When exploring the best cities to buy property in KSA, investors are discovering a market that is becoming more structured, transparent, and strategically rewarding. Saudi Arabia is quietly stepping into a new spotlight, one defined not by hype but by steady momentum, clarity, and long-term opportunity.

Why “Now” is Ideal for Global Investors

Foreign investors historically approached Saudi real estate with caution. Ownership restrictions, unclear market information, and unfamiliar dynamics made the market feel complex. That perception has taken a sharp turn with new developments.

Regulatory reforms are opening doors for broader ownership, while platforms like Bayut-KSA provide verified listings and insights into neighbourhoods, projects, and trends. Beyond regulations, the Kingdom’s urbanization patterns, population growth, and robust economic activity combine to form a market that is not just accessible but readable.

Best Cities to Buy Property in KSA: Strategic Outlook

- Total residential market projected to grow from USD 155B (2025) → USD 214B (2030).

- Apartments & condominiums are the fastest-growing segment, with a ~7.6% CAGR, reaching USD 118B.

- Luxury housing grows from USD 33B → USD 47B, but mid-market/affordable units show the fastest real demand growth.

- Population growth (~1.4% annually) and urbanization (>85%) drive long-term housing demand.

- Government initiatives under Vision 2030 and mega-projects sustain property value appreciation.

- Rental market growth accelerates, fueled by expatriates and urban households.

- Strategic investments: focus on affordable apartments for high growth & rentals; luxury for premium gains.

- Diversification across segments hedges risk; early entry near mega-projects maximizes returns.

Best cities to invest in Saudi Arabia

Riyadh – Confidence in Every Corner

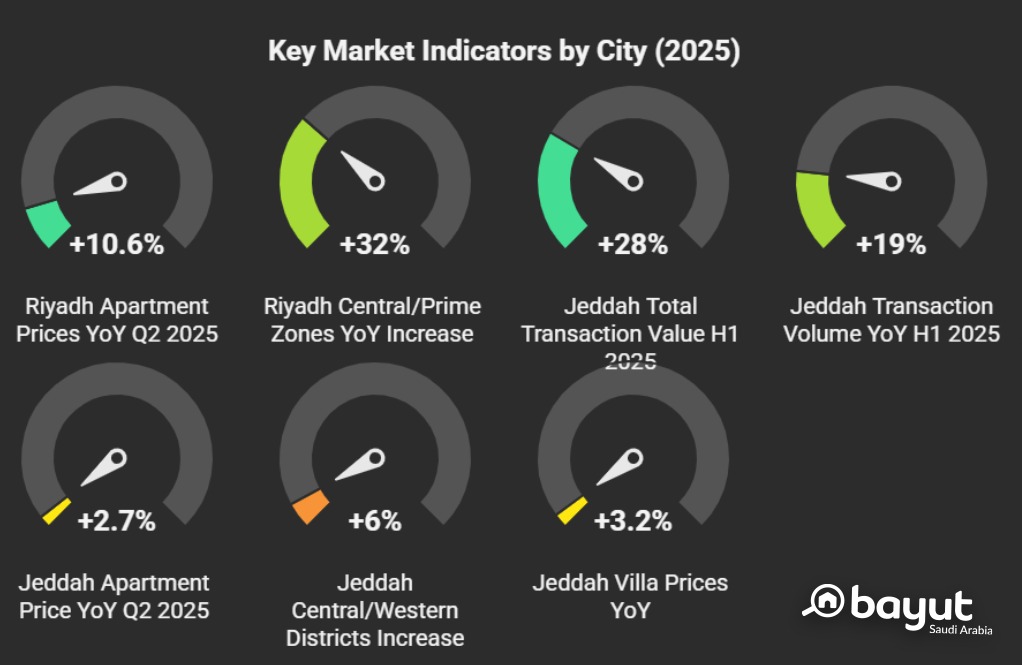

Riyadh is a city that has found its stride. Residential communities are modernizing steadily, commercial districts hum with activity, and master-planned developments reflect careful long-term planning.

For foreign investors, this is stability personified. Projects like Watad Residential Tower, Aknan 23 and 24, signal that the market values reliability, design, and developer credibility. Here, investment is less about chasing trends and more about positioning strategically and letting growth unfold in tandem with the city’s steady expansion.

Investor takeaway: Riyadh represents predictable urban growth – a market where capital appreciates in line with structured development and solid planning.

Download Our App

Get the app and search experience among thousands of verified properties now!

Jeddah – Yield Meets Lifestyle

Jeddah, by contrast, is a city of rhythm. Coastal charm, tourism, and a strong expatriate presence create a consistently active rental market. Investors find opportunities in mid-tier residential and mixed-use developments that balance yield with lifestyle appeal.

Projects like Darco Signature in Al-Rawdah, Jeddah, exemplify this: accessible entry points, high tenant demand, and locations shaped by lifestyle and convenience. For those seeking a steady income without high risk, Jeddah’s market fundamentals offer clarity and reward.

Investor takeaway: Jeddah is ideal for those looking for rental yield paired with lifestyle-driven demand, a market where fundamentals rarely fail.

Madinah – Quiet Growth, Steady Value

Madinah operates with a quieter rhythm. The city may not grab headlines, but it offers low-entry opportunities and steady appreciation. Residential communities focused on families and professionals are gaining traction, and the city’s growth reflects subtle, sustainable value accumulation rather than speculative spikes.

Multiple developments show the appeal: functional design, community focus, and accessibility. For investors who value clarity and low-volatility growth, Madinah is a market where insight and patience pay off.

Investor takeaway: Madinah offers methodical, steady appreciation, ideal for investors seeking calm, structured market entry.

Makkah – Specialist Strategy

Makkah is unique. Its real estate is shaped by spiritual tourism, seasonal peaks, and hospitality-driven demand. Here, success is built on timing, understanding cycles, and partnering with experienced operators.

Short-stay accommodations, hospitality-led projects, and operator-managed residences dominate. Investors must align strategy with predictable seasonal surges, such as pilgrimage periods and major religious events.

When approached thoughtfully, Makkah delivers strong, structured returns, though they unfold differently than traditional residential or commercial markets.

Investor takeaway: Makkah is a specialist market – high reward for investors who respect its rhythm and plan strategically.

This table provides a visual shorthand for investors: a quick mental model of how each city behaves, what it rewards, and how to approach it strategically.

Regulatory Confidence – Unlocking Access

The Kingdom’s real estate regulations are evolving to reduce barriers and enhance predictability. Ownership frameworks are becoming more transparent, processes clearer, and markets increasingly structured for international participation.

Foreign investors benefit not just from access, but from trust in the system. When combined with platforms offering verified data and real-time insights, these changes transform perception from “high risk” to a readable, navigable opportunity.

Strategic Takeaways for Investors

Navigating Saudi real estate is easier when decisions are based on verified data rather than speculation. Bayut-KSA provides transparent listings, neighbourhood trends, and project details across Riyadh, Jeddah, and Madinah.

- Riyadh: Stability and modern urban living

- Jeddah: Yield-driven, lifestyle-oriented investments

- Madinah: Community-centric, low-entry opportunities

Final Word on Your Future Step

Saudi Arabia is evolving from a market of potential to a structured, readable investment landscape. Riyadh offers stability, Jeddah delivers yield, Madinah builds quiet value, and Makkah rewards those who plan for its seasonal rhythm.

Supported by regulatory reforms and market intelligence platforms like Bayut-KSA, foreign investors can enter with confidence, clarity, and strategic timing – participating not in speculation, but in a strategically charted real estate horizon.