In recent years, Saudi Arabia has witnessed an unprecedented surge of interest in the entertainment sector. With sweeping reforms aligned with Vision 2030 and a growing young population hungry for new experiences, the Kingdom is embracing entertainment not only as a cultural priority but also as a major economic driver. In this article, we will discuss Investment in the entertainment sector in Saudi Arabia, and explore the main investment opportunities and the key supporting institutions.

How to Invest in the Entertainment Sector in Saudi Arabia?

Investing in Saudi Arabia’s entertainment sector involves several essential steps and considerations. Understanding the process is critical for any investor interested in Investment in the entertainment sector.

Understand the regulatory landscape

Investors need to be aware of the evolving regulatory framework. The General Entertainment Authority (GEA) issues licences for entertainment venues, events, and supplier services. Investors should ensure full compliance with these licensing requirements and stay updated on any amendments.

Identify the investment model

You can invest via direct project development (e.g., theme parks, venues), joint ventures with local partners, or acquiring stakes in existing entertainment companies. Saudi Arabia promotes public‑private partnerships (PPPs) in this domain, providing multiple channels for Investment in the entertainment sector.

Select location and target market

Riyadh, Jeddah, and the Red Sea region are emerging hotspots. Access to infrastructure, tourism influx, and the demographic profile (a large native youth population) are critical for successful investment.

Factor in incentives and funding opportunities

Government-driven funds, dedicated licensing regimes, and supportive infrastructure projects reduce risks and enhance attractiveness. For example, the Events Investment Fund (EIF) aims to attract private and foreign investment in entertainment infrastructure, facilitating Investment in the entertainment sector.

Conduct market research and cultural adaptation

Entertainment in Saudi Arabia isn’t simply a replication of Western models. Projects must respect cultural values, family-oriented consumption, and regional differences in demand. Proper research is essential to ensure success in Investment in the entertainment sector.

Build local relationships and operational capacity

Local partnerships, strong operational planning, and talent development are vital. Since the entertainment sector is relatively nascent, human capital and management experience are still developing.

Monitor return on investment and scalability

Given large-scale infrastructure costs and long-term horizons (e.g., some projects aim for contributions by 2030 or 2045), investors should model long-term revenue, visitor growth, ancillary spend, and exit strategy.

Investment opportunities in the entertainment sector

The entertainment sector in Saudi Arabia offers multiple promising avenues for investment. Below are key opportunity categories, each explained in detail, presenting lucrative options for Investment in the entertainment sector.

Theme Parks and Attractions

Large-scale leisure destinations, amusement parks, water parks, and integrated entertainment complexes are being developed. Saudi Arabia is executing major projects that represent a “market canyon” of unmet local demand. These projects serve the local population and international tourism cohort alike. From a strategic perspective:

- Green-field site development (land, construction, licensing)

- Ride and attraction supply (equipment, design, operations)

- Theming, food and beverage, retail, hospitality synergies

- Maintenance, operations, and lifecycle investment

Given the youth demographic and under-penetrated market, returns could come from ticketing, media rights, food & retail, and merchandise.

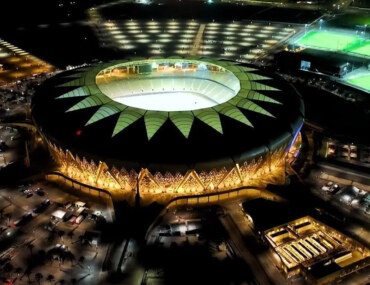

Live Events, Festivals & Concerts

Saudi Arabia is ramping up large-scale events: international music concerts, e-sports, cultural festivals, motorsport events. The infrastructure build-out and regulatory opening create opportunities: event organisers, venue operators, ticketing platforms, talent agencies. Investors can enter via:

- Building and operating indoor and outdoor venues

- Producing and promoting events, live experiences

- Supporting ecosystem services: lighting, staging, broadcast, ticketing

- Investing in recurring seasonal events to build brand and loyalty

Film, Content Production & Gaming/Esports

Saudi Arabia is actively promoting content production (film, TV, digital), and gaming/esports. Production rebates, foreign-ownership incentives, and the large Arabic-speaking audience create opportunities. Investment opportunities include:

Studio development, film production, distribution platforms

- Gaming studios, esports arena development, tournaments

- Talent development, post-production services, VFX and animation

With digital consumption high and local content under-developed prior, early movers may benefit significantly from Investment in the entertainment sector.

