When thinking of Saudi Arabia, the first thing that often comes to mind is oil. But is that all there is to the Saudi economy? Absolutely not. The growth of the Saudi economy in recent years reflects a significant transformation within the Kingdom. It steadily moves away from the long-standing stereotype of being an oil-only economy. This shift has become especially evident as new sectors, reforms, and growth drivers continue to define Saudi Arabia.

Global Ranking

Saudi Arabia does not fall short in comparison with its global counterparts. Its nominal GDP was estimated to be approximately $1.27 trillion in 2025, ranking 19th among the world’s largest economies.

- Tourism Boom Driving Growth: The Kingdom welcomed over 122 million domestic and international visitors in 2025. It is reporting 5 % year-on-year growth in high-end tourism amid growing international interest.

- Tech & Innovation Investments: Saudi AI firm Humain secured up to $1.2 billion in financing, highlighting Saudi Arabia’s pivot into artificial intelligence.

- Strong Foreign Exchange Position: Saudi Arabia currently leads the Arab world with the largest foreign exchange reserves, around $463 billion in 2025.

What is Ahead in 2026?

Investment now plays a larger role in overall economic activity, and private-sector activity continues to expand. At the same time, sectors like tourism, technology, construction, transport, and logistics are becoming key drivers of growth and attracting both local and foreign investors.

Download Our App

Get the app and search experience among thousands of verified properties now!

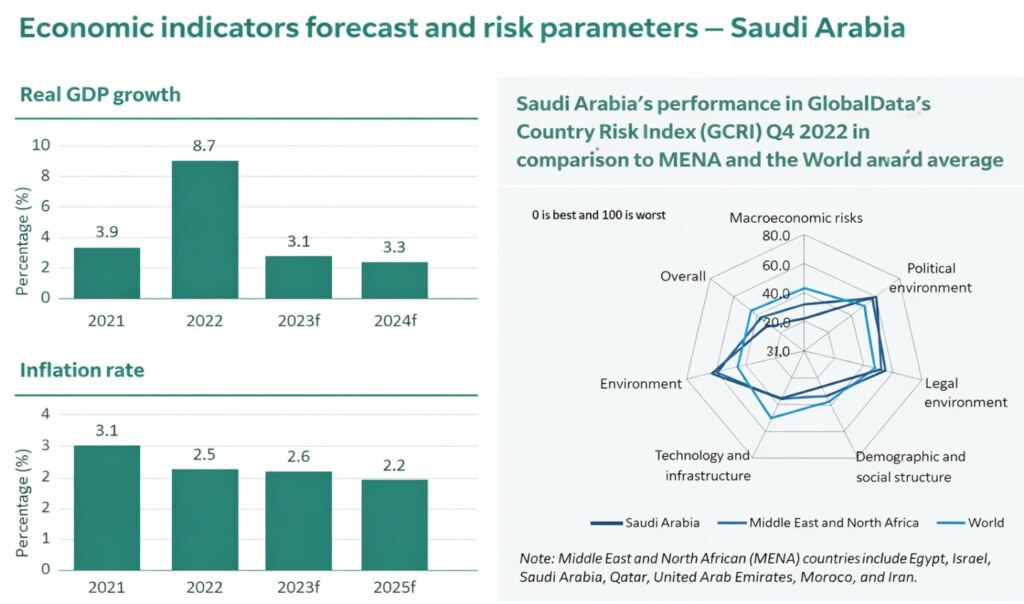

International forecasts align closely with this outlook:

- The International Monetary Fund (IMF) has also raised its 2026 growth forecast to 4.5 %, up from earlier estimates, reflecting continued resilience and diversification.

- The World Bank expects real GDP growth near 4.3–4.4 % in 2026, noting the strengthening contribution of non-oil activities.

Vision 2030: A Roadmap to Growth

Saudi Arabia’s Vision 2030 has unfolded into large-scale projects and new sectors that are attracting global investment.

- NEOM & The Line

- Red Sea Project & Amaala

- Qiddiya Entertainment City

- Diriyah Gate Development

- New Murabba (Riyadh)

- Rua Al Madinah & Pilgrimage Infrastructure

- King Salman International Airport

What is aiding KSA’s economic growth?

Vision 2030 acts as a solid blueprint, reshaping the Kingdom’s economy over the past decade. Non-oil sectors are growing and contributing more to the economy than ever before.

These sectors include:

- Economic Diversification (Non-Oil Expansion)

- Investment & Capital Spending

- Financial Market Reform & FDI Attraction

- Employment & Labour Policies

- Technological & Digital Growth

- Exports & Trade

Strategic Alliances Supporting Growth

KSA does not act alone; it works alongside strategic partners that support its long-term goals.

- United States–Saudi Strategic Partnership: Investment and commercial agreements worth approximately $575 billion, covering energy, technology, aerospace, and infrastructure.

- Saudi–Italy Investment Cooperation: 22 new agreements signed across technology, trade, energy, healthcare, tourism, and innovation, strengthening bilateral economic ties.

- Global Industrial Cooperation: Partnership with the World Economic Forum to accelerate industrial transformation and adopt global best practices.

- Saudi Arabia–WHO Health Agreements: Agreements signed with the World Health Organization to combat diseases and enhance global health cooperation.

Real Estate Contribution to the Saudi Economy

Real estate is a key contributor to Saudi Arabia’s economic growth through multiple channels:

- Employment creation: Housing and commercial development generate jobs across construction, finance, brokerage, and professional services.

- Capital inflows: Large-scale developments attract local and foreign investment, increasing capital movement within the economy.

- Sector enablement: Commercial real estate supports tourism, retail, logistics, and technology-driven industries.

- Urban expansion: New residential communities and mixed-use projects drive infrastructure development and improve productivity.

- GDP contribution: Ongoing property development and transactions contribute directly to non-oil GDP growth.

Bayut KSA: Powering Real Estate Growth

As the growth of the Saudi economy continues, real estate remains a key driver of diversification and investment. Bayut-KSA supports this momentum by bringing transparency and data-driven insights to the property market, helping buyers, renters, and investors make confident decisions across the Kingdom.