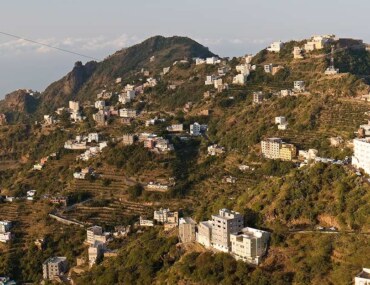

For many Muslim investors, Al Madinah Al Munawwarah is approached with reflection before calculation. It is a city where intention matters, and decisions carry meaning beyond financial return. At the same time, Madinah is a thriving city that supports millions of visitors, residents, and workers each year. As infrastructure expands and services modernise under Saudi Arabia’s long-term vision, investment in Al Madinah Al Munawwarah is increasingly seen as a careful balance between purpose, regulation, and sustainable development.

Al Madinah Al Munawwarah as an Investment Environment

Anyone comparing Madinah to other Saudi cities quickly notices that demand behaves differently here. Growth is not driven by corporate headquarters or population inflows alone, but by a rhythm that follows religious life.

In 2024, Saudi Arabia recorded 18.5 million pilgrims visiting Makkah and Madinah, creating consistent demand for accommodation, services, and supporting infrastructure. This demand is:

- Recurring throughout the year

- Closely aligned with the Islamic calendar

- Less sensitive to global economic shifts

Because of this structure, Madinah is best understood through continuity and service needs rather than short-term cycles.

Development Guided by Stewardship and Care

Development in Madinah is rarely discussed in terms of speed. Instead, the focus is on care how growth can support visitors while preserving the city’s spiritual character.

Saudi Arabia’s approach centres on:

- Visitor flow and crowd management

- Regulated hospitality expansion

- Transport and infrastructure upgrades

- Long-term urban planning

In the first quarter of 2025, tourism-related business registrations in Madinah grew to 3,877, which is a 44.8% increase year-on-year.

Also read about what simplified project funds to invest in with Bayut.sa.

Key Investment Sectors in Al Madinah Al Munawwarah

Hospitality Serving Religious Visitation

Walking near central areas during peak seasons makes one thing clear: accommodation is not optional—it is essential.

Hospitality opportunities include:

- Hotels and serviced apartments

- Short-stay accommodation

- Retail and food services serving pilgrims

Returns here depend on occupancy, service quality, and operational discipline rather than speculative price growth.

Residential Housing Supporting City Life

Behind every visitor experience is a workforce that needs stable housing. Residential demand in Madinah grows quietly but steadily.

It is supported by:

- Hospitality and tourism workers

- Healthcare and education professionals

- Municipal and operational services

This sector typically offers consistent rental demand and long-term occupancy.

Logistics and Support Infrastructure

Much of Madinah’s daily function happens out of sight. Supplies move, services operate, and the city runs continuously.

In 2025, authorities announced SAR 455 million in industrial and logistics projects in the Madinah region, strengthening:

- Supply chains for hospitality and retail

- City operations

- Long-term urban functionality

These assets benefit indirectly from sustained visitation.

Long-Term Strengths of Investment in Al Madinah

Al Madinah Al Munawwarah offers a distinct investment environment shaped by heritage, and what draws investors to Madinah is not rapid change, but reliability. The environment rewards patience and understanding.

Key advantages include:

- Demand anchored in religious visitation

- Strong government oversight

- Institutional involvement in major developments

- Lower exposure to speculative volatility

Together, these factors support stability over time.

Who Can Invest in Al Madinah Al Munawwarah?

Because of its spiritual significance, investment in Al Madinah Al Munawwarah is restricted to Muslims. This framework ensures that development aligns with the city’s character and responsibilities.

Within this structure, Muslim investors may pursue:

- Residential rental properties

- Hospitality assets

- Commercial properties supporting visitor services

- Participation in CMA-regulated real estate investment funds

Important Considerations Before Investing

Responsible investment in Madinah begins with asking the right questions, not rushing to answers.

Practical considerations include:

- Aligning assets with pilgrim or workforce demand

- Understanding zoning and regulatory requirements

- Evaluating accessibility and service proximity

- Using verified data to assess pricing and availability

Careful due diligence remains essential.

Bayut KSA: Insight Built on Trust

In a city where demand is steady but location and zoning matter deeply, clarity becomes essential. Pricing can vary, and understanding real availability requires reliable information.

Bayut-KSA supports investors with verified listings, neighbourhood insights, and real market visibility. It helps decisions remain informed, responsible, and aligned with Madinah’s unique standing.