Also Read: Top Districts of Qatif for Investment in 2025: Where Saudi Growth Begins

Integrated Destination Developments / Leisure Real-Estate Hybrid

Mega-projects combining tourism, hospitality, shopping, and entertainment are emerging. Investments that combine real estate, hospitality, and entertainment create synergies: longer dwell-time, higher per-visitor spend, diversified revenue streams. Entry points include residential-leisure-entertainment mixed-use, branded hotel plus entertainment complex, and location-based entertainment within resorts.

Technology-Enabled Experiences & Platforms

Beyond physical venues, digital platforms, virtual reality, augmented experiences, and interactive media are gaining traction. Considering the high internet penetration and youth digital usage in Saudi Arabia, investors in immersive experiences, e-sports streaming, digital ticketing, and interactive entertainment have appeal. This represents a modern avenue for Investment in the entertainment sector, requiring smaller capital but offering scalability and faster market entry.

Key Supporting Entities & Responsible Authorities in the Kingdom

Before diving fully into investment commitments, it’s essential to understand which institutions are driving and regulating the entertainment ecosystem.

The General Authority for Entertainment (GEA)

The GEA was established in line with Vision 2030 to regulate and develop the entertainment sector. Its mission includes enabling an attractive and vibrant entertainment sector that stimulates investment for sustainable growth and provides high-quality entertainment offerings.

Key responsibilities:

- Issuing entertainment licences (for venues, events, suppliers)

- Promoting the role of the private sector in building and expanding entertainment activities

- Setting strategic priorities and standards for the sector

For an investor, engaging early with GEA to understand licensing, compliance, local partnerships and regulatory expectations is critical.

The Events Investment Fund (EIF)

Launched in January 2023, the EIF is focused on financing the events industry in the Kingdom, building sites for cultural, entertainment, tourism, and sports events, and attracting direct investment.

For investors this means:

- Availability of co-investment mechanisms or anchor infrastructure support

- Access to strategic venues, partnership opportunities

- Alignment with wider economic goals (e.g., increasing non-oil GDP, job creation)

Together, GEA and EIF form the backbone of the entertainment-investment ecosystem in Saudi Arabia.

FAQs about Investment in the Entertainment Sector

Before we conclude, here are some of the common questions that arise when considering entertainment investment in Saudi Arabia.

What minimum license or regulatory barrier should I anticipate?

You should anticipate obtaining the correct licence via GEA for any venue, event or entertainment-provider business. Licensing frameworks have been modernised to expedite approvals.

Can foreign investors participate fully, or are there local-partner requirements?

While Saudi Arabia is increasingly opening up to foreign investment, many successful ventures emphasise local partnerships, with local knowledge and networks adding significant value. Cultural adaptation is key.

What is the expected time-horizon for returns in this sector?

Given the scale of many projects (theme parks, destination complexes, integrated developments) the horizon tends to be medium to long-term (5-10 years or more). Investors in digital or smaller-scale assets may see quicker pay-back.

How large is the market and what growth prospects?

Reports project that entertainment could contribute around 4.2% of GDP by 2030. Large capital commitments (tens of billions of US dollars) are underway to build the ecosystem.

What are the main risks in investing?

Key risks include regulatory change, cultural mis-alignment, over-dependence on tourism flows, high upfront infrastructure costs, and under-developed local operational capacity.

What government incentives support Investment in the entertainment sector in Saudi Arabia?

Saudi Arabia supports Investment in the entertainment sector through tax incentives, reduced customs duties, financing programs like the Events Investment Fund, and streamlined licensing from the General Authority for Entertainment, all aligned with Vision 2030 goals.

And so we come to the end of our article, in which we discussed how to Investment in the entertainment sector in Saudi Arabia, and explored the main investment opportunities as well as the key supporting institutions. The Kingdom’s transformation into a global entertainment hub is not a passing trend but a strategic economic pivot.

If you are serious about tapping into this sector, you are advised to stay informed, engage with the right partners, and act with both patience and cultural insight. We also recommend visiting the Bayut KSA Blog for further comprehensive insights and updates on investment opportunities in the Kingdom, and to explore how to Invest in Saudi.