When people discuss real estate investment in Saudi Arabia, major cities usually dominate the conversation. Riyadh and Jeddah are often seen as the safest bets. Yet experienced investors know that long-term value is not always found where prices have already peaked. As attention shifts toward regional cities with real, needs-driven demand, investment in Al Dawadmi real estate is increasingly entering the picture.

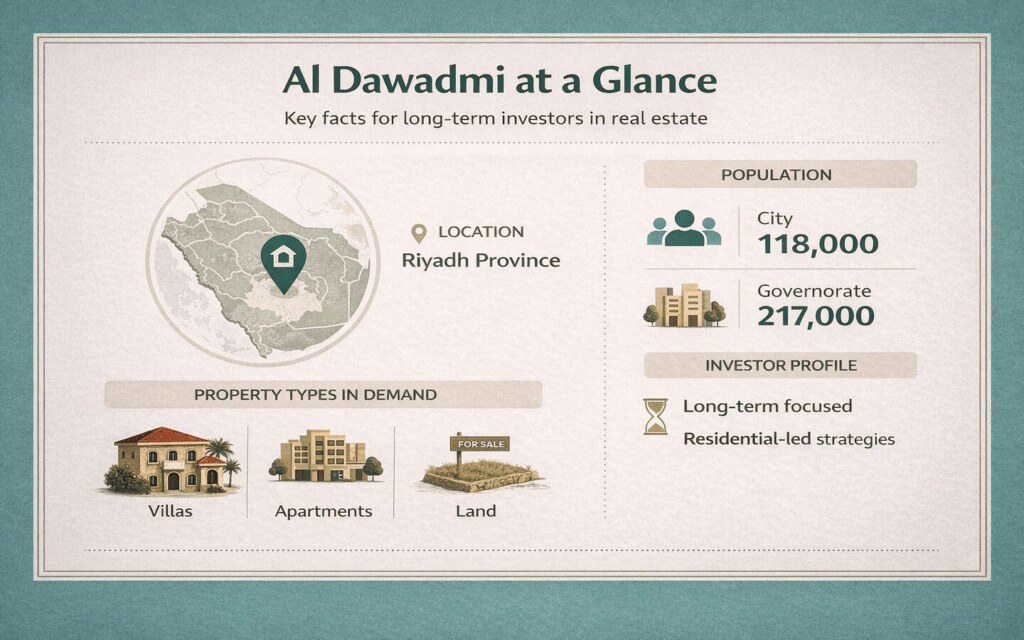

Located in the Riyadh Province and supported by a stable local population, Al Dawadmi is emerging as a practical option for buyers seeking affordability, stability, and long-term growth rather than speculation.

Why is Al Dawadmi Gaining Investor Attention?

Al Dawadmi serves as a residential and administrative centre for the surrounding communities. This role supports consistent housing demand rather than speculative spikes.

Key factors attracting investors include:

- Population stability: Around 86,000 residents in the city and over 200,000 in the wider governorate

- Lower entry prices: More accessible than major Saudi cities

- Local demand drivers: Families, professionals, and public-sector employment

- Reduced volatility: Pricing shaped by end-user needs

These fundamentals appeal to investors seeking predictable performance.

Market Overview of Investment in Al Dawadmi Real Estate

A focused market overview of investment in Al Dawadmi real estate shows a market driven mainly by residential demand rather than commercial speculation.

Property types dominating the market

- Family-sized villas

- Affordable apartments

- Residential land for owner-built homes

National trends provide useful context. Saudi Arabia’s Real Estate Price Index recorded year-on-year growth in 2025, led by the residential sector. Residential land prices increased at a faster pace than built properties, reinforcing land’s importance as a value driver, particularly in regional markets like Al Dawadmi.

What this means locally

- Land often leads pricing cycles

- Built properties follow gradually

- Price growth is slower but more stable

Residential Demand & Rental Performance

Residential real estate remains the backbone of Al Dawadmi’s market.

Demand is strongest for:

- Villas suited to family living

- Apartments near services and employment hubs

Rental yields are generally moderate, but occupancy tends to be consistent when pricing aligns with local income levels. Many investors use Bayut-KSA to:

- Compare live listings

- Evaluate neighbourhood-level pricing

- Track supply and demand trends

This helps set realistic expectations before investing.

Opportunities for Investment in Al Dawadmi Real Estate

The opportunities for investment in Al Dawadmi real estate favor patience and strategic planning rather than quick returns.

Key opportunities include

- Residential land in developing districts

- Mid-market rental villas targeting families

- Affordable apartments with steady occupancy

These opportunities are best suited for medium- to long-term investors.

How Al Dawadmi Differs from Major Cities

Unlike Riyadh or Jeddah, Al Dawadmi is not driven by luxury demand or international buyers. Its market is shaped by local needs. This results in:

- Less competition among buyers

- More predictable pricing

- Lower exposure to sharp corrections

For conservative investors or first-time buyers, this environment can be easier to navigate.

Recent Developments Influencing the Market

Recent developments supporting investment in Al Dawadmi real estate are driven by clear policy and infrastructure actions rather than speculation.

- Vision 2030 regional growth: Led by the Ministry of Municipal and Rural Affairs and Housing (MOMRAH), Vision 2030 promotes balanced development in secondary cities, supporting housing demand in places like Al Dawadmi.

- Riyadh Region infrastructure upgrades: The Royal Commission for Riyadh City (RCRC) and the Ministry of Transport and Logistics Services are delivering major road and connectivity projects, improving access and livability across the region.

- Stable population base: Data from the General Authority for Statistics (GASTAT) shows Al Dawadmi has around 86,000 residents, with over 200,000 in the wider governorate supporting steady, needs-driven housing demand.

- Residential-led price trends: According to the Saudi Central Bank (SAMA), recent growth in Saudi real estate has been led by residential land, a key value driver in regional markets.

- Ownership reforms (2026): Updates to non-Saudi property ownership regulations, overseen by REGA and MISA, are expected to improve market transparency and long-term investor confidence.

Bottom line: These factors support gradual, fundamentals-driven growth in Al Dawadmi rather than short-term price spikes.

Key Considerations Before Investing

Before committing, investors should keep the following in mind:

- Liquidity is lower than in major cities

- Capital appreciation typically requires longer holding periods

- Neighbourhood selection within Al Dawadmi is critical

Reviewing verified listings and price comparisons on Bayut-KSA can help investors reduce risk and make informed decisions.

Bayut-KSA: Your Trusted Partner

Investment in Al Dawadmi real estate is shaped by fundamentals. Local demand, gradual development, and long-term planning matter more here than speculation.

For investors, the challenge is often not finding an opportunity. It is separating realistic pricing and genuine demand from assumptions, especially in regional markets where information can be limited.

Access to verified listings, clear price comparisons, and up-to-date market visibility becomes essential. This is where Bayut-KSA plays a practical role, helping investors evaluate real options in Al Dawadmi with clarity and confidence before making long-term decisions.