Few assets move quietly while absorbing so much capital. Data centers have done exactly that. As cloud computing, artificial intelligence, and digital services expand, the infrastructure behind them has become indispensable. Storage and processing are no longer background utilities. They are core requirements for modern economies. This shift has pushed investment in data centers into the mainstream.

Capital is flowing not because the sector is fashionable, but because demand is persistent, contracts are long-term, and switching costs are high. Investors now want clarity on how this market generates returns, how large it has become, and whether current momentum is sustainable.

Are Data Centers Treated as Infrastructure?

Data centers now behave less like traditional real estate and more like critical infrastructure. Once operational, they support continuous activity that businesses cannot easily relocate or pause.

Several forces drive this:

- Enterprise migration to cloud platforms

- Rapid growth in artificial intelligence workloads

- Rising demand for low-latency and localised data processing

- Regulatory pressure to store and process data within specific jurisdictions

Together, these forces create demand that is structural rather than cyclical, which explains why long-term capital is increasingly comfortable in this space.

Is Investing in Data Centers a Good Investment?

For many investors, the appeal lies in resilience rather than headline returns. Data center investments typically offer:

Download Our App

Get the app and search experience among thousands of verified properties now!

- Long lease terms, often with built-in escalations

- Enterprise or hyperscale tenants with strong credit profiles

- High tenant switching costs due to technical complexity

- Lower correlation with traditional property cycles

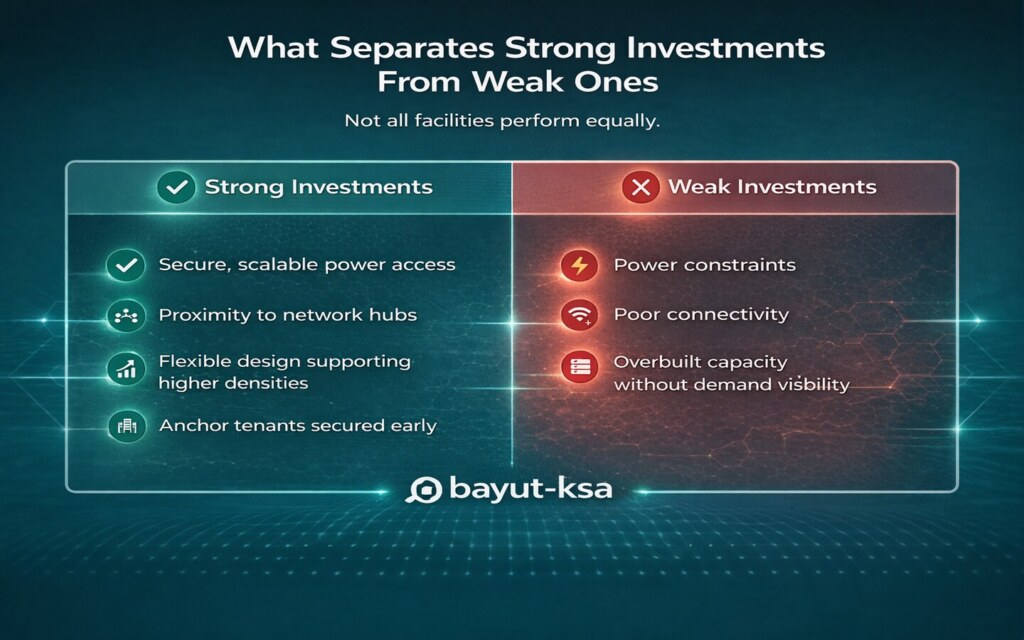

That said, performance is not uniform. Returns depend heavily on:

- Power availability and pricing

- Network connectivity

- Location relative to users

- Operator expertise

When these factors align, data centers tend to deliver steady, infrastructure-like returns.

How Can Money Be Made From a Data Center?

Revenue generation in data centers is layered rather than singular.

Common income streams include:

- Colocation leasing, where customers rent racks and power

- Wholesale leasing to large cloud or enterprise clients

- Interconnection services, allowing direct network access

- Managed services, such as monitoring and security

Value is often created over time by:

- Increasing rack density

- Expanding capacity within existing facilities

- Improving energy efficiency

- Locking in long-term contracts before new supply enters the market

Which Industries Use Data Centers in Saudi Arabia?

In Saudi Arabia, data center demand is driven by sectors that support national digital growth and daily economic activity.

Key users include:

- Government and public services, powering digital platforms, identity systems, and e-government services

- Telecommunications providers, supporting 5G networks and national connectivity

- Cloud and technology companies, hosting enterprise systems and regional data

- Financial institutions, running secure banking, payments, and trading infrastructure

- Healthcare providers, managing digital records, imaging, and telemedicine

- E-commerce and logistics platforms, handling transactions, inventory, and delivery systems

This mix anchors data center demand to essential services in the Kingdom, supporting stable, long-term occupancy.

2025 Data Center Investments

Clarity matters here because “investment” is often used loosely.

In 2025:

- Reports indicate that Saudi Arabia’s Public Investment Fund (PIF) has made a $6 billion commitment to develop a major data center ecosystem, often focusing on AI.

- This figure reflects investor capital deployed into data center assets, not total construction or equipment spend

Separately:

- Large cloud providers continue to spend aggressively on capital expenditure, including data centers, servers, and AI infrastructure

- This hyperscaler spending runs into the hundreds of billions globally, but it is capex, not market investment volume

Understanding this distinction prevents inflated expectations and keeps analysis grounded.

Size and Momentum

The investment in the data centers market continues to expand, though growth is becoming more selective.

Key characteristics of the current phase:

- Strong demand for existing, operational assets

- Increased competition for power-secure locations

- Slower transaction activity in secondary markets

- Rising construction costs influencing development decisions

Geographically:

- Mature markets focus on upgrades and efficiency

- Emerging markets attract greenfield development

- Secondary cities gain attention due to power and land constraints

This creates multiple entry points depending on risk tolerance and expertise.

Where Data Meets Decision-Making: Bayut KSA

Understanding investment trends is only useful when they can be applied at a local level. In a market where infrastructure, demand, and location play a decisive role, investors need visibility beyond high-level signals.

Bayut-KSA helps translate market data into practical decisions by providing access to verified listings, location-level trends, and demand indicators across Saudi Arabia. This allows investors to assess where digital infrastructure, real estate, and long-term growth intersect in practice.