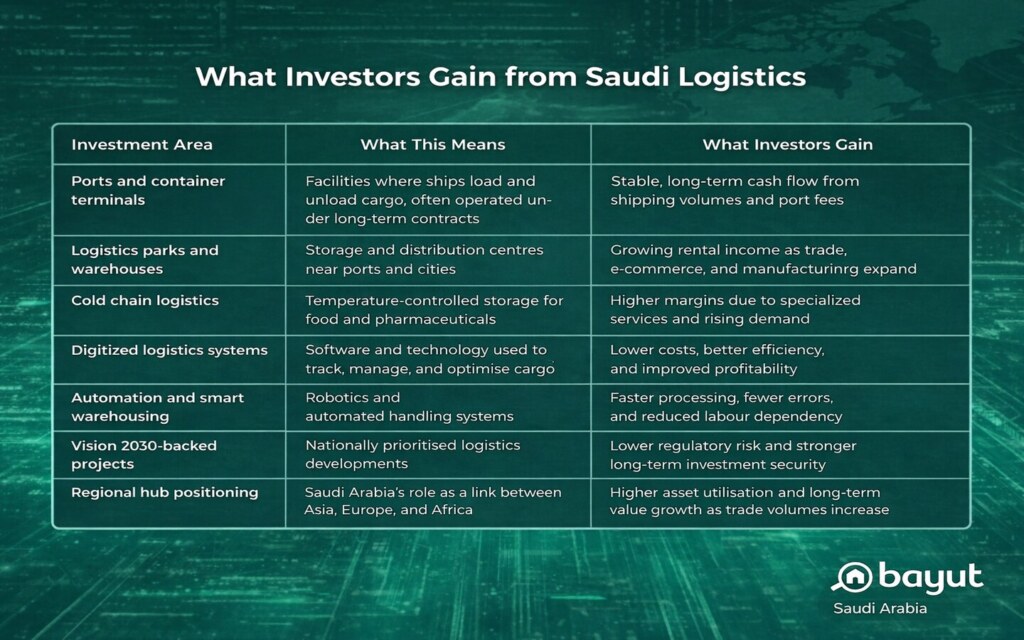

From an investor perspective, this translates into opportunity across multiple layers:

- Ports and terminals, supported by long-term concessions and BOT-style models

- Logistics parks and warehousing, benefiting from rising trade volumes and industrial growth

- Digitization and automation, where efficiency gains directly improve margins and asset utilisation

This includes major investments in connectivity, such as a planned cross-Kingdom rail corridor linking Red Sea and Gulf ports to inland logistics hubs, designed to reduce freight times and improve cargo flow across the country.

Considerations for Long-Term Investors

As with any growing market, logistics in Saudi Arabia comes with factors investors should simply be aware of realities of scale and transition.

A few points to keep in mind:

- Project timelines: Large infrastructure and logistics developments naturally roll out in phases, which means returns are often gradual rather than immediate.

- Skills development: As logistics becomes more digitised, continued investment in training will be important to support smooth operations.

- Competitive landscape: Saudi Arabia is building its logistics role alongside established regional hubs, which takes time and consistent performance.

- Global trade cycles: Logistics volumes move with global trade conditions, creating normal ups and downs along the way.

Taken together, these are typical considerations for long-term infrastructure and logistics investments. For investors with a patient outlook, they are part of the process rather than signals of instability.

The Bottom Line

Logistics in Saudi Arabia is becoming part of a bigger shift in how the Kingdom attracts long-term investment. As infrastructure, technology, and demand come together, the real advantage lies in understanding where opportunities are taking shape early.

That is where Bayut-KSA adds value. By bringing together market insights and property opportunities in one place, Bayut-KSA helps investors move beyond headlines and make smarter, more confident decisions in Saudi Arabia’s evolving investment landscape